2018 REIT Returns

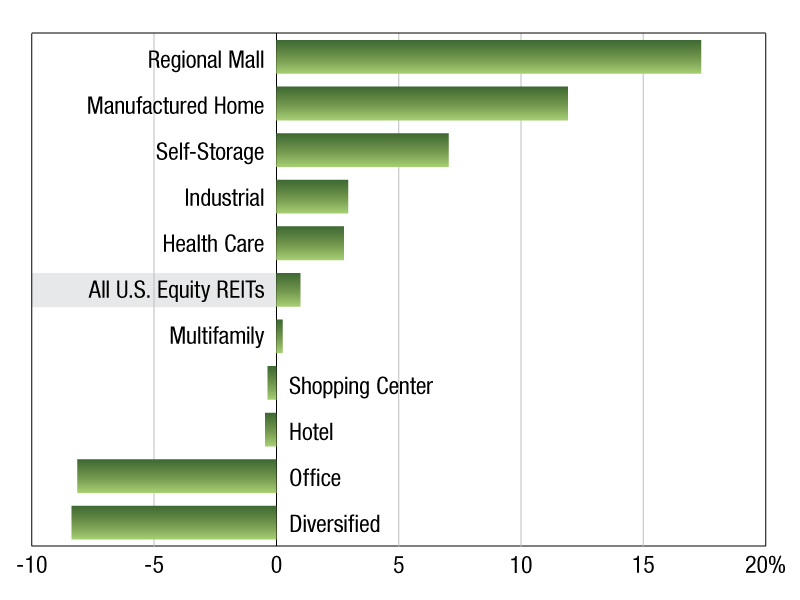

As of October 31, publicly traded U.S. Equity REITs posted a 0.98 percent one-year total return.

As of October 31, publicly traded U.S. Equity REITs posted a 0.98 percent one-year total return.

The Regional Mall REIT sector topped the chart with 17.4 percent total return, beating the broader U.S. Equity REIT index by 16.4 percentage points. Manufactured Homes and Self-Storage REIT sectors followed with 11.9 percent and 7.0 percent one-year total returns, respectively.

On the other end of the spectrum, the Diversified sector had the highest one-year negative total return of 8.4 percent. The Office sector was second to the last among the sectors, with -8.1 percent one-year total return.

The Multifamily sector index was ranked in the middle of the pack, posting a one-year total return of 0.3 percent. Among the multifamily-focused REITs, NexPoint Residential Trust Inc. delivered the highest one-year total return of approximately 55.6 percent. BRT Apartments Corp. and UDR Inc. followed at 22.3 percent and 4.5 percent one-year total returns, respectively. Bluerock Residential Growth REIT Inc. posted a negative 9.9 percent return for the year, the lowest among the total returns of multifamily index constituents.

Carter Phillips is an analyst in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Nov. 12, 2018

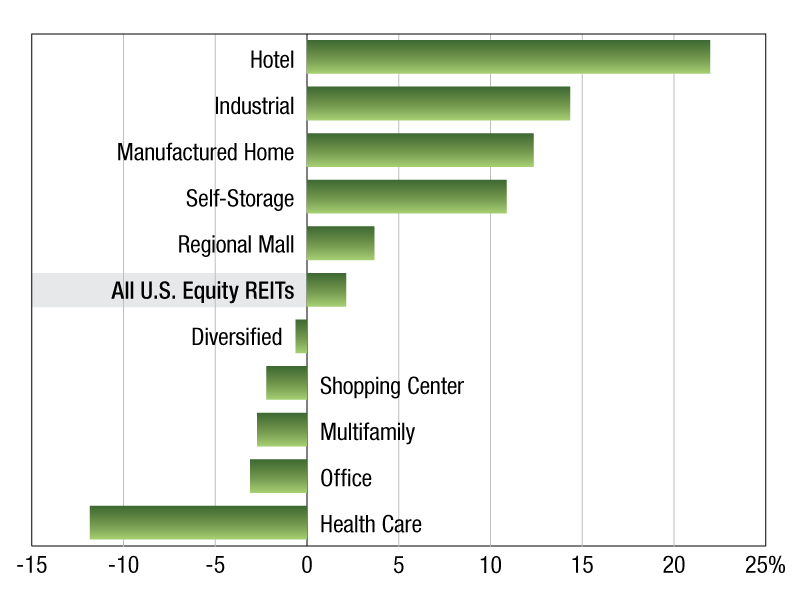

As of May 31, publicly traded U.S. equity REITs posted a 2.1 percent one-year total return.

