Real Estate Market Sentiment Improves

Despite the slight increase in optimism, RCLCO’s latest survey points to an impending recession.

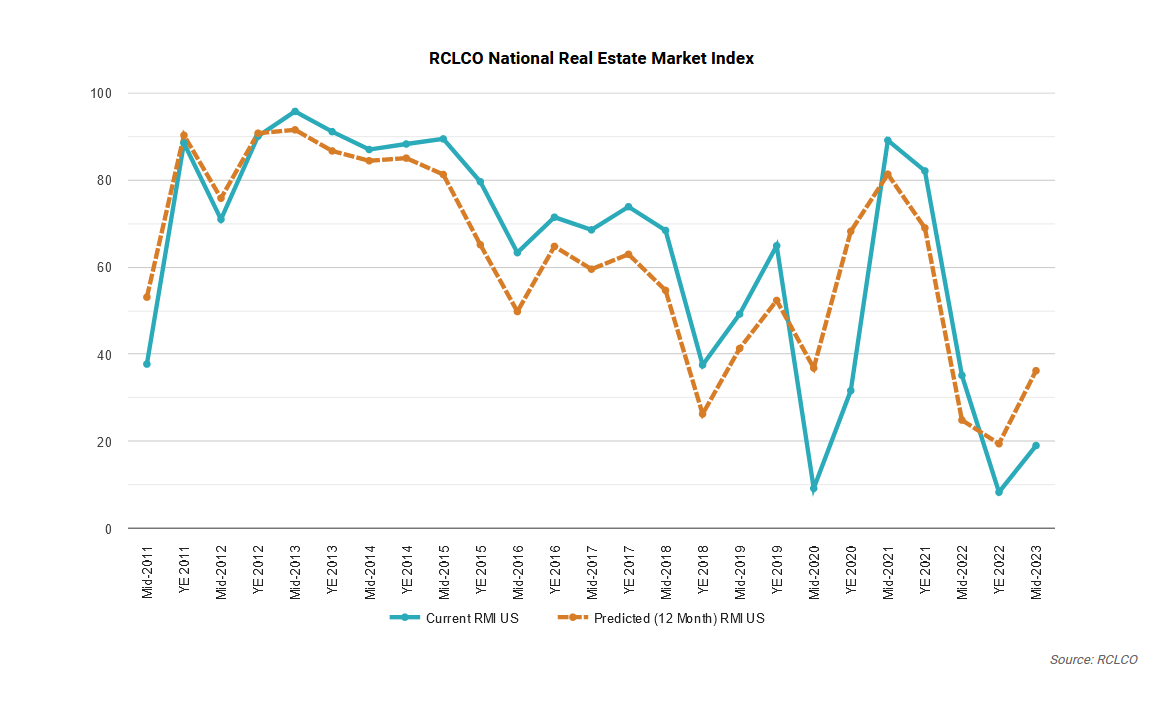

“Better, but still not good” is how RCLCO describes their mid-year National Real Estate Market Index (RMI), the product of the company’s latest Sentiment Survey.

In the past six months, the RMI has risen by 10.7 points, from a record-low 8.3 points at year-end 2022 to 19.0 now, yet the index remains in perilous territory. An RMI below 40 (on a scale of 0 to 100 points) “is typically consistent with a period of real estate market distress/recession,” RCLCO says.

Over the dozen years that the RMI has tracked real estate market conditions in the U.S., the past three years have been especially volatile, what with the pandemic, war in Ukraine and recent rate hikes by the Fed.

READ ALSO: Barkham Predicts Mild Recession, Rapid Recovery

Although the survey’s respondents, who are primarily investors or developers, predict continued improvement in the real estate market, they also see it remaining in distress for a further six to 12 months.

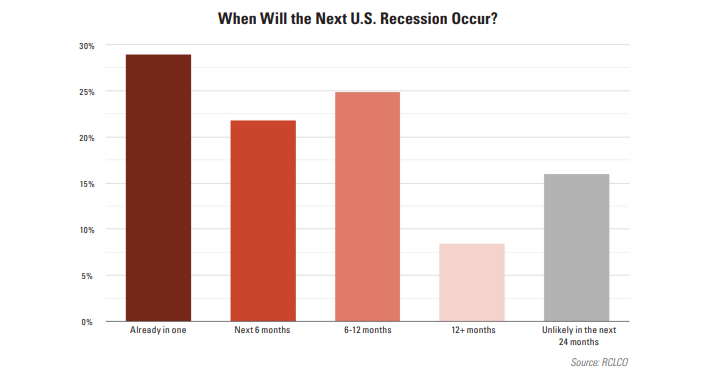

That’s against a backdrop of recession concerns. An overwhelming majority of those surveyed (84 percent) foresee a recession in the next two years, and nearly half (47 percent) predict one within 12 months.

“One potential silver lining,” RCLCO reports, “is that the majority of respondents anticipate that the looming recession will likely be of shallow to moderate depth,” or at most negative 2 percent of GDP.

Nearly half of respondents (47 percent) expect inflation to start to decrease.

Downturn’s impact on CRE sectors

Over the next 12 months, survey respondents anticipate that most CRE sectors will be in some degree of downturn, “though some niche sectors such as self storage, seniors housing, grocery/necessity retail and hospitality are anticipated to have more resilience.”

Unsurprisingly perhaps, the office sector is the one that respondents believe will see the largest peak-to-trough asset value declines, averaging an estimated 16.3 percent below peak. Retail was second on this unwelcome list, at 8.3 percent, followed by hotels (7.0 percent), multifamily (6.5 percent), industrial (4.0 percent) and self storage (3.6 percent).

You must be logged in to post a comment.