Return to Office Sentiment Heats Up: BOMA

A growing number of tenants highly value in-person work, according to the organization's latest wide-ranging survey.

Office tenants nationwide are seeing both more value and importance in their physical space compared to last year, with widespread returns to the office being more prominent in some sectors than others. Still, there is a widespread embrace of hybrid and fully remote working models that shows no sign of slowing down. Additionally, most involved in office work are rethinking their space needs to some degree, with over half expressing a desire to reduce their total square footage. Those are some key findings of the latest report from the Building Owners and Managers Association (BOMA) tracking the evolving attitudes of office use.

The project, commissioned by BOMA, conducted by Brightline Strategies and underwritten by Yardi Systems Inc., shows increasingly favorable sentiment toward in-person office work when compared to the same surveys conducted over the past two years. The study polled 1,267 office space decision- makers and influencers amid recession concerns, inflation, rising interest rates, a lingering pandemic and exorbitant construction, management and maintenance costs.

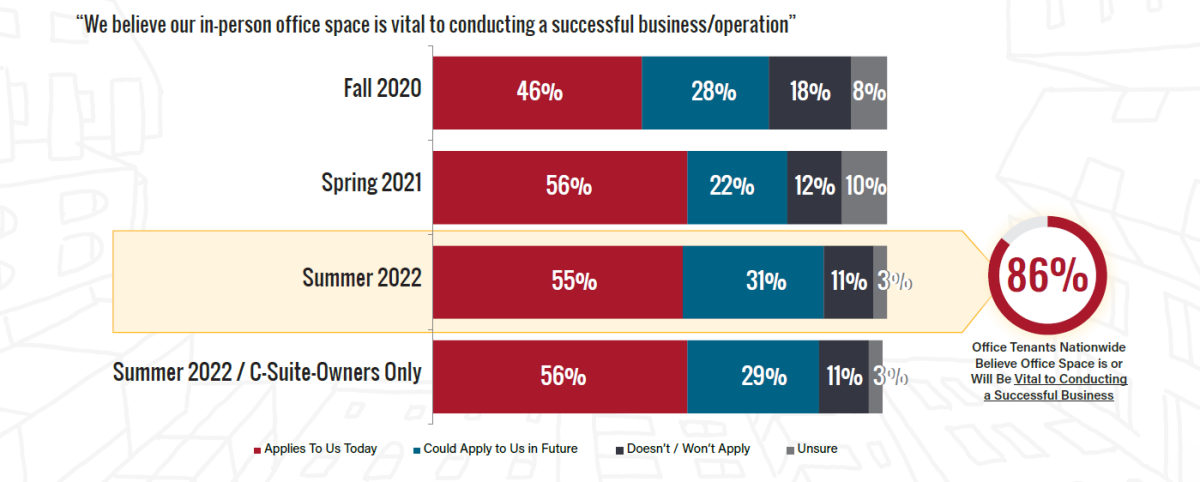

Initially, it shows that 86 percent of respondents believe in-person office work is or could be an essential part of a successful business practice. Of these respondents, 55 percent said the sentiment applies to them now, and 31 percent agreed that it could in the future. Those findings mark an 8 percent increase from the previous year’s study.

Chart courtesy of BOMA International

Of these, Class A office tenants have shown the highest degree of enthusiasm for in-person work, with 90 percent of respondents in the sector expressing their view of the importance of in-person office work. Still, for their part, C-suite owners expressed considerably more interest in in-person office work than in the previous survey, with 85 percent of those surveyed saying that it does or could apply to them.

Furthermore, 57 percent of the survey’s subjects revealed that they see more inherent, irreplaceable value in their physical office space, a more than twofold increase from the previous year. The most positive sentiments were held primarily among tenants in the technology, manufacturing and real estate sectors which more than 10,000 square feet; all see increased value in their space exceeding 60 percent, some nearly two to three times as high as the spring 2021 survey.

READ ALSO: Office Investment Momentum Propped Up by Mixed-Use Deals

On a regional basis, the most dramatic increases in favorability are concentrated in the Northeast and West Coast. In the Northeast, for example, 65 percent of respondents in the most recent survey are seeing more value their office space; in the spring of 2021, only 18 percent did so. According to the report, much of this is attributable to operational and collaborative impacts of the work-from-home environment of the past two years, and their adverse effects on company culture.

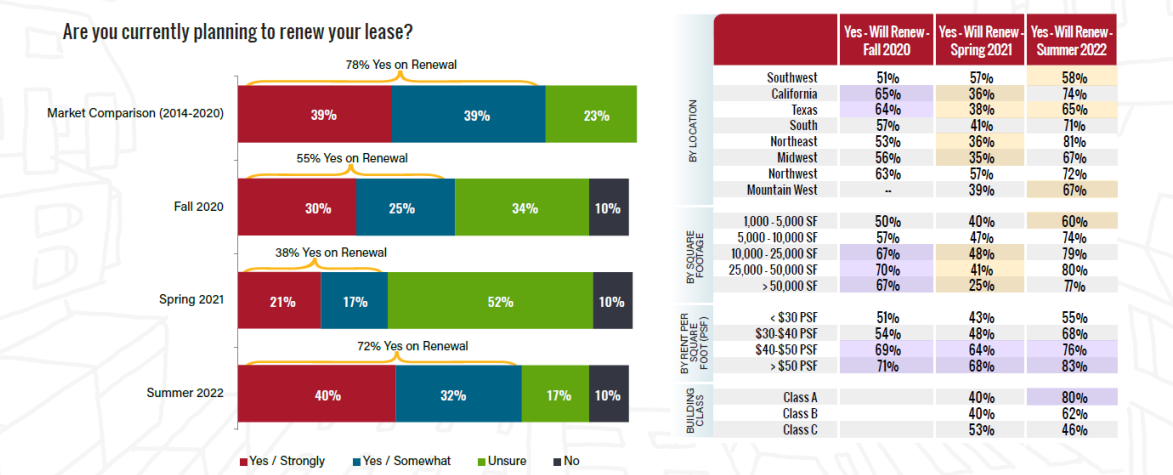

In the same vein, 72 percent of respondents are planning to renew their leases in some form, nearly double from 2021’s responses. Those most likely to renew are concentrated in the Northeast, Northwest, California and Texas.

Chart courtesy of BOMA International

Telework trends

Despite the widely favorable opinion of in-person office work, the benefits of a work-from-home or hybrid model are also gaining traction. Fifty-five percent of tenants expressed moderate to strong support for more telework, and those strongly supporting it increased 6 percent to 25 percent compared to last year. Those responses took into account a possible end to the pandemic, asking tenants to consider it in regard to future remote-work related logistics decisions.

Nearly one third of respondents said that their operations will be conducted either mostly or fully remotely, with those leasing between 10,000 and 25,000 square feet being the most likely to adopt this model into the foreseeable future. Much of the reasoning from those favoring remote work seems to be unrelated to the pandemic; more than 50 percent of respondents cited family obligations and commute-related issues as their primary motivations.

Moreover, 81 percent of respondents in the same data set stated that they were being directly impacted from inflation-related business-related costs; 80 percent said that supply chain-related delays were impacting their operations and leasing-related assessments as well.

