Report: Vast Majority of Tenants Satisfied With Management

A Q3 study by Kingsley Associates breaks down office management satisfaction across a variety of sectors.

A tenant’s satisfaction with their management team has a significant impact on their overall satisfaction with their tenant experience.

For all commercial property types, satisfaction with management is the most highly correlated rating area to overall satisfaction, followed closely by the other key management metrics such as responsiveness, accommodation of special requests, and problem resolution.

For this reason, Kingsley Associates will focus on differences seen across property types and markets for the key metric of overall satisfaction with management.

Nationwide satisfaction

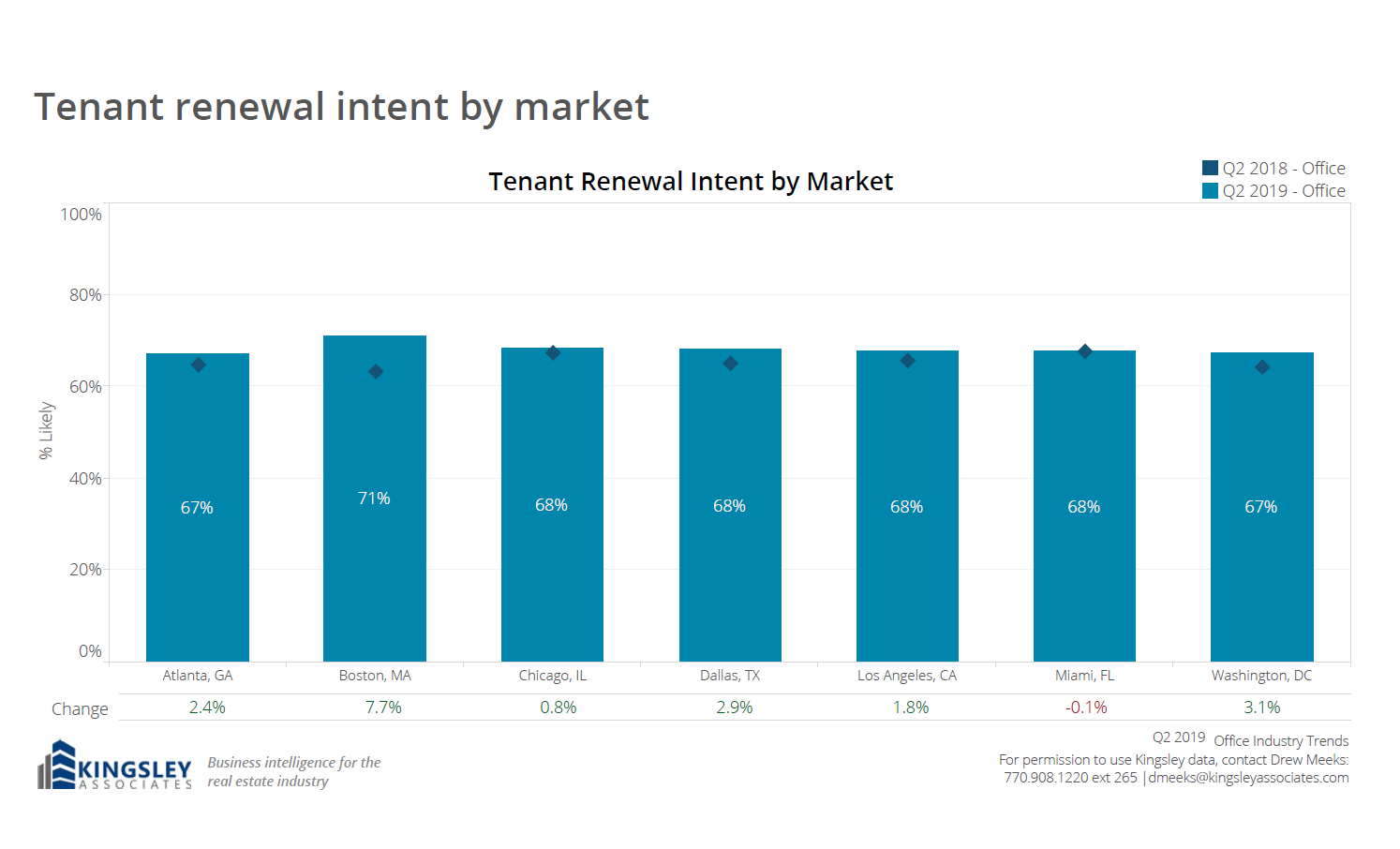

Over the last six years, national office management satisfaction has been relatively steady around 90 percent. This past quarter, management satisfaction rose slightly to 91 percent from the prior quarter. The importance of management service delivery is shown in the factors driving tenants’ renewal intentions.

