Pure Play. InvenTrust’s Tom McGuinness Goes All In on Retail

Tom McGuinness learned at an early age that real estate can be profitable. His parents purchased his childhood home in 1960 for $15,000. When they sold it 20 years later, the value had appreciated to $150,000. The lesson wasn’t lost on the future CEO.

By Sanyu Kyeyune

Tom McGuinness learned at an early age that real estate can be profitable. His parents purchased his childhood home in 1960 for $15,000. When they sold it twenty years later, the value had appreciated to $150,000. The lesson wasn’t lost on the future CEO.

“Location matters,” McGuinness asserted, referring to the family-oriented, working-class neighborhood on Chicago’s southwest side where he grew up. “That’s something I learned very early in my career.” Inspired by his parents’ venture into real estate, he decided to try his own hand at the business.

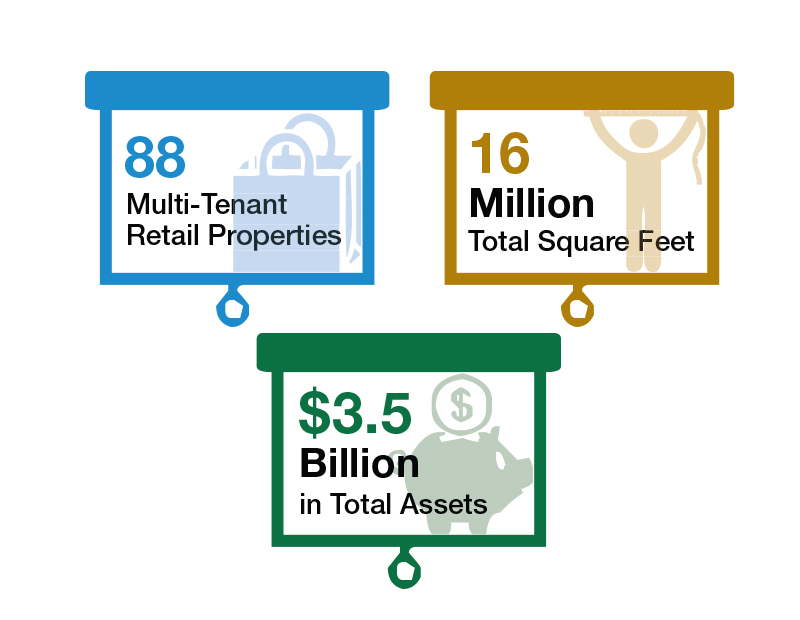

In the decades since, McGuinness has applied his skills and experience to the challenges of turning a diversified non-listed REIT into a pure-play retail platform, known since April 2015 as InvenTrust Properties Corp. Over the past three years, he has guided his multibillion-dollar enterprise through a complex metamorphosis, all while navigating the retail sector’s own fast-paced transformation. Operating within a quickly evolving segment, the simpler, more focused approach has enabled the company to refine its portfolio into a $3.5 billion open-air retail platform, which is poised to complete more than $1 billion in transactions this year, including $750 million in acquisitions.

Through it all, McGuinness’ cohort maintains, the REIT chief has stayed true to his roots. “I think he can relate to the maintenance guy at a property and then equally relate to CEOs of billion-dollar companies,” said Travis Roberts, CEO of University House Communities, the student housing subsidiary that InvenTrust divested in 2016.

McGuinness’ successful navigation of a dynamic situation speaks to his tenacity, said Jim Watts, a fellow Chicago native who has known McGuinness for more than 30 years. The two met in the late 1980s when Watts was a lobbyist for the Chicago Association of Realtors. He recounts a time when he and McGuinness competed in the American Birkebeiner, a 30-mile ski competition held in Hayward, Wis.

“Tom had never really skied before, but the first time he tried, he finished the race and I didn’t,” Watts chuckled. “If he works 70 hours or less a week, I’d be shocked. He’s just a ‘get it done’ type of guy.”

Conducting due diligence and renovations for Chicago-area developers and managers in the late 1970s pushed McGuinness to learn all aspects of the real estate business, but the operations side appealed to him most. “Even in high school, I liked fixing things, painting, et cetera,” he recalled. “So instead of just outsourcing improvement work, I would come up with the specs, call contractors for bids, lead and supervise the job. I was very involved not just with analysis, but also with the execution.”

Along the way, McGuinness developed a keen understanding of capital expenditures and operational costs, which in 1982 earned him his first leadership role: director of maintenance for Oak Brook, Ill.-based Inland Property Management Inc., an affiliate of The Inland Real Estate Group of Companies Inc.

Initially assigned to a single region, he gradually took on additional duties as a director of operations for multiple territories and then, in 1994, started commercial property management operations for the first of Inland’s non-listed REITs. McGuinness assumed a similar role in 1999 for Inland Eastern REIT, first handling due diligence, property management and acquisitions for community shopping centers. Eventually he rose to COO, overseeing the $6.2 billion sale of Inland Eastern’s 307 retail properties to DDR in 2007.

Rapid rise

The fourth Inland-sponsored REIT, launched in 2005, was Inland American Real Estate Trust, which grew into the largest non-traded REIT in the U.S., racking up $8 billion by 2009. In 2007, the company began to diversify, purchasing student housing assets and Utley Residential, a student housing operator.

Marking the company’s first foray into the hospitality sector, Inland American made a transformative play with the acquisition of Winston Hotels Inc.—a publicly traded owner of limited-service, extended-stay and full-service hotels—and upscale hotel REIT Apple Hospitality Five, adding 27 lodging properties to the company’s portfolio in October 2007. By 2012, Inland American had assembled $12 billion worth of assets; the following year, McGuinness was appointed president.

