REIT Values

As of Sept. 1, 2017, the manufactured homes sector led all publicly traded U.S. Equity REIT sectors in terms of the last twelve months funds from operations (LTM FFO) multiple.

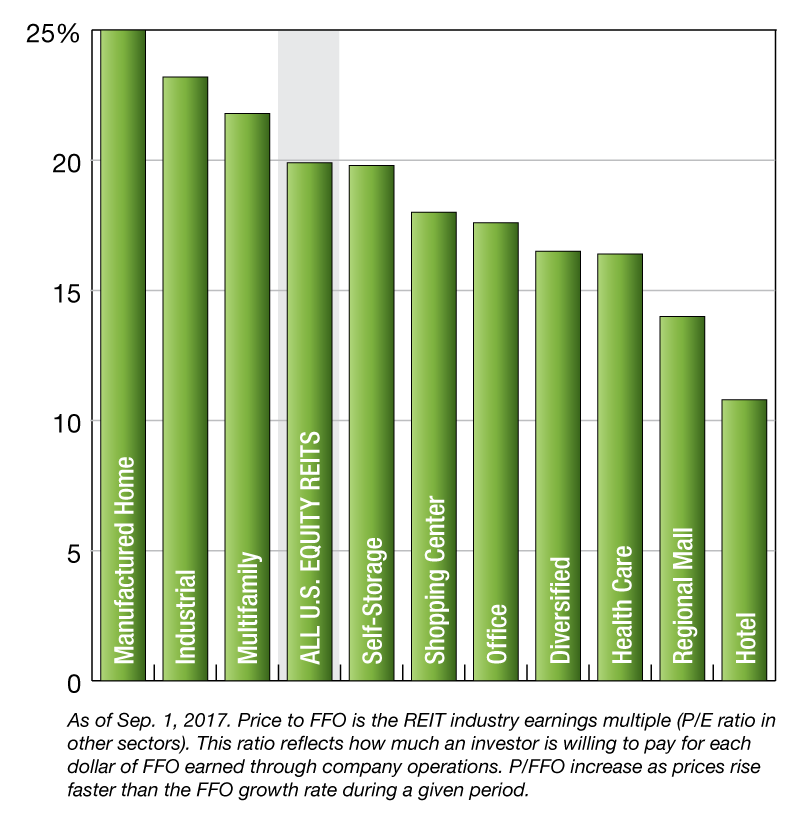

SNL U.S. REIT Index Price/LTM FFO [x]

As of Sept. 1, 2017, the manufactured homes sector led all publicly traded U.S. Equity REIT sectors in terms of the last twelve months funds from operations (LTM FFO) multiple. The said sector posted a 25x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 5.1 points. The industrial and multifamily REIT sectors followed with multiples of 23.2x and 21.8x, respectively. The hotel sector ranked last with a 10.8x price to LTM FFO.

Among the REITs focused on manufactured homes, Equity LifeStyle Properties Inc. had the highest multiple of 26.3x, and started September with an $89.8 price per share.

Equinix, Inc., a data center REIT, had a 41.6 LTM FFO multiple, the highest among the publicly traded U.S. equity REITs, and traded at a $466 price per share as of Sept. 1. Terreno Realty Corp. followed with 37x price to LTM FFO while trading at a $36.3 price per share.

Khamile Armhynn Sabas is an analyst in the Real Estate Product Operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.