REITs vs. FAANG: The Valuation Showdown

A handful of powerful tech stocks outpaces the market capitalization of the entire REIT market, yet that tells only part of the story. Scott Crowe of CenterSquare Investment Management explains why today's economic conditions and historic trends give REITs an edge in the long run.

By Scott Crowe

Scott Crowe, Chief Investment Strategist, CenterSquare Investment Management

Are the market’s five most popular and best-performing tech stocks worth 50% of the value of U.S. the commercial property market?

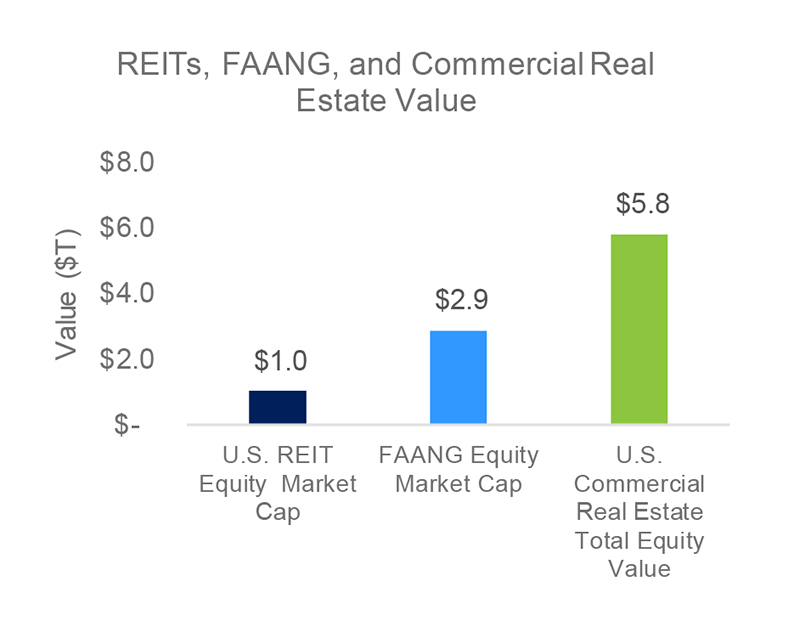

That is the investment challenge posed by today’s equity market, with the total market capitalization of FAANG stocks (Facebook, Apple, Amazon, Netflix, and Alphabet’s Google), currently equal to 3 times the total capitalization of the U.S. REIT market (which represents 20% of the U.S. commercial real estate market).

While the average age of office stock in New York City is 50 years old, it has remained functional with moderate amounts of capital expenditure. In comparison, in 1968 the idea of a mobile phone seemed pure science fiction.

Source: EPRA Q1 March 2018 Global Real Estate Total Markets Table, Bloomberg, as of Q1 2018.

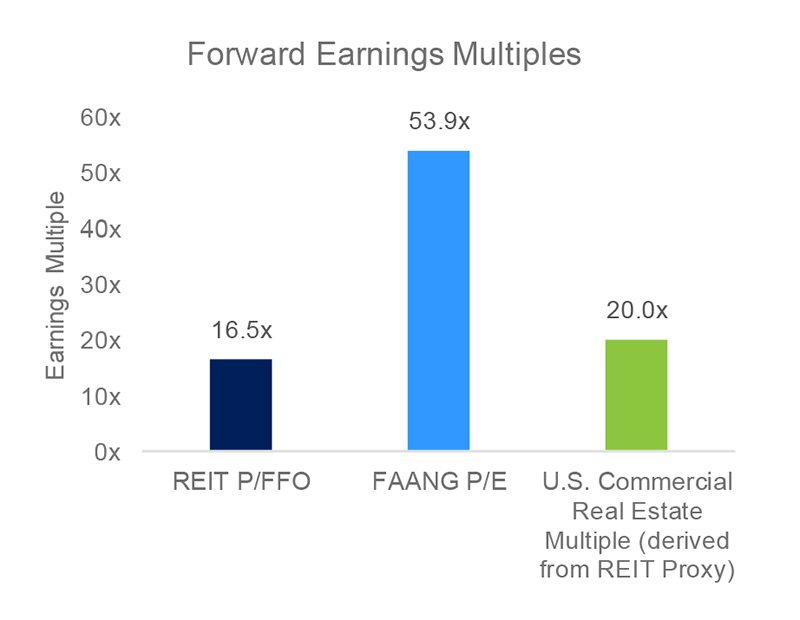

The valuation discrepancy between REITs and FAANG stocks today may be one of sentiment, but while the fast pace of technological change generates investor enthusiasm, many of today’s largest and most successful tech companies will not be direct beneficiaries of this change. Instead, based on history, these companies are likely to experience an erosion of their premier position.

Source: Citi, Bloomberg, as of 3/29/18. U.S. Commercial Real Estate Multiple is based on a universe of REIT stocks built to resemble the NCREIF Fund Index – Open End Diversified Core Equity (ODCE). The REIT ODCE Proxy is proprietary to CenterSquare and uses gateway/infill names in the core sectors and weights them according to the ODCE index to create a proxy.

What will be the largest equity in decades to come and what companies will be dominating the new and exciting technologies that will be shaping our lives? Uncertain. Will they, their employees, and their customers need a physical location? Probably. While economic cycles change, commercial real estate is enduring. Hard assets exist no matter what economic driver dominates at a point in time. Corporations, employees and consumers all need to occupy a real estate asset – be it an office building, a logistics facility or an apartment – to facilitate the economy. By contrast, the largest company in the S&P 500 has changed with regularity over time, as shown below, with each market cycle. A decade ago, the largest equity was Exxon Mobil, today it is Apple.