Thirty-seven percent of office tenants cited property management as a key reason why they were likely to renew their lease. Property management was close behind location (78 percent) and quality of building (47 percent) for reasons why tenants decided to renew their lease.

Just over half of the major markets saw a year-over-year increase in management satisfaction this past quarter. New York is trailing the other key markets and the national score with 89 percent of tenants indicating they are satisfied with management. On the other hand, Boston, Chicago, and Dallas are all tied for top management satisfaction among the major markets with 94 percent of tenants satisfied with management. The top three markets also all increased year-over-year.

Management communication is a key piece of the management satisfaction puzzle. Tenants who indicate their proactive contact preferences are met are more satisfied and more likely to renew. Nationally, 74 percent of office tenants’ proactive contact preferences are being met. It is crucial to understand how frequently a tenant would like to be proactively contacted, and then put plans in place to meet those communication preferences.

Additionally, property management teams should set operational goals to respond to non-emergency requests within 24 hours. By setting goals around this proactive communication and responding within 24 hours, property management teams can maximize tenants’ overall satisfaction, which leads to higher loyalty levels.

LA industrial market slides

There is a much higher level of volatility in the time trend of satisfaction with management across industrial tenants than what Kingsley Associates sees across office tenants. This past quarter, the metric increased to 87 percent from 86 percent in the second quarter of 2019.

The metric peaked in the third quarter of 2016 at 91 percent before plummeting within a year to 85 percent in the third quarter of 2017. Concretizing the importance of management service delivery, it is third most important for renewal factor for industrial tenants who have indicated they are unlikely to renew.

Space requirements and price are the only factors more important than property management for industrial tenants who are not planning to renew their lease. At the market level, there have been a number of dramatic year-over-year increases and decreases in management satisfaction. San Francisco saw the largest increase with a 7.2 percentage point increase from this time last year.

Seattle and Dallas both also displayed large increases from the prior year with 4.7 and 3.0 percentage point increases, respectively. On the other end of the spectrum, Los Angeles experienced a 3.9 percentage point decrease from this time last year. Los Angeles is also the lowest scoring market of the top markets with only 84 percent of industrial tenants satisfied overall with their management team.

MOB sector on the rise

Over the last six years, management satisfaction at medical office properties has been gradually increasing. The metric dipped last quarter before rising again this quarter to 90 percent, which is in line with the score from the first quarter of 2019. Medical office tenants cite property management as a key renewal factor both when renewing and when not renewing.

For both groups, property management, is the third most cited influencing factor at 30 percent cited for those likely to renew and 21 percent cited for those unlikely to renew. Atlanta is the most improved market for medical office management satisfaction this quarter. Year-over-year the market has increased by 7.1 percentage points.

None of the other major markets come close to rivaling this increase in Atlanta. On the other hand, San Francisco and Seattle both decreased dramatically since this time last year. San Francisco’s medical office satisfaction with management decreased 9.8 percentage points. Seattle’s decrease is slightly smaller with a 7.7 percentage point decrease since this time last year.

Retail volatility

Tenants’ satisfaction with management is generally lower at retail properties than tenants of the other commercial property types. Nationally, retail satisfaction with management dropped this past quarter from 78 percent satisfied in the middle of the year to 77 percent satisfied in the third quarter.

On the whole, the national trend for retail management satisfaction is quite volatile. It peaked in the first quarter of 2018 at 79 percent satisfied and has declined and increased a few times since then. For retail tenants unlikely to renew, 29 percent of them cited property management as a key factor behind their decision. This is a higher percentage of tenants who cited property management as why they are unlikely to renew than any other commercial property type.

At the market level, scores vary for retail tenants as much as the national score. Most of the major markets saw a year-over-year decrease or increase above 4 percentage points. For the other property types, most of the year-over-year market changes are around 3 percentage points or less. The largest market increase in the retail sector was in Seattle with a 26 percentage point increase from this time last year. Management satisfaction in the market jumped from around 60 percent satisfied last year to 85 percent satisfied this past quarter. This large jump has also put Seattle at the top of the list for the major markets.

Alternatively, retail satisfaction with management in Miami dropped 6.2 percentage points year-over-year. Miami is also the market with the lowest management satisfaction of the top markets with only 69 percent of tenants satisfied with management. Retail tenants usually have lower management satisfaction than the other commercial property types and that may be influenced by the low percentage of tenants that indicate their contact preferences are being met. Nationally, only 59 percent of retail tenants feel that their contact preferences are being met.

You must be logged in to post a comment.