2018 REIT Results

The projected proportion of earnings to be paid as dividends, cycling among REIT subcategories.

by Khamile Armhynn Sabas

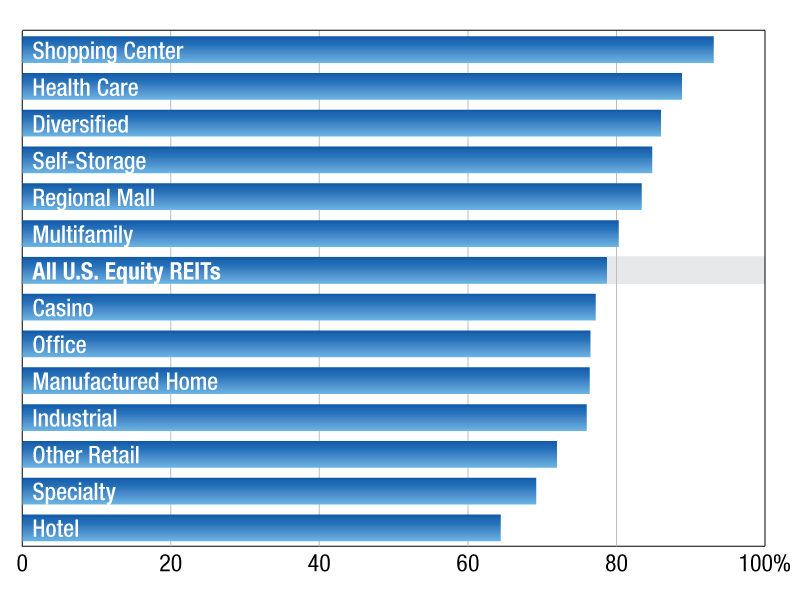

U.S. equity REIT average AFFO payout ratios

As of Aug. 1, publicly traded U.S. Equity REITs had an average AFFO payout ratio estimate of 78.7 percent. Among the sectors, Shopping Center REITs had the highest average AFFO payout ratio estimate for 2018, at 93.1 percent. The Health Care and Diversified sectors followed at 88.8 percent and 86 percent, respectively. On the other hand, Hotel REITs had the lowest average AFFO payout ratio estimate, at 64.4 percent.

The Multifamily REIT sector had a 80.3 percent current year AFFO payout ratio estimate as of August 1. Among the Multifamily REITs, Independence Realty Trust was on top of the list with a 111.1 percent AFFO payout ratio estimate. Following next was Investors Real Estate Trust with a 101.8 percent payout ratio. NexPoint Residential Trust was at the bottom of the list with a 52.8 percent payout ratio.

Khamile Armhynn Sabas is a senior associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Aug. 15, 2018

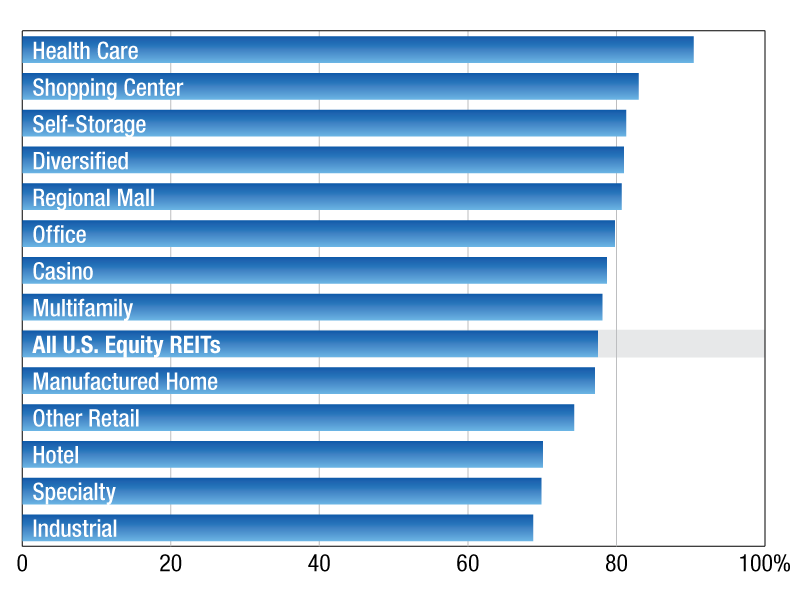

U.S. equity REIT average AFFO payout ratios

As of March 2, publicly traded U.S. Equity REITs had an average AFFO payout ratio estimate of 77.5 percent. Among the sectors, Health Care REITs had the highest average AFFO payout ratio estimate for 2018, at 90.4 percent. The Shopping Center and Self-Storage sectors followed at 83 percent and 81.3 percent, respectively. On the other hand, Industrial REITs had the lowest average AFFO payout ratio estimate, at 68.8 percent.

The Multifamily REIT sector had a 78.1 percent current year AFFO payout ratio estimate as of March 2. Among the Multifamily REITs, Independence Realty Trust was on top of the list with a 106.5 percent AFFO payout ratio estimate. Following that company was Bluerock Residential Growth REIT with a 98.9 percent payout ratio. NexPoint Residential Trust was at the bottom of the list with a 59.2 percent payout ratio.

Khamile Armhynn Sabas is an associate in the real estate product operations department of S&P Global Market Intelligence.

—Posted on Mar. 19, 2018

You must be logged in to post a comment.