REIT Allocations Are Shifting: Nareit

Third-quarter data is in, and some industry darlings are getting larger slices of the pie.

Allocations by active managers mostly shifted toward data center, telecommunications and health-care assets in the third quarter of 2024, according to new findings from Nareit. The dataset tracks quarterly investment holdings for the 26 largest actively managed real estate investment funds focusing on REIT investment.

Digital and health-care assets will be the twin pillars of real estate for the next decade, Alex Snyder, portfolio manager at CenterSquare Investment Management, told Commercial Property Executive. He has long believed this.

“This is exemplified nowhere better than in the positive movement of stock prices for the REITs that play in those places,” he added. “Big tech has been spending tens of billions of dollars a quarter in an artificial intelligence arms race, and, per many projections, multiple trillions of dollars will be spent on compute and its related infrastructure over the next decade.”

READ ALSO: The Dizzying Pace of Data Center Investment

Health care’s share of its index weight translates to it being overweight by 115 percent—or 1.8 percentage points. Snyder said health-care real estate is benefiting from an aging population.

“As we experience a sharply gray demographic shift, the number of people requiring extra care in specialized facilities is expected to increase markedly,” he pointed out.

“There is also precious little supply in most health-care real estate, particularly assisted living and skilled nursing facilities, given the difficulty of obtaining financing for development and the difficulty of operating them once they’re built. You don’t need an economist to tell you if high demand and low supply are a favorable setup.”

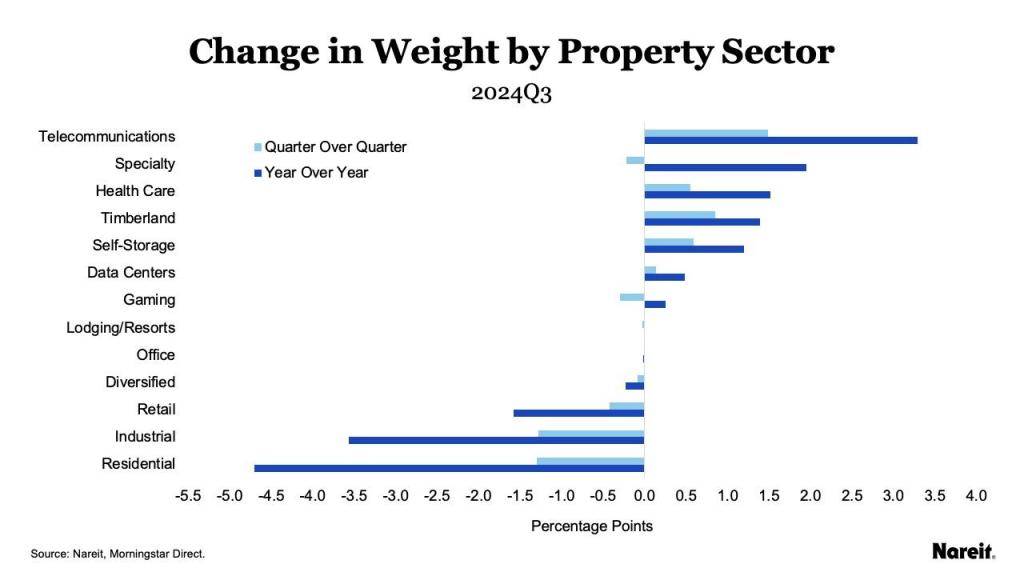

Meanwhile, retail (-0.4 percent), industrial (-3.6 percent) and residential (-4.7 percent) all retreated year-over-year and quarter-over-quarter. Industrial has fallen each quarter for the past year. In more specialized categories, timberland and self storage rose, both year-over-year and quarter-over-quarter.

Taking a look at data centers, telecom

The Nareit report also found that data centers and telecommunications are now the most overweight relative to their index weight, with investments at 130 and 123 percent of their index shares, respectively. Data centers now comprise 9.1 percent of the All Equity Index.

“In the third quarter, active fund managers overweighted their allocations to data centers by 2.7 percentage points, which put it at 130 percent of its share of the index,” according to the report.

Telecommunications had the largest year-over-year increase for the second consecutive quarter, up 3.3 percentage points. Its quarterly growth of nearly 1.5 percent was also the highest.

You must be logged in to post a comment.