Q&A With Pioneering Bank Founder Wendy Cai-Lee

The first Asian-American woman to start a U.S. bank discusses how this lender is putting its mark on CRE finance.

In the intricate web of commercial real estate banking, one figure stands out: Wendy Cai-Lee, the pioneering force behind Piermont Bank. As the first Asian-American woman to start a commercial bank in the U.S., Cai Lee is committed to innovation and inclusivity in an industry often dominated by tradition.

Under her leadership, Piermont Bank has carved a distinct path, becoming the first multiracial Minority Depository Institution in the country—and still one of only four in the U.S. Here’s what she told Commercial Property Executive about her journey to bank CEO and Piermont’s financing mission.

READ ALSO: Alternative Financing Is CRE’s New Lifeline

What inspired you to pursue a career in banking and ultimately establish Piermont Bank?

Cai-Lee: I started my career 29 years ago with JP Morgan Chase. I am an investment banker by training, and I’ve managed and grown business units in both Fortune 500 companies as well as start-ups.

My experiences in both financial services and banking showed me that there was a market demand for a commercial bank serving today’s entrepreneur-led businesses. These are businesses that are typically in a high-growth mode with an innovative business model and need anywhere from $1 million to $10 million in financing. I believed a bank like Piermont could be successful while satisfying that specific market demand and scale to provide services to even larger businesses.

For years, I’ve seen the same pain points within banks and heard the same customer complaints. To make some fundamental changes within banks, we decided that starting with a blank slate makes the most sense because there is no legacy system and process. This way, we can build a product roadmap and service model that are most relevant to today’s entrepreneurs. With the help of my team and our investors, I launched Piermont in 2019 and we’re now coming up on our five-year anniversary with nearly $600 million in total assets.

In what way has your background influenced your approach to leadership within the CRE sector?

Cai-Lee: After working with CRE clients in Greater New York and other metropolitan markets across the U.S. for many years, speed and certainty to execute are important to the success as a CRE lender. As a digital commercial bank, we built a CRE platform that can act with speed. For example, we can turn around loan decisions within three days with a completed loan package.

In the CRE market, having a bank partner that can move as quickly as is the borrower’s need is valuable. On the certainty to execute, we leveraged technology to digitalize everything on the backend so the bankers can spend more time understanding clients’ needs and the intricacies of each transaction. This helps us identify any issues early and ensure our ability to close deals faster.

Are there any specific strategies or lessons learned that you would like to share with other women and minorities aspiring to leadership roles in the industry?

Cai-Lee: I don’t think it’s any great secret that even today, in 2024, women still have to work harder than men in order to be taken seriously and be successful. There are fewer female bank CEOs today than three years ago.

My immigrant background helped me build resilience and good work habits. I learned from an early age how to take charge in certain situations and problem-solved to get things done—whether it was helping my parents who didn’t speak English apply for a mortgage or registering my younger sister for school when my parents weren’t capable of dealing with the application process. This was when I was only 12.

When it comes to my professional career, I learned early not to focus on the things I can’t change or control. Figure out what it takes to make things work and get it done. And if I encounter someone who is a constant problem, I recalibrate my tone and take a sterner stance with them. It’s worked for me.

As a minority woman in the industry, how do you see diversity and inclusion impacting the future of commercial real estate? What steps can companies take to foster greater diversity at all levels of the CRE ecosystem?

Cai-Lee: I’ve seen some positive changes in recent years with diversity and inclusion in CRE. Investors are more aware and believe in creating a positive long-term impact from their property investment. Aside from fostering eco-friendly buildings, we now see CRE owners and developers allow space to include considerations about the impact of properties on the local community, covering aspects like diversity. We are seeing more dedicated space for community use in mixed-used properties, both new buildout and repurpose of space.

Banks play a vital role in CRE financing, and banks are also starting to feel pressure from their customers and from the public at large. Customers want to bank with a firm that reflects their views and beliefs. Younger generations, in particular, place an elevated importance on mission and social responsibility when they choose their bank.

READ ALSO: Let’s Put CRE’s Debt Maturity Burden Into Perspective

How does Piermont Bank drive positive social and economic change through its lending practices?

Cai-Lee: I’m proud of the fact that more than 50 percent of our lending is in low- and moderate-income areas and to women and minority-owned businesses. I know the challenges they face every day because I’ve dealt with them myself—as have many members of our team. I believe that makes us stand out from other banks.

When our clients meet with us, they see someone who looks like them and talks like them, and knows firsthand what they’re dealing with daily as a business owner. These are proud and hardworking people. They don’t want or need anything extra. They want fairness and equal access to the kind of support other business owners have available to them, which is exactly what we set out to provide every day.

Financial institutions can drive positive changes by providing a level playing field and focusing on the potential of a business and its business model, not the color of the owner’s skin or gender.

What trends do you anticipate shaping the CRE market in the coming years?

Cai-Lee: We are actively lending in the CRE space with a robust portfolio of clients in the multifamily, mixed-use and industrial-warehouse asset groups. Based on current market conditions and our projections in the years ahead, we expect those will continue to be our sweet spots.

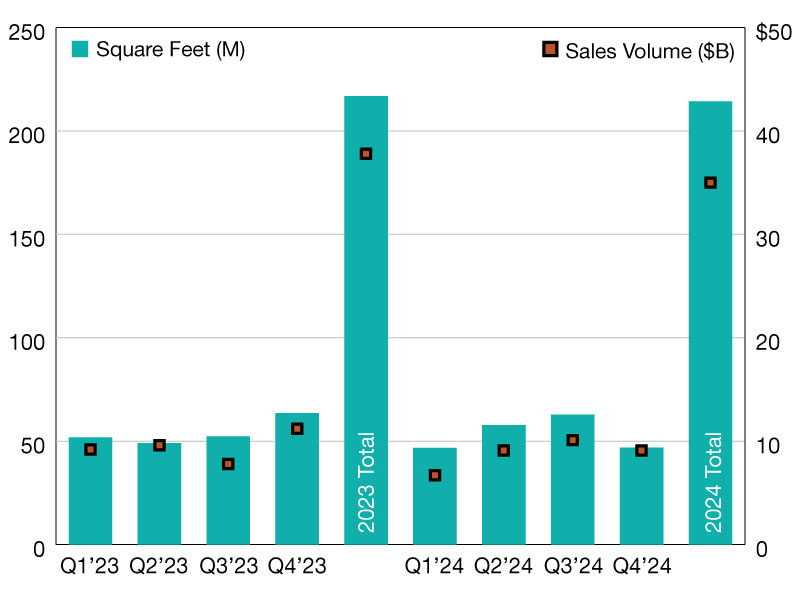

In terms of other CRE asset types, we’re being selective in large retail assets. In 2023, like everyone else, we experienced challenging and sometimes volatile market conditions in commercial real estate.

As we head further into this year, the elevated requirement for liquidity and capital from bank regulators will continue to add operational and lending pressure on banks. As such, maintaining a healthy cash and capital level is viewed as prudent and a must.

You must be logged in to post a comment.