2018 REIT Values

The multifamily sector had a 20.1x last 12 months funds from operations multiple as of Aug. 31, outperforming the broader US REIT index and six other REIT sectors.

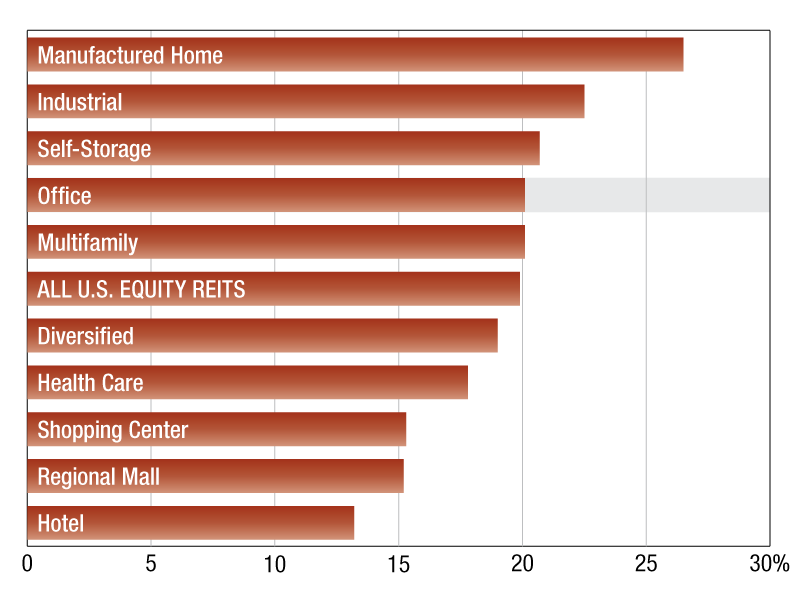

SNL U.S. REIT Index Price/LTM FFO [x]

As of Aug. 31, 2018, the Manufactured Homes sector led all publicly traded U.S. Equity REIT sectors in terms of the last 12 months funds from operations (LTM FFO) multiple. The said sector posted a 26.5x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 6.6 points. The industrial and Self-Storage REIT sectors followed with multiples of 22.5x and 20.7x, respectively. The Hotel sector ranked last with a 13.2x price to LTM FFO. Among the REITs focused on Manufactured Homes, UMH Properties Inc. had the highest multiple of 49.0x, and ended August with an $15.96 price per share. Innovative Industrial Properties Inc., an industrial REIT, had a 55.3x LTM FFO multiple, the highest among the publicly traded U.S. Equity REITs, and traded at $45.40 per share as of Aug. 31. JBG Smith Properties followed with a 52.9x price to LTM FFO while trading at $37.46 per share.

The Multifamily sector had a 20.1x LTM FFO multiple as of Aug. 31, outperforming the broader US REIT index and six other REIT sectors. Equity Residential led the Multifamily REITs with a 21.3x LTM FFO multiple, closing Aug. 31 at $67.75 per share. UDR, Inc. followed with a 21.1x multiple, trading at $39.97 price per share. On the opposite end, Preferred Apartment Communities Inc. had the the lowest Price / LTM FFO multiple at 12.5x. The company ended August trading at $17.82 price per share.

Carter Phillips is an analyst in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Sep. 19, 2018

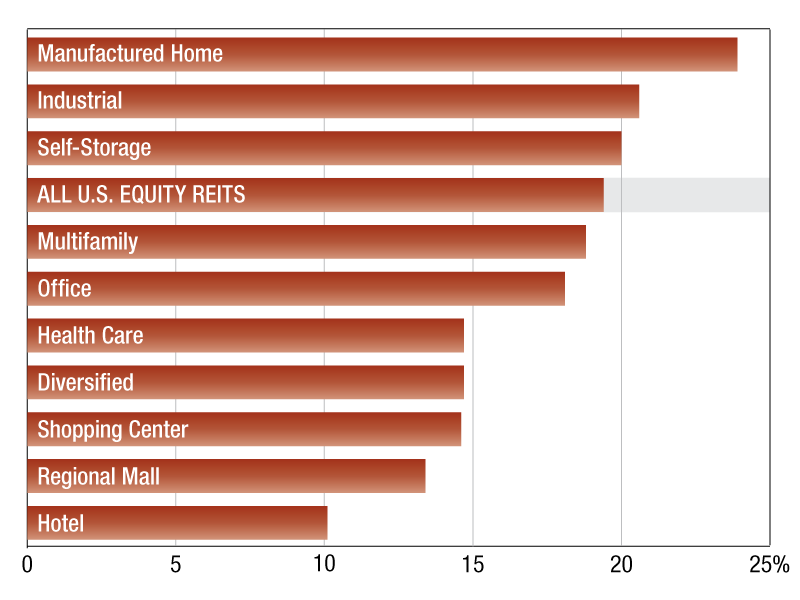

SNL U.S. REIT Index Price/LTM FFO [x]

As of March 29, the Manufactured Homes sector led all publicly traded U.S. Equity REIT sectors with the largest last 12 months funds from operations (LTM FFO) multiple, at 23.9x, outperforming the SNL US REIT Equity Index by 4.5 points. The Industrial and Self-Storage REIT sectors followed with multiples of 20.6x and 20.0x, respectively. The Hotel sector ranked last with a 10.1x price to LTM FFO. Among the Manufactured Homes-focused REITs, Equity LifeStyle Properties had the highest multiple of 24.7x, and ended March with $87.77 price per share. Invitation Homes Inc., a single-family housing REIT, had a 45.7 LTM FFO multiple, the highest among the publicly traded U.S. Equity REITs, and its common stock traded at $22.83 price per share as of March 29. American Tower Corp. followed with 35.4x price to LTM FFO, while closing the trading day at $145.34 price per share.

The Multifamily sector had an 18.8x last 12 months FFO multiple as of March 29, outperforming six other REIT sectors.

NexPoint Residential Trust led the multifamily-focused REITs with 21.2x LTM FFO multiple, closing the trading day at $24.84 price per share. Essex Property Trust followed with 20.2x LTM FFO while trading at $240.68 price per share. At the other end of the spectrum, Preferred Apartment Communities had the smallest price to LTM FFO multiple, at 10.8x. The company ended March at $14.19 price per share.

Khamile Armhynn Sabas is an associate in the real estate product operations department of S&P Global Market Intelligence.

—Posted on April 18, 2018

You must be logged in to post a comment.