Return-to-Office Mandates Start to Clock In

New York City and Miami are front-runners as markets recover, according to Placer.ai.

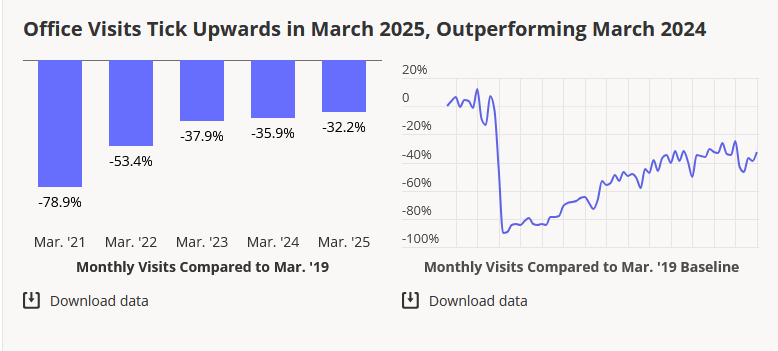

Office traffic nationally remains well behind the pace of the pre-pandemic level but it is showing steady improvement.

Visits in March came in 32.2 percent below March 2019 levels. However, a recent report from Placer.ai said that although numbers declined in January and February, last month’s data reveals that new return-to-office mandates could have had an impact.

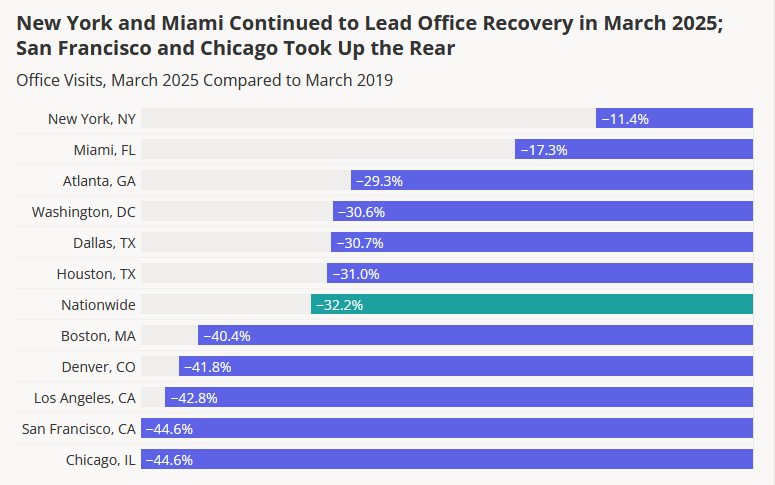

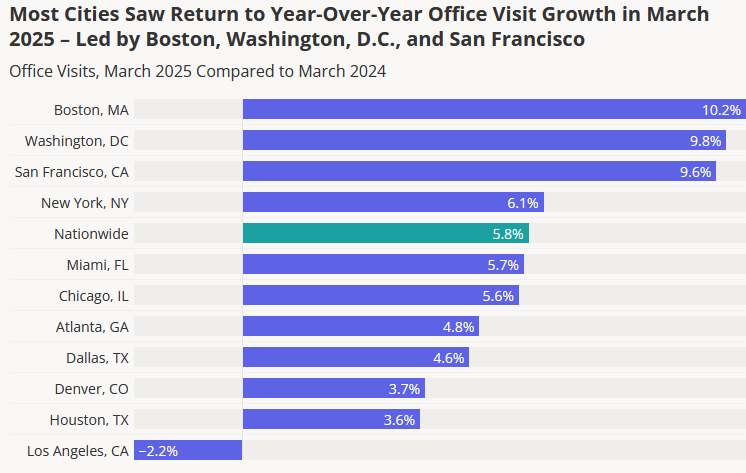

New York City (down 11.4 percent) and Miami (down 17.3 percent) have recovered the most. Boston (10.2 percent), Washington, D.C. (9.8 percent) and San Francisco (9.6 percent) are showing the most improvement year-over-year.

This comes after solid improvement registered late last year, according to Placer.ai.

The Placer.ai Nationwide Office Building Index is based on foot traffic from 1,000 commercial office buildings throughout the U.S. with first-floor retail. Mixed-use buildings and government buildings are not factored.

