REIT Returns

As of Nov. 3, publicly traded SNL U.S. REIT Equity Index posted a 13.7 percent one-year total return.

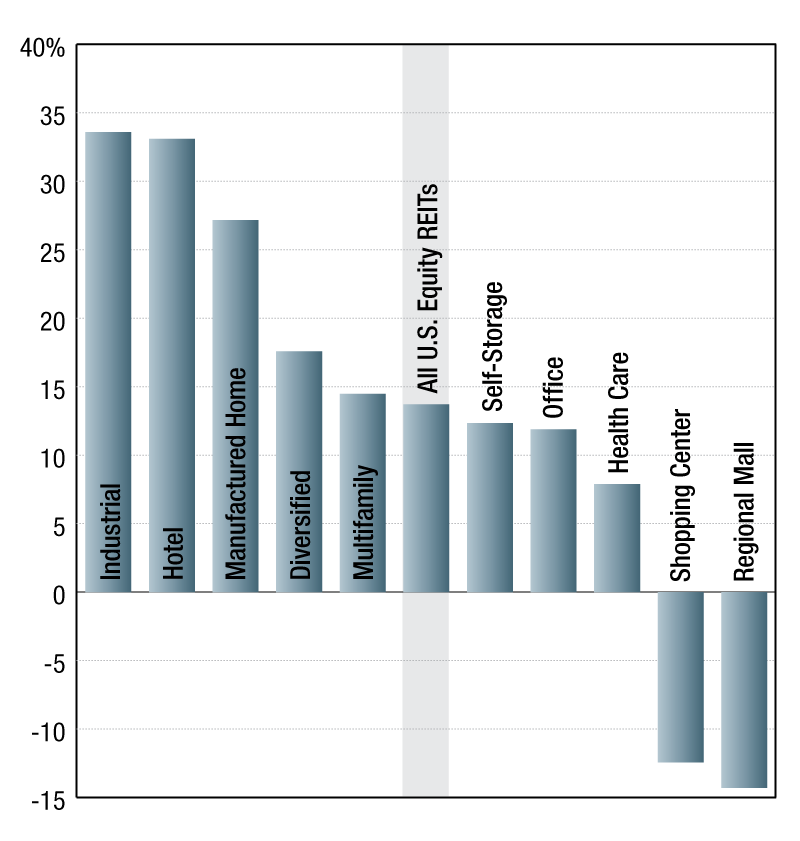

U.S. equity REITs one-year total return by sector

As of Nov. 3, publicly traded SNL U.S. REIT Equity Index posted a 13.7 percent one-year total return. The Industrial sector topped the chart with approximately 33.6 percent returns, outperforming the broader U.S. Equity REIT index by 19.9 percentage points. Hotel REITs closely followed with a 33.1 percent return and next to it was the Manufactured Home sector with a 27.2 percent total return. On the other hand, the Retail sector indexes posted negative one-year total returns. Specifically, Shopping Center and Regional Mall REITs indexes recorded negative returns of 12.4 percent and 14.3 percent, respectively.

The Multifamily sector index surpassed the broader U.S. Equity REIT index by 76 basis points, posting a one-year total return of 14.5 percent. Among the multifamily-focused REITs, Preferred Apartment Communities Inc. recorded the highest one-year total return of 65 percent. NexPoint Residential Trust Inc. and Independence Realty Trust Inc. followed at 54.3 percent and 41.1 percent one-year total returns, respectively. On the contrary, only Bluerock Residential Growth REIT Inc. posted a negative yearly total return among the Multifamily REIT index’s constituents, at negative 0.44 percent return.

Khamile Armhynn Sabas is an analyst in the real estate product operations department of S&P Global Market Intelligence

You must be logged in to post a comment.