Report: Global Institutions Spend More on Real Estate

The annual survey by Hodes Weill & Associates and Cornell University also found that confidence by institutional investors was up for the third straight year.

Image by Bruce Emmerling via Pixabay

Despite the uncertainties of the ongoing COVID-19 crisis, global institutional investor confidence in the commercial real estate market increased in 2020 for the third straight year and target allocations were also up, according to the annual allocations survey by Hodes Weill & Associates and Cornell University’s Baker Program in Real Estate.

The 2020 Institutional Real Estate Allocations Monitor found target allocations to real estate increased 10.6 percent in 2020, up 10 basis points from 2019 and up 170 basis points since the initial survey in 2013. The increase for 2020 assumes the potential for an additional $80 billion to $120 billion of capital allocations to commercial real estate in the coming years, which should support continued liquidity and asset valuations.

READ ALSO: Under Pandemic Pressure, Capital Markets Adapt

Launched in 2013, the Allocations Monitor is an annual assessment of the world’s major institutional investors’ allocation to and objectives in real estate investments. The report analyzes trends in institutional portfolios and allocations. The 212 institutions from 29 countries participating in the survey represent $12.6 trillion in assets under management and real estate portfolio investments totaling approximately $1.3 trillion. Forty-three of the firms had assets under management in excess of $50 billion.

Growing since 2018, investor positivity reached a seven-year high. The Conviction Index, which measures institutions’ view of real estate investment from a risk-return standpoint, rose from 5.7 to 5.9. It’s a good sign, considering the survey was done in the midst of the pandemic between June and October, though it only rose from 5.8 to 5.9 in the Americas.

“While investors are voicing concerns about the impacts of COVID-19 and current geopolitical issues on their investment portfolios, we believe that conviction is rising as investors have experienced general stability in their portfolios, and new opportunities are emerging in the asset class. Anecdotally, nearly all investors are seeking to add new investments to their portfolio to take advantage of the buying opportunity they anticipate over the next few years,” the report stated.

Shift to Opportunistic Strategies

Investors also seem to be anticipating distress in markets, with many shifting to opportunistic strategies. While value-add continued to be the most favorable strategy (84 percent), the report found it had declined in popularity, with investors stating they would be allocating more investments into higher-yielding, opportunistic real estate, including distressed strategies.

READ ALSO: Sizing Up Investment Opportunities: What Lies Ahead?

The Americas reported the highest shift to opportunistic strategies: 75 percent compared to 73 percent from respondents in the Asia-Pacific region and 62 percent from respondents in Europe, the Middle East and Africa. Respondents from the Americas also had the highest response for value-add strategies: 88 percent, compared to 82 percent for EMEA and 80 percent for APAC.

Douglas Weill, managing partner at Hodes Weill & Associates, said in a prepared statement that institutions are anticipating that a buying opportunity is emerging because distress and dislocation are becoming more prevalent. Furthermore, institutions expect there will be an increase in investment pacing and more liquidity, which should support asset pricing, transaction volumes and cost of capital, he added. Real estate should continue to provide attractive returns relative to other asset classes, particularly in a market defined by uncertainty. The report notes that, since the pandemic slowed down many investment plans in 2020, some investors may be playing catch-up in 2021 and expect to be actively allocating to new investments over the next 12 to 24 months.

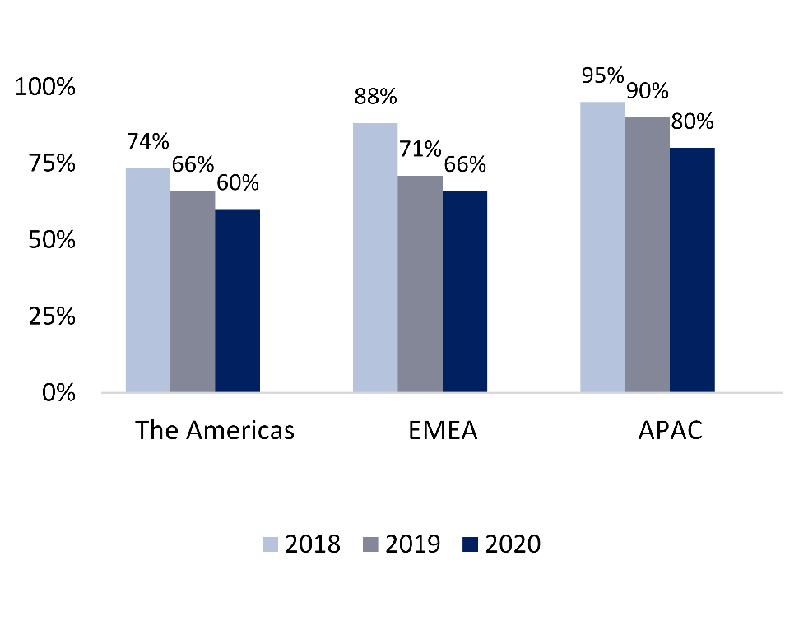

Institutions investments outside of their domestic region, by location of institution. Source: Hodes Well & Associates, Cornell University’s Baker Program in Real Estate

While the 2018 allocations monitor report noted that institutions remained “meaningfully under-invested in real estate,” this year’s results indicate that gap is closing. Actual allocations increased from 9.4 percent in 2019 to 10.0 percent this year. Institutions were still under-invested in 2020, but by an average 60 basis points compared to 110 basis points reported in 2019.

While cross-border capital flows remained resilient, the report noted, allocations are shifting towards “home country” investments during the pandemic. One reason could be the fact that many investors faced travel restrictions making it difficult to do on-site diligence and property tours.

Of the three main regions, outside investments by North American investors dropped from 74 percent in 2018 and 66 percent in 2019 to 60 percent in 2020. APAC investors had the highest investments outside their own region in 2020, coming in at 80 percent compared to 6 percent for EMEA investors this year. Despite the ongoing issues with the pandemic in North America, the region continued to be the recipient of the most cross-border capital allocations, followed by Continental Europe, the report said.

You must be logged in to post a comment.