During this period of growth, McGuinness met Tom McAuley, who sat on the board of directors for Inland Real Estate Corp. and was closely involved with the Winston transaction. When the deal closed, McGuinness became responsible for overseeing the hotel company’s various units, including its revenue management group, which required him to develop an entirely new skill set. Observing McGuinness’ adeptness, McAuley commented, “He’s a quick study. You throw a different property type at him, and he’ll learn it very fast. ”

McAuley noted not only McGuinness’ adaptability but also his transparency and honesty, especially toward the employees of the acquired companies who became his reports. “He treats them like family,” McAuley said, “and they create a lot of value for the company, which is very important during a merger integration.”

While Inland American grew, financial markets were beginning to topple worldwide. “As we went into 2008, we weren’t sure where the slowdown in the economy was going to go, so we wanted to protect our shareholders and their dividends,” McGuinness explained. In an effort to hedge against a nosedive by any one asset class, McGuinness drove an initiative to further diversify the portfolio, adding net-leased retail assets, office properties and distribution centers.

Although the strategy kept the company afloat through the recession, it had only postponed a liquidity event, so McGuinness took steps to distinguish Inland American from other non-traded REITs. In 2014, he took the company under self-management, bringing with him all of the employees from the external business and property management units. The following year, he renamed the firm InvenTrust Properties, Inc. (IVT). Then began the task of developing the team and company processes.

Paring down

“We realized that if we were ever going to have a listing, then that level of diversity was probably not beneficial,” McGuinness recalled. “We started with the sale of our apartment portfolio to Greystar for $460 million and our net-lease portfolio for $1.8 billion to AR Capital in 2013, then we turned our attention to the hotel, retail and student housing platforms.”

Acquiring upscale student housing communities was first on McGuinness’ agenda, but he soon recognized that the relatively young asset category was lacking in inventory. To address this issue, McGuinness’ firm got into the development business itself, building the majority of the student housing properties it owned and managed, until concluding that the construction process would impede the company’s trajectory toward a listing.

The result was the largest-ever transaction of its kind, the $1.4 billion sale of University House Communities in June 2016. A joint venture of Canada Pension Plan Investment Board and GIC, the Singaporean sovereign wealth fund, became the new owner of the 13,000-bed portfolio.

Shedding the lodging platform also was a priority for McGuinness. “The portfolio was in the right condition because we’d invested so much in capital expenditures, and the overall sector was also performing well,” he explained. In 2014, he oversaw the $1.1 billion sale of the company’s select-service hotel portfolio to Chatham NorthStar, followed by the 2015 listing on the New York Stock Exchange of Xenia Hotels & Resorts (XHR).

In a display of professional integrity, McGuinness assured that Xenia was set up to thrive after its listing: “I knew with CEO Marcel Verbaas leading the company and the strong balance sheet in place, Xenia would be able to execute on its long-term strategies.”

Category cachet

*Walmart, Target and warehouse clubs are considered grocers, regardless of whether the box is owned by the REIT or shadow-anchored. Grocer exposure is based on property count. Source: InvenTrust Properties Corp.

With the creation and spinoff of Highlands REIT in April 2016, InvenTrust had repositioned itself as a pure-play retail REIT.

The refinement has continued in 2017, which opened with the $73 million acquisition of Campus Marketplace in San Marcos, Calif., 35 miles north of San Diego. Ralph’s and CVS anchor the 144,000-square-foot shopping center, whose other tenants include Bank of America, Subway, Starbucks and Sport Clips. Already stabilized, the asset was 95 percent leased as of March.

True to the firm’s Sunbelt focus, InvenTrust scored a pair of adjacent shopping centers in Pembroke Pines, Fla.—Paraiso Parc and Westfork Plaza—for $163 million cash. Once an expansion project wraps in late 2017, the assets will encompass 389,000 square feet of space, anchored by Publix; the grocery chain is one of InvenTrust’s top tenants, contributing 2 percent of the company’s total annualized base rent.

“We felt that the asset class that the world knew us for was multi-tenant retail—not malls, but more grocery-anchored shopping centers,” McGuinness said. “Ultimately, that’s where we’d be able to create the most value for our shareholders.”

While outlining his strategic vision, McGuinness reflected on the long-ago sale of his childhood home. “It reminded me that markets where people are working and have disposable income are the ones where you’re likely to get rent and occupancy increases.”

One such market is Houston, which contributes the highest portion of InvenTrust’s portfolio net operating income (an estimated 14 percent in 2017), followed by Dallas at 12 percent. The cities’ prominence in Inventrust’s NOI is a direct result of the state’s favorable business climate, which attracts companies and spurs job creation, especially in higher-paying science, technology, engineering and math fields.

InvenTrust’s portfolio strength also derives from a balanced tenant composition, which, in McGuinness’s view, is crucial to surviving the retail sector’s ebbs and flows. “We partner with retailers that embrace the Internet, as opposed to those who try to dismiss its impact or try to work against it,” he noted.

Despite the sensational headlines that have dominated media coverage of the retail sector lately, McGuinness is confident that the grocery-anchored concept will remain relevant: “E-commerce is here to stay, but that doesn’t scare us. It’s a huge opportunity.”

Executive Summary

Since taking the reins of Inland American Real Estate Trust in 2012, CEO Tom McGuinness has engineered its transformation from a diversified non-listed REIT into a pure-play retail REIT, now named InvenTrust Properties Corp. Central to the metamorphosis has been the divestment of the firm’s student housing and hotel portfolios. InvenTrust’s sweet spot is grocery-anchored retail centers in Sunbelt locations with strong employment trends. This year, McGuinness is eyeing upward of $1 billion worth of deals, including $750 million in acquisitions.

Originally appearing in the September 2017 issue of CPE.

You must be logged in to post a comment.