Proptech Continues to Ride High

The industry’s upward trajectory is expected to persist even if an economic downturn takes hold, according to MetaProp’s new mid-year global confidence index.

According to MetaProp, 2019 is turning out to be a dynamite year for the proptech industry, which continues to transform commercial real estate. The proof is in the numbers presented in the venture capital firm’s new mid-year global proptech confidence index for 2019.

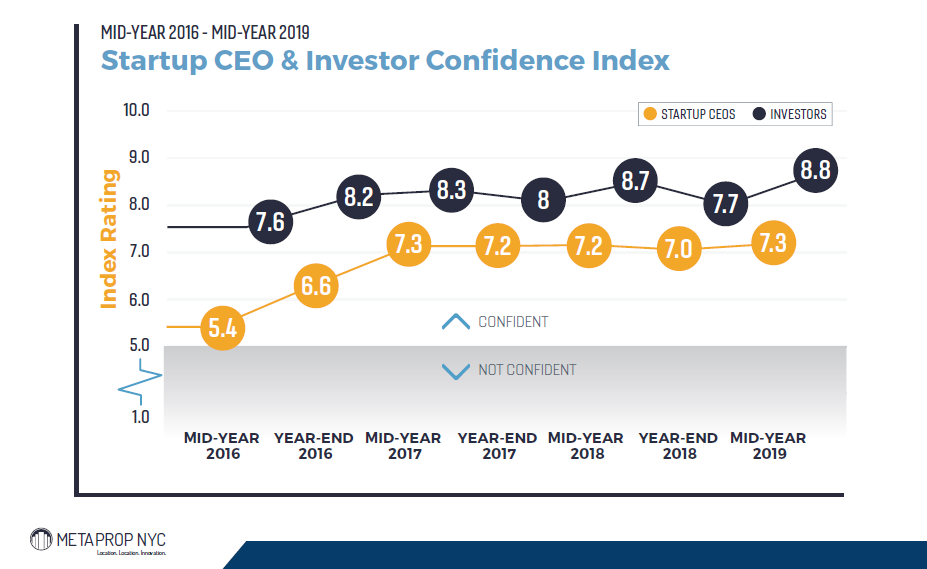

Proptech industry enthusiasm has reached new heights. Startup confidence—pertaining to the potential for startups to be acquired, go public or have a major liquidity event—remains strong, increasing from 7.0 at the end of 2018 to a mid-year 2019 figure of 7.3, the all-time high point first reached two years ago. Additionally, the investor confidence index jumped from 7.7 at the close of 2018 to 8.8 at the mid-year point, buoyed by increased deal flow, market highs and, notably, ongoing M&A expectations.

READ ALSO: Big Tech Reveals Smart Building Strategies

“The most eye-opening finding of the report is that 96 percent of investors expect to see either the same number of acquisitions or more acquisitions in the M&A market over the next 12 months,” Aaron Block, co-founder & managing director of MetaProp, told Commercial Property Executive. “In seven editions of the report, this number is an all-time high and up from 87 percent at year-end 2018. Just days after we compiled the data from our survey, [proptech industry bellwether] WeWork acquired building access startup Waltz, and a few weeks later, Procore acquired Honest Buildings. We believe there’s a lot more to come!”

MetaProp’s new report also found that 80 percent of startups foresee an easier or similar go of raising venture capital over the next 12 months, compared to 73 percent at the of 2018. “The pace of startup formation seems to be accelerating, companies are maturing nicely and valuations are rising. High profile IPOs are on the horizon,” Block added.

Also, a record 64 percent of proptech investors expect to increase investments over the next 12 months, marking a notable rise from the 46 percent who shared the sentiment at mid-year 2018. And investors were in full agreement on one point—the expectation that either more pitches or the same number of pitches from proptech companies will come to the fore over the next 12 months.

Forecast: recession-proof

The Great Recession wreaked havoc on the commercial real estate industry, and should the economy go on the downswing again, so will real estate—but not proptech. “A potential economic downturn would put additional pressure on building owners, managers, developers and landlords to adopt proptech, and would make it increasingly important to find smart and creative ways to save time, money and resources, similar to the explosion of fintech startups after the 2008 recession,” said Block.

The overall takeaway from MetaProp’s report is, essentially, all positive. As Block noted, “Proptech is red hot and the consensus is that there’s room to grow.”

You must be logged in to post a comment.