Rethinking CRE Risk & Return in 2024

It's not economic cycles that determine your level of opportunity, writes David Frosh of Fidelity Bancorp Funding.

In the course of 2023, economists and stock market analysts found themselves notably off the mark in their predictions, surpassing even their usual dismal results. Contrary to expectations, economic growth has exceeded most projections. Amazingly a significant uptick in interest rates was met by continued growth in national housing prices. No one predicted this.

To grasp the significance of the current economic landscape, reflect on the fact that a person needs to be approximately 36 years old to have navigated through a prolonged recession as an adult. From 1981 to 2021, interest rates plummeted by a staggering 2,000 basis points, and markets for both debt and equity soared all over the world (over this time, the S&P 500 increased approximately 10x). Despite numerous forecasts of an impending downturn in the face of higher interest rates, the economy has remained robust. The question now looms: Where are interest rates headed? The answer seems elusive, leaving even seasoned analysts without a clear trajectory. My bet is that analysts will continue to be wrong. More importantly, it should not matter to you, the investor.

What the experts say

Industry stalwarts such as Howard Marks, Warren Buffet, the late Charlie Munger, and Ray Dalio have consistently cautioned against succumbing to the noise of market speculation. While their advice holds merit, the collective response has been to ignore them. From the cryptocurrency sphere to the stock market, individuals have embraced significant risks without penalty. Marks astutely points out that over the past decade, those who meticulously researched and pondered risk did not fare as well as those who did less homework and spent more time on the golf course. The absence of penalties for high-risk ventures created an environment that enabled investors to amass unprecedented wealth. The continuous decline in interest rates masked many errors while amplifying gains from average investments.

Despite interest rates still lingering below the 50-year norm, predicting their future movement remains an enigma. Buffet asserts that the golden age for investing may be a thing of the past, ushering in an era where investors must once again hone their skills. Investors need to focus on the opportunities the market is presenting rather than what might happen.

Marks suggests a closer examination of bonds and private credit. With more than $1.5 trillion in commercial real estate loans coming due over the next three years, which will need to be refinanced or paid off through property sales, a remarkable opportunity exists. Banks, facing challenges not entirely of their making, are being replaced by alternative lenders because regulatory restraints make it difficult for them to lend. None want to be the next Silicon Valley Bank.

Why interest rates matter little

For the first time in a generation, bonds may offer returns comparable to the stock market but with lower volatility and arguably lower risk. Private credit funds are now earning returns between 7.5 percent and 10 percent on asset-backed loans.

Over the past 15 years, it seemed nearly impossible not to profit from real estate. Drops in interest rates consistently enhanced property values. As the wise Munger noted, individuals were willing to pay as much as they could borrow.

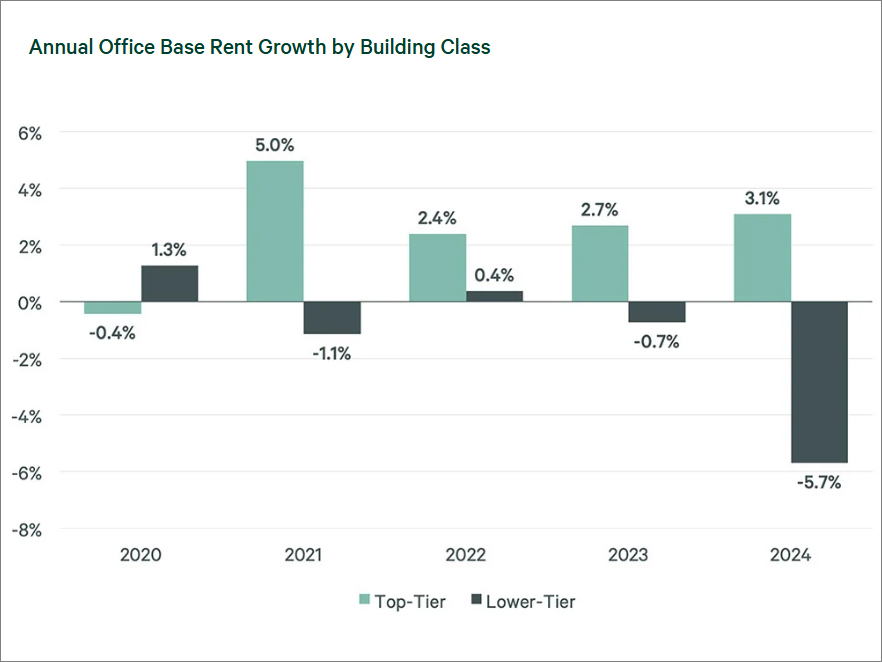

However, the current landscape presents a formidable challenge for real estate investors. Properties currently leveraged between 65 percent and 90 percent are now facing a 100 percent increase in debt costs. With stagnant or declining rents, lenders are reluctant to extend high-leverage loans. At current interest rates, investors find themselves in a position where they must inject additional equity or risk losing their properties.

This serves as a crucial reminder: Economic cycles are not the key issue for real estate investors. It is leverage. Savvy investors with conservative leverage ratios, on the other hand, view downturns as opportunities to thrive and grow their portfolio.

You must be logged in to post a comment.