REITWeek Special Report: It’s a Good Time to Be a REIT

REITs are heading into the second half of 2016 flush with confidence that they will maintain robust property fundamentals and steady price appreciation.

By Paul Fiorilla, Associate Director of Research, Yardi Matrix

REITs are heading into the second half of 2016 flush with confidence that they will maintain robust property fundamentals and steady price appreciation.

The sector is up 6 percent year-to-date through early June, outperforming the S&P 500 (3.6 percent) and Russell 2000 (2.3 percent), as REIT portfolios post heady performance. Occupancies of REIT properties are near all-time highs, helping to produce strong income numbers. Self-storage and apartments are leading the way in terms of income growth, but virtually all property segments are growing strong by historical standards.

Market players at this week’s NAREIT Investor Forum in Manhattan were generally optimistic about continued growth in the segment, citing favorable conditions for commercial real estate and continued strong investor demand.

“The industry looks quite well positioned for the future,” said Calvin Schnure, a senior vice president of economic analysis at the National Association of Real Estate Investment Trusts.

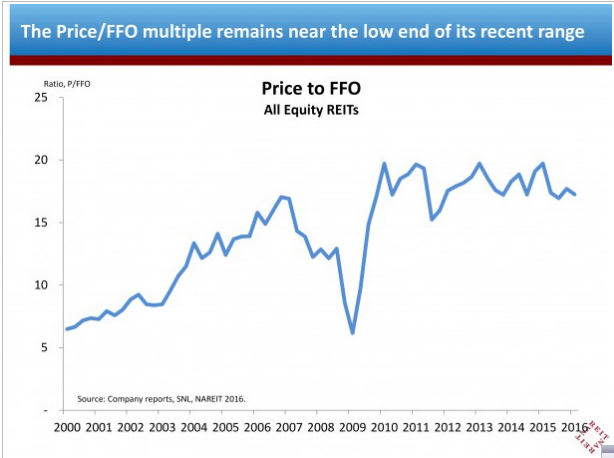

The industry does face challenges. Stock prices to funds from operations (FFO) are relatively high, and investors remain skittish about the prospect of rising interest rates and whether property performance has nowhere to go but down. A wave of mergers and acquisitions produced net negative growth in some segments (apartment and office) in the first quarter, while growth was focused on niche segments, particularly single-family rentals, data centers, self-storage and health care, as investors try to identify areas with higher growth potential.

The industry does face challenges. Stock prices to funds from operations (FFO) are relatively high, and investors remain skittish about the prospect of rising interest rates and whether property performance has nowhere to go but down. A wave of mergers and acquisitions produced net negative growth in some segments (apartment and office) in the first quarter, while growth was focused on niche segments, particularly single-family rentals, data centers, self-storage and health care, as investors try to identify areas with higher growth potential.

Property Performance

REITs are benefiting from the trends that have produced strong performance in the entire commercial real estate sector. Demand for all property types has risen as job growth has soared in recent years, while new supply has been moderate. REIT occupancy in first quarter 2016 was 93.2 post, just slightly below the peak of 93.4 percent that was reached in third quarter 2015 but well above historical levels. The average occupancy rate was 89.5 percent in first quarter 2012, for example.

Occupancy rates are 95 percent or better in several individual segments, including apartments, retail, industrial, diversified and data centers. Other segments have seen big improvements in recent years. Self-storage occupancy, for example, was 90.3 percent in in the first quarter, up from 79.7 percent in the first quarter of 2012, and hotel occupancy was 76.4 percent in the first quarter, up from 69.7 percent in the same quarter of 2012.

Rising demand has helped boost property income. Same-store net operating income (SS NOI) was up 5.2 percent year-over-year in the first quarter, the biggest increase in the current cycle. The increases are led by self-storage (11 percent), apartments (6.9 percent) and data centers (6.3 percent), but the gains are also broad, with all major property segments including office (5.3 percent), industrial (5.0 percent) and retail (4.4 percent) posting robust increases.

Self-storage has benefited from healthy demand, as households need more space to store belongings, businesses use facilities to store office supplies, inventory and records, and the years-long consolidation from mom-and-pop type facilities to large REITs has improved efficiency and marketing.

The apartment segment is in the midst of a long-term high-demand cycle due to the growth in the Millennial population, urbanization and declining homeownership rate. Equity Residential Trust chief executive officer David Neithercut said his company’s occupancies and renewal rates are up while turnover is down significantly in recent years, and he said that should continue as household formation grows in coming years while supply growth is expected to remain tepid. EOP executives told the audience that development financing has become more difficult and expensive in recent months as banks have increased loan spreads by 100 bps and have reduced leverage to 60 percent from 70 percent. “It’s a good time to be in the apartment business,” Neithercut said at a company presentation. “The fundamentals remain very strong.”

Capital Costs Up

While fundamentals have improved steadily in recent years, the sector has seen some volatility in share prices, mostly brought about by concerns about slower global economic growth and rising interest rates. REITs have always been sensitive to macro equity market trends and increases in interest rates, which produces short-term volatility even when property performance is stable. Equity REIT share values fell 9.1 percent in 2Q15 and 4 percent in the first two months of 2016 when sentiment turned bearish in the broader world.

REITs also have to deal with rising capital costs as banks and CMBS programs have raised loan spreads overall by 25-50 bps in recent months and the share prices have dipped a little as a share of funds from operations (FFO). REIT shares traded at an average of 17.3 times FFO in the first quarter, which is relatively high by historical standards but off of recent high of 19.7 in the first quarter of last year.

Equity REITs controlled $1.8 trillion of properties as of 1Q16, with a market capitalization of $933 billion. Growth in the sector has turned to specialty segments while dispositions have outpaced acquisitions in some of the major property segments. The sector with the biggest net dispositions is apartments, primarily because Equity Residential sold $6 billion of non-core, mostly suburban assets in the first quarter. The office segment had net dispositions of $2.7 billion in the first quarter.

Property segments with gains in the first quarter were led by single-family homes, which grew by $6.6 billion thanks in large part to the merger by Starwood Waypoint Residential Trust and Colony American Homes. The combination created a $7.7 billion entity called Colony Starwood Homes. Data center REITs grew by $3.9 billion, as owners including Equinix and Digital Realty Trust continue to increase in size, while self-storage and health care REITs grew by $1 billion in the first quarter.

Growing specialty sectors have the lure of potential out-performance. Mainstream sectors might feel secure, but with several years of strong price appreciation and property performance behind them, investors that want to juice returns are increasingly looking for growth stories that can be found in specialty segments.

You must be logged in to post a comment.