“While we still have large high-rise vacancies in our downtown and Midtown corridors—in the 20 percent range—those buildings are seeking alternative uses for more multifamily applications and hotel conversions in those submarkets,” Jason Price, executive director of marketing & research at Commercial Properties Inc./CORFAC International, told Commercial Property Executive.

READ ALSO: Where Office Space Wins

The demand for urban office space closer to neighborhoods and retailers is very competitive in the Phoenix market, Price added. Based on Commercial Properties Inc./CORFAC International’s internal deal data, he sees this shift in leasing activity for urban office space compared to the previous year.

“In the first quarter of 2024, we closed 80 office lease deals covering 150,908 square feet. Fast forwarding to 2025, while our firm saw a slight decrease in the number of lease deals (75 in total), there was a significant increase in the square footage leased, equating to 202,716 total square feet, primarily in urban office products.”

The data suggests fewer deals but larger-sized office lease transactions, which coincides with more businesses relocating to Arizona’s pro-business environment, Price observed. “This attracts established companies who enjoy lower business costs and want amenities for their employees nearby.”

Return-to-office momentum builds

“We are already seeing tangible progress as return-to-office momentum builds,” Christopher Clemente, CEO of Washington, D.C.-based Comstock Cos., told CPE.

“[Public transportation] train ridership at Reston Station is up more than 30 percent year-over-year. With more people back on the move, our office tenants report increased foot traffic, and restaurants, retailers and fitness studios throughout our mixed-use communities are experiencing meaningful gains. This isn’t just a shift in workplace habits—its broader economic ripple reinvigorates daily life across the region.”

The year began with announcements from some corporate giants instituting return-to-office mandates, signaling a massive shift in remote work policies that has remained steady during the first quarter of 2025, according to Ben Kuykendall, senior sales & leasing associate at First Capital Property Group/CORFAC International.

“These corporate giants are returning to their headquarters campuses,” Kuykendall said. “The trend we’ve seen among smaller local and regional firms in Orlando has been to retain an office presence but to trade down to smaller footprints with more flexible layouts with features like hot desks and small private call rooms.”

“Companies we’ve worked with to relocate or expand their offices have consistently stated that working from home is no longer effective, and they want to find a space that’s convenient and compelling so that their teams can work in person.”

Positive signs in key Midwest markets

In the St. Louis area, traffic is heavier, restaurants are buzzing with Doordash pickups headed to offices hard at work, according to Joel Meyer, SIOR, principal of Intelica/CORFAC International.

“The parking lots are packed. While some buildings and submarkets still face elevated vacancy, we’re seeing real tightening in top-tier spaces—especially Class A assets.

In Clayton, Mo.—the financial hub of the St. Louis MSA—Class A/B office vacancy has dropped from 20 percent to just 11.6 percent.

“Top credit tenants are actively competing for the best space, signaling renewed momentum in the market,” Meyer said.

In Chicago, there has been a shift in the employer-employee dynamic from what was felt just a few years ago, Grant Bollman, vice president at Lee & Associates of Illinois, told CPE.

“The current economic cycle has created uncertainty in the labor pool, leaving more employees doubting their ability to find another remote or hybrid job should their employer take a hard line on its return-to-office policy,” he said.

“But it’s not necessarily adversarial. In many cases, landlords have spent money to make the office a more welcoming place where people want to be. We have a long way to go to solve the office vacancy problem, but these factors are shifting things in the right direction.”

RTO perks make a difference

Having an inviting environment is crucial, according to Jeff Gural, chairman & principal of GFP Real Estate, based in New York City.

“We’ve implemented several initiatives to make our buildings more appealing, including our popular NFL and concert ticket giveaway programs where the tenant’s employees can scan a QR code in the lobby daily to be entered into monthly drawings for box seats for concert tickets and Jets/Giants games at MetLife Stadium.”

“We’re also enhancing the daily office experience with special touches like handing out roses on Valentine’s Day, hosting regular coffee and bagel mornings, organizing social events in our lobbies and bringing in world-class musicians for lobby concerts.”

GFP is addressing practical concerns such as childcare through its partnership with Buckle My Shoe preschool, offering tenants’ employees a 50 percent discount through a shared subsidy program.

“These efforts are paying off—our leasing occupancy has steadily increased back into the 90-percent-plus range after dipping during COVID,” Gural said.

You must be logged in to post a comment.