Q&A With CREFC’s Lisa Pendergast

The organization's executive director talks about waiting for the Fed to ramp up the momentum in the capital markets.

At the CREFC High-Yield, Distressed Assets, & Servicing Conference, there was talk of forbearance and refinancing risk. But there were also discussions about loan pipelines refilling and the CMBS market making a comeback.

Commercial Property Executive sat down with CREFC Executive Director Lisa Pendergast at the conference in New York City to chat about the lows and highs of today’s capital markets, and how commercial real estate will get over the current “hump” of stubbornly high interest rates and rising cap rates. Here’s what she had to say.

How would you describe the environment for new loans and refis?

Pendergast: I think the lending side is waiting for the Fed. A lot of things will work at lower rates, and cap rates being as high as they are, only means lower valuations on assets. It’s a combination of the two: higher rates and lower valuations. You took out a loan, and the valuation on the asset might have been 30 percent to 40 percent higher than it is today. I do believe it is a time issue.

And are special servicers still offering extensions? Or are they done with waiting and seeing?

Pendergast: There are a lot of servicers willing to extend. But to the good, what I’m hearing is very few people are getting an extension just because they ask for one. You need to show up. You need to bring capital into the building. You need to, potentially, pay down your loans. And then you will get that extension. We’re getting further away from COVID, and now it’s really getting back to basics. When it works, it works.

How concerned are you about magnitude of loans to be refinanced? A conservative estimate is $2.6 trillion maturing in the next four years.

Pendergast: To the extent that inflation subsides and the Fed starts to ease, that will be helpful to refinancing these loans successfully. But, right now, it is a significant problem. Especially, not only do I now have to refinance my loan at a higher rate, but the occupancy in my asset is also no longer 85 percent or 96 percent—it is 60 percent.

How do you bridge that gap? Private debt and preferred equity. Those are the types of things that are going to be needed to bridge the gap. And, right now, that preferred equity isn’t cheap, but it’s not necessarily that you’re locking in that preferred equity for 10 years. You need it to get over the hump. You pay it down, and you move on. It’s those type of things that smart landlords and those who lend to them and arrange financing will offer.

Do you think private equity and debt has a permanent role to play in the capital markets?

Pendergast: I think they will have a significant role to play. It will be slightly less than what it is today. In many ways, they’re looked at now as sort of rescue money. But don’t forget, it’s expensive to go there. If you have the opportunity not to, you won’t.

Those debt funds—we’ve worked with NCREIF, and we now have a debt fund index—are very constructive in what they’re doing. If you look at the debt funds and the CRE CLOs, most of them are 40 percent to 60 percent multifamily, and they’re mostly transition. So that’s a great leader in developing new multifamily.

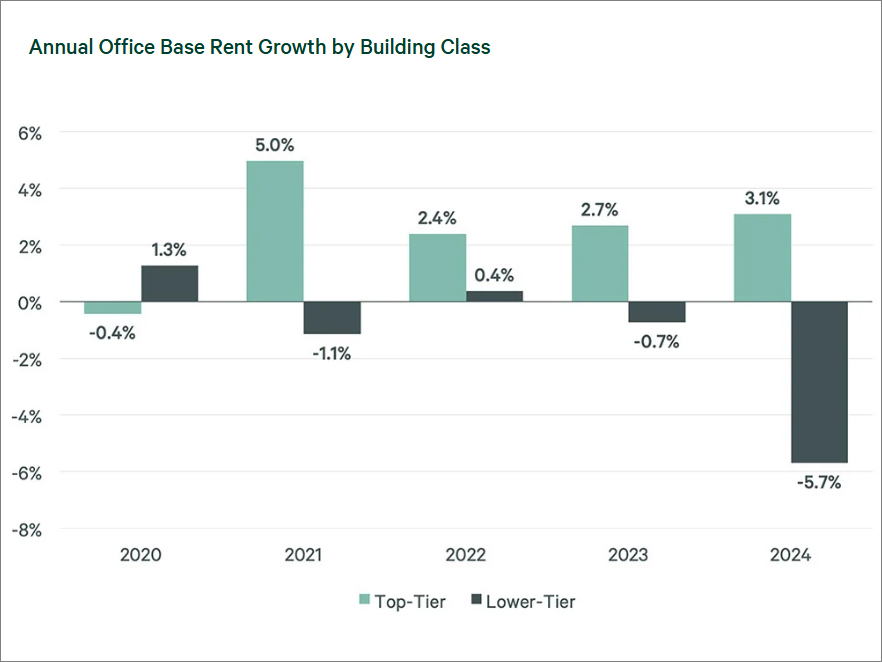

Many office properties are struggling due to vacancies and expectations that remote work will persist. They will be difficult to refinance or sell. Do you think conversion to multifamily is a viable alternative for many of these owners?

Pendergast: I worry about these whole conversions to multifamily. They really don’t work for a lot of office buildings. They kind of work for those aged office buildings that haven’t been renovated, are smaller and have floorplates that are more conducive to conversion. In some of these big office properties, you need to walk 100 feet to get to the window. That’s just wasted space, and it doesn’t work. So I am concerned about this sort of middle-aged office buildings that may be a little dated, but are just simply too big. The floorplates are too large where you have all that wasted space in the middle. You need windows.

CMBS activity is ramping up again. That’s a positive sign that’s been mentioned a number of times at the conference.

Pendergast: We’re twice where we were last year, which is better. It wasn’t as if issuances blew the doors off last year, but it’s a good step in the right direction. Spreads are tightening for two reasons: These deals coming into the market are super-squeaky clean, and there’s not a lot of supply. There are a lot of investors bidding on what they know to be very clean deals. In 2009 and 2010 and 2011, those were some of the cleanest deals that you ever saw. After a crisis, everyone finds a way to do things super conservatively.

Care to make a prediction for how the year will shake out?

Pendergast: I suspect that the Fed will be on hold and, at some point, decide to reduce rates. I don’t think this is a Fed, though, that is going to move quickly. They will be somewhat pedantic about how they go about doing that. But, to the extent that I think we turned a corner, that would be challenging. Maybe the Fed sees an inflation trend that makes them wary of where we’re going. But, I think if they even signal “no”—that they’re on hold for good—that would be almost like a rate increase at this point.

You must be logged in to post a comment.