REBNY Special Report: Behind Blackstone’s Investment Strategy

The private equity giant's Nadeem Meghji discussed some of the firm's most significant deals and the strategies behind them at the recent luncheon in New York.

By Samantha Goldberg

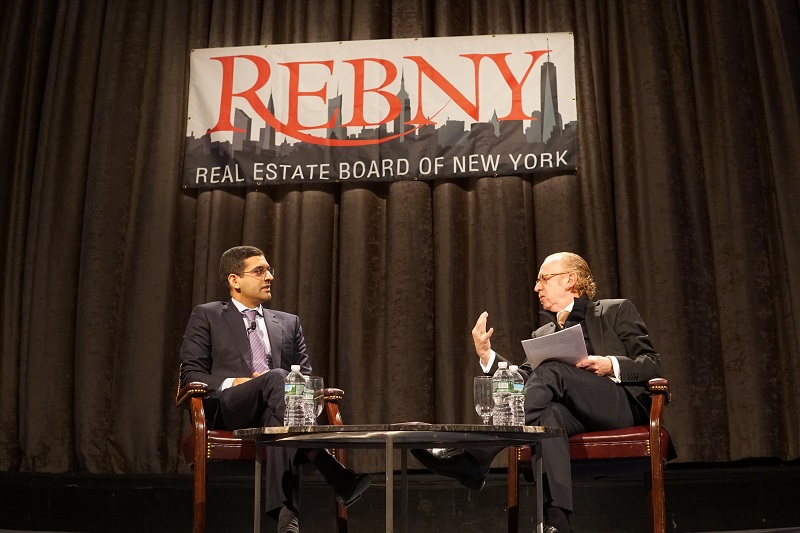

James Kuhn (right), president of NGKF, interviews Nadeem Meghji of Blackstone at REBNY’s Members’ Luncheon

“Having the ability to be analytical, spot trends, see patterns between asset classes and geographies, and to have a differentiated view is really critical, and it’s what I think underpins the way we invest at Blackstone.” That’s how Nadeem Meghji, a senior managing director & head of the Americas division for real estate giant The Blackstone Group, kicked off the Real Estate Board of New York’s Members’ Luncheon on March 15.

Sitting down with James Kuhn, president of Newmark Grubb Knight Frank, Meghji discussed the strategies behind some of the firm’s major recent deals, as well as its view of the New York City real estate market.

Despite beginning his career with the firm at the start of the Great Recession in 2008, Meghji said he was able to learn the cyclical nature of the real estate industry and took comfort in knowing Blackstone had a lot of “dry powder” to invest and was able to sell about $30 billion worth of Equity Office Properties’ assets before the downturn.

This strategy of “buying big and buying fast,” as Kuhn put it, requires a certain level of confidence. Take, for example, Blackstone’s partnership with Wells Fargo to buy most of GE Capital Real Estate’s assets, valued at $23 billion, which closed in less than a month in 2015.

“The most important thing was that we were prepared for the opportunity,” Meghji explained. Blackstone had sold GE a third of its U.S. assets prior to the downturn, so it was familiar with the portfolio. In addition, having U.S., European and debt businesses gave it the global experience and expertise needed to close the deal.

Blackstone has used this strategy of being prepared and leveraging its scale throughout its transactions, which span multiple sectors.

In the hotel arena, Blackstone has been the world’s biggest buyer for the past 25 years, with notable transactions such as last year’s $6 billion buy of Strategic Hotels & Resorts Inc. Kuhn also pointed to the $1.7 billion purchase of The Cosmopolitan of Las Vegas hotel and casino in 2014.

“It’s all about buying the right piece of real estate,” Meghji said. The property’s location “on the 50-yard line of the Strip” and the firm’s ability to buy the asset at half of the nearly $4 billion construction cost made the asset attractive. “All it needed was the right operating team to take over.”

Blackstone has invested $150 million in the property, adding rooms and improving amenities, which has doubled its EBITDA since the purchase, he said.

