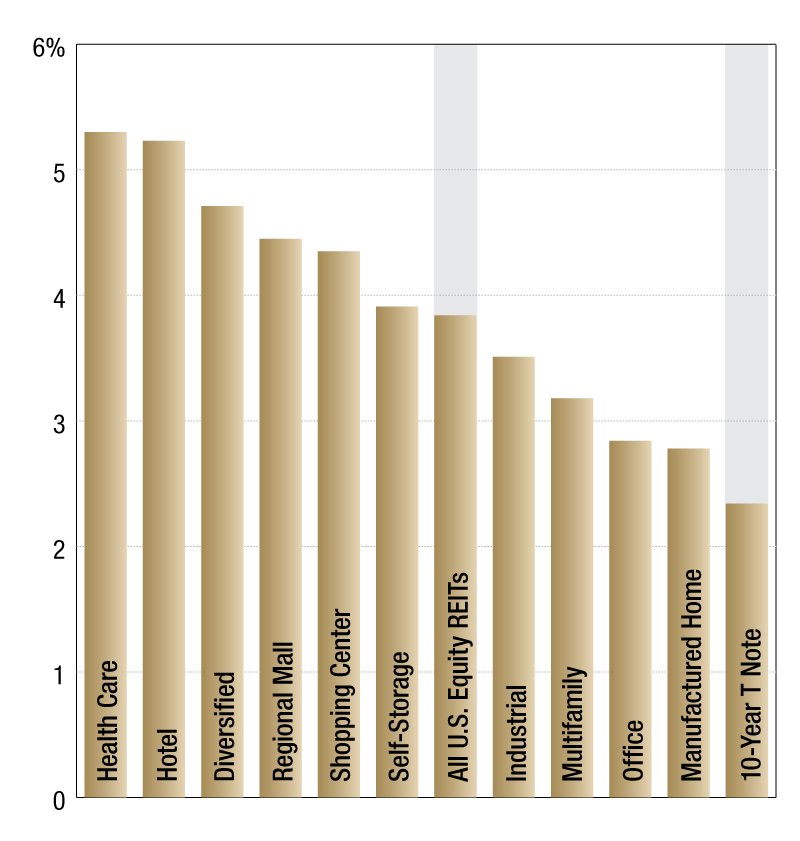

REIT Dividend Yields

The Health Care sector posted the greatest one-year average dividend yield among the group, at 5.3 percent, outperforming the broader SNL U.S. REIT Equity Index by 1.5 percentage points.

% by sector

As of Nov. 30, publicly traded U.S. Equity REITs had a one-year average dividend yield of 3.8 percent. The Health Care sector posted the greatest one-year average dividend yield among the group, at 5.3 percent, outperforming the broader SNL U.S. REIT Equity Index by 1.5 percentage points. The Hotel and Diversified sectors followed with one-year average dividend yields of 5.2 percent and 4.7 percent, respectively. The 10-Year T Note, on the other hand, registered a one-year average yield of 2.3 percent. The Manufactured Homes sector logged the lowest dividend yield among U.S. REIT sectors, at 2.8 percent.

The SNL U.S. REIT Multifamily index recorded a one-year average dividend yield of 3.2 percent, a little behind the broader SNL U.S. REIT Equity Index. Among the publicly-traded U.S. multifamily-focused REITs, Bluerock Residential Growth REIT posted the highest one-year average dividend yield at 9.6 percent. Independence Realty Trust and Preferred Apartment Communities followed, logging one-year average dividend yields of 7.5 percent and 5.8 percent, respectively. BRT Apartments posted a 1.6 percent average dividend yield within the same time frame, the lowest among its multifamily peers.

Khamile Armhynn Sabas is an associate in the real estate product operations department of S&P Global Market Intelligence

You must be logged in to post a comment.