The Hotel REIT sector topped the chart with approximately 22 percent total return, beating the broader U.S. equity REIT index by 19.9 percentage points. Industrial and Manufactured Homes REIT sectors followed with 14.4 percent and 12.4 percent one-year total returns, respectively. On the other end of the spectrum, the Health Care sector had the highest one-year negative total return of 11.8 percent. The Office sector was second to the last among the sectors, with negative 3.1 percent one-year total return.

The Multifamily sector index was ranked at the bottom of the sector list, posting a one-year total return of negative 2.7 percent. Among the Multifamily-focused REITs, BRT Apartments Corp. delivered the highest one-year total return of approximately 68.5 percent. NexPoint Residential Trust Inc. and Camden Property Trust followed at 19.1 percent and 9.3 percent one-year total returns, respectively. Bluerock Residential Growth REIT Inc. posted a negative 21.2 percent return for the year, lowest among the total returns of multifamily index constituents.

Khamile Armhynn Sabas is a senior analyst in the real estate client operations department of S&P Global Market Intelligence.

—Posted on June 19, 2018

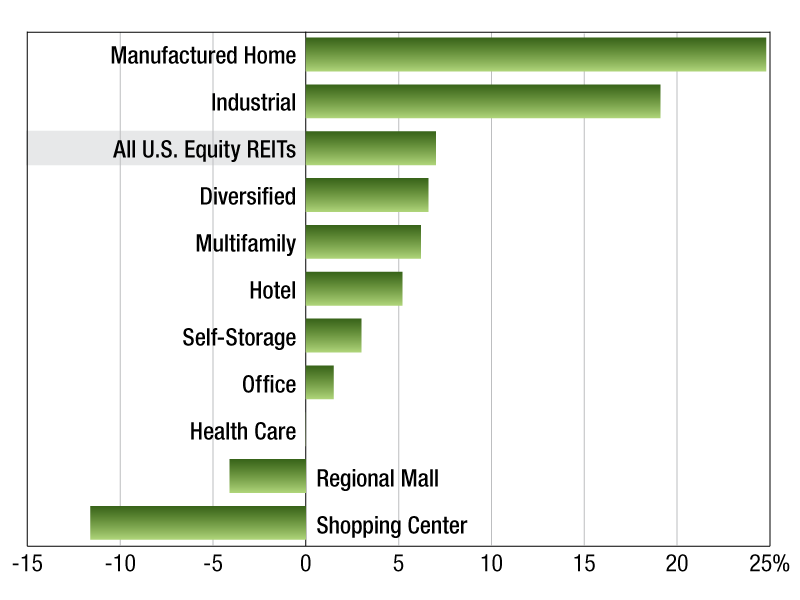

As of Jan. 3, publicly traded U.S. Equity REITs posted a 7 percent one-year total return. The Manufactured Homes sector topped the chart with a 24.8 percent return, beating the broader U.S. Equity REIT index by 17.8 percentage points. Industrial REIT sector followed with a 19.1 percent one-year total return. On the other end of the spectrum, the Retail sector indexes posted the lowest one-year returns. Particularly, the Shopping Center and Regional Mall REIT indexes recorded negative returns of 11.6 percent and 4.1 percent, respectively.

The Multifamily sector index posted a one-year total return of 6.2 percent. BRT Apartment Corp. recorded the highest one-year total return of the group at 45.4 percent. Preferred Apartment Communities Inc. and NexPoint Residential Trust Inc. followed with 41 percent and 27.5 percent one-year total returns, respectively.

On the other hand, Bluerock Residential Growth REIT, Inc. posted a negative 20.9 percent return for the year, lowest among publicly traded U.S. Multifamily REITs.

Khamile Armhynn Sabas is an analyst in the real estate product operations department of S&P Global Market Intelligence.

—Posted on Jan. 30, 2018

You must be logged in to post a comment.