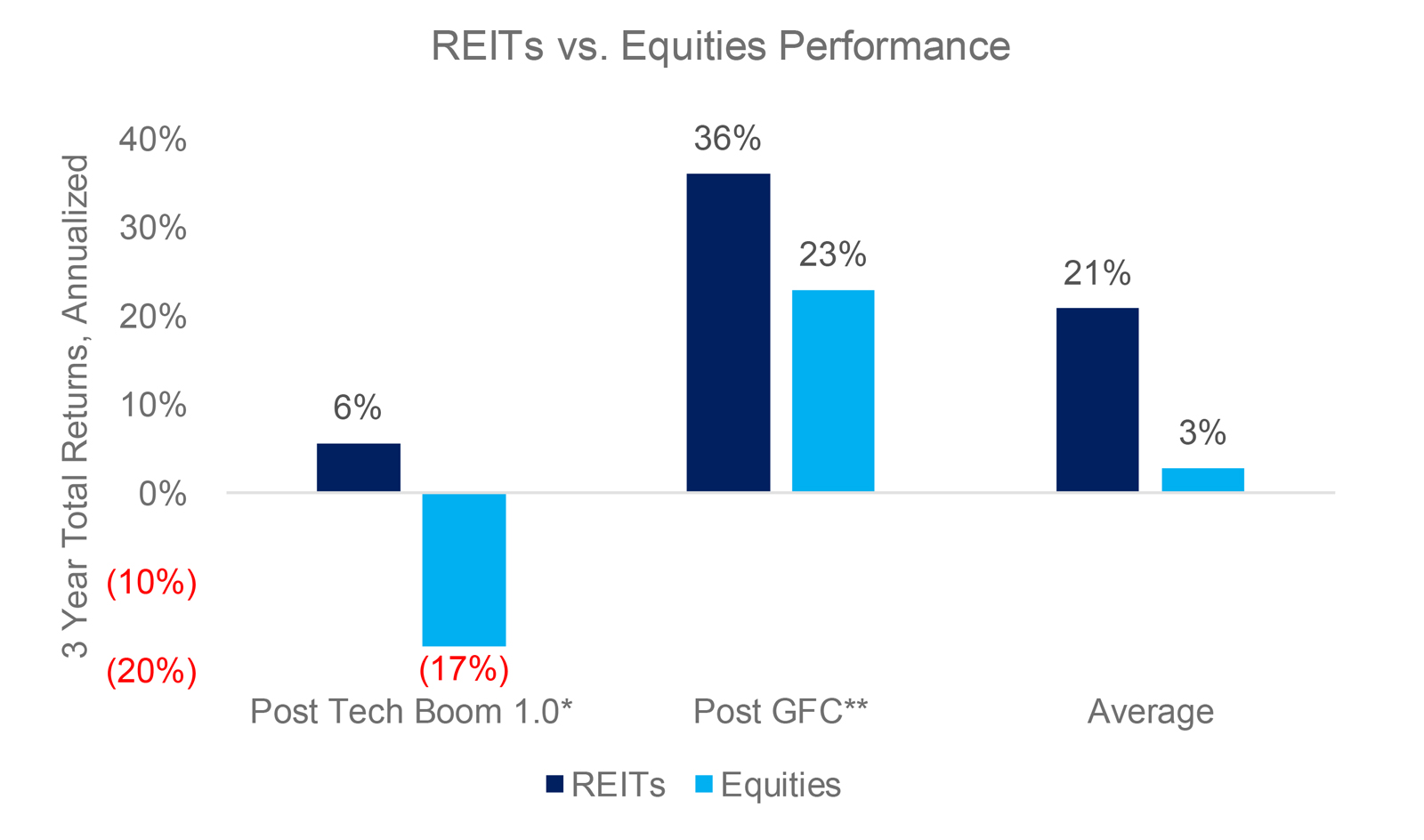

The relative valuation argument for REITs also holds true for the broader equity market. REITs have only been this deeply discounted relative to equities on a full cycle twice over last 20 years; the Tech Boom 1.0 (1998-2000) and the Global Financial Crisis (2008-2009). During these cycles, not only have REITs delivered positive returns, but also outperformed equities. This suggests that at some point the Fed hiking interest rates will become more of a challenge to equity valuations than it is to real estate.

Post-Tech Boom is defined as the period from 3/31/2000 – 3/31/2003. Post GFC (Global Financial Crisis) is defined as the period from 2/28/2009 – 2/28/2012 Equities based on S&P 500, REITs based on the FTSE NAREIT Equity REITs Index. Source: Bloomberg, as of 3/29/18.

A common concern about REITs is that they are an unfavorable investment as interest rates rise. However, historical performance suggests the opposite; REITs have delivered positive returns during cycles of increased interest rates. Interest rates rise because economic growth improves, which increases real estate NOI, and this more than offsets valuation pressure from higher rates. In addition, as growth improves, about half of the increase in interest rates is offset by declining bank credit spreads as lenders become more optimistic.

In fact, even with the increase we have seen in 10-year bond yields recently, REITs continue to trade at average dividend yield spreads to government bond yields and above-average spreads to corporate bond yields. It appears the market is well positioned for higher interest rates, as this topic has been central to investor attention for years. Consequently, investors did not price in low interest rates as a permanent fixture for either the REIT or private real estate market.

In conclusion, the valuation case for REITs is compelling. REITs are offering investors access to strong yield spreads versus government and corporate bonds, and a proven track record that outperforms equities over the medium term when relative valuations get stretched. So, the challenge for investors is this – would you rather own five technology stocks that risk shifting sentiment around the latest trends, or 50% of U.S. commercial real estate assets that stand steadfast over time?

The statements and conclusions made in this presentation are not guarantees and are merely the opinion of CenterSquare and its employees. Any statements and opinions expressed are as of the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of CenterSquare.

You must be logged in to post a comment.