The firm has been focusing its capital on select-service hotels (which offer higher margins and lower capex) and on brands like Motel 6, La Quinta Inns & Suites and Hilton, which provide a lot of cash flow potential and are more about brand management, Meghji said.

Blackstone bought Willis Tower in Chicago in 2015 for $1.3 billion, with plans for a $500 million repositioning of the asset.

On the office side, Kuhn highlighted Blackstone’s $1.3 billion purchase of Chicago’s Willis Tower in 2015, which included an underperforming retail component.

“We saw this as an opportunity to control an iconic property,” Meghji explained. After years without improvements, Willis Tower was the “perfect ‘buy it, fix it’ asset.”

The purchase also reflected the firm’s recognition of a new urbanization trend, with companies like Kraft and Heinz moving back to downtown Chicago, resulting in a more than doubling of rents since 1995. Blackstone is now investing $500 million to reposition the asset and add amenities, creating a similar environment to what’s now Brookfield Place in downtown Manhattan, Meghi noted.

In addition to its involvement in the traditional real estate food groups, Blackstone has diversified into sectors such as life sciences, in which its almost $9 billion purchase of BioMed gained it lab office buildings in Cambridge, Mass.; San Francisco; and San Diego.

Blackson views “this as a business which was going to experience a lot of cash flow growth,” Meghji said, adding that as interest rates rise, the firm is seeking assets with growth potential, including those in life sciences.

The Apple of Their Eye

In New York City in particular, Blackstone is still optimistic about the real estate market, but has concern about certain sectors. The firm is bullish on Class B apartments and office, for instance, but sees oversupply in the hotel and luxury condo sectors and believes high-street retail ran “too far, too fast,” Meghji said.

He finds the Manhattan market interesting, as its “center of gravity is moving west” due to Related Cos.’s Hudson Yards development. “The area is getting better.”

A significant purchase was Blackstone’s $750 million buy of the Class A Park Avenue Tower in 2014, which represents the firm’s focus on buying great office assets in strategic locations.

“Park Avenue is not going anywhere,” he said. Blackstone saw the tower as having “great bones” but in need of TLC. It added amenities like a movie studio and bar, which have increased leasing velocity.

Blackstone also believes there’s still “room to run” in the multifamily sector, Meghji said, as supply still hasn’t quite caught up to the rate of household formation.

Blackstone bought the massive 11,000-unit Stuyvesant Town-Peter Cooper Village in Manhattan in 2015 for $5.3 billion. (Photo: Alec Jordan)

The firm’s optimism about Class B apartments is reflected in its iconic $5.3 billion acquisition of the 11,000-unit Stuyvesant Town-Peter Cooper Village in 2015.

As Class A rents start to slow down in Manhattan, Stuy Town’s rents of $50 to $60 per square foot offer some insulation, Meghji said, compared to new supply that typically charges $100 per square foot.

He added that the goal of the purchase was to hold the property for the long term and create a “win-win-win” for investors, the city of New York and residents. To help achieve this, the firm was able to set aside 5,000 affordable units that will remain affordable for “decades to come.”

The biggest challenge for Blackstone was to earn tenants’ trust, Meghji said. The firm engaged with them, conducted surveys and brought in a property manager from one of its hotels in Boca Raton, Fla., to provide better customer service to the community.

These transactions represent Blackstone’s continued confidence in the Big Apple’s real estate. “We are long-term believers in New York City,” Meghji said. “We feel very strongly that this is going to be a very attractive place to invest for a very long period.”

Meghji expressed a cautiously optimistic view of the real estate market in general, noting that if higher interest rates and fiscal stimulus come with higher economic growth, “then real estate should do fine.”

He added that the way Blackstone is positioning itself in “this new environment” of uncertainty is by focusing on selling rather than buying “bond-like real estate that has long-term leases without any growth” and instead focusing on real estate with shorter-term leases in asset classes and geographies where “we have conviction.”

In a high economic growth environment, this strategy will allow Blackstone “to be able to participate in those cash flows, which is a nice offset to rising rates.”

You must be logged in to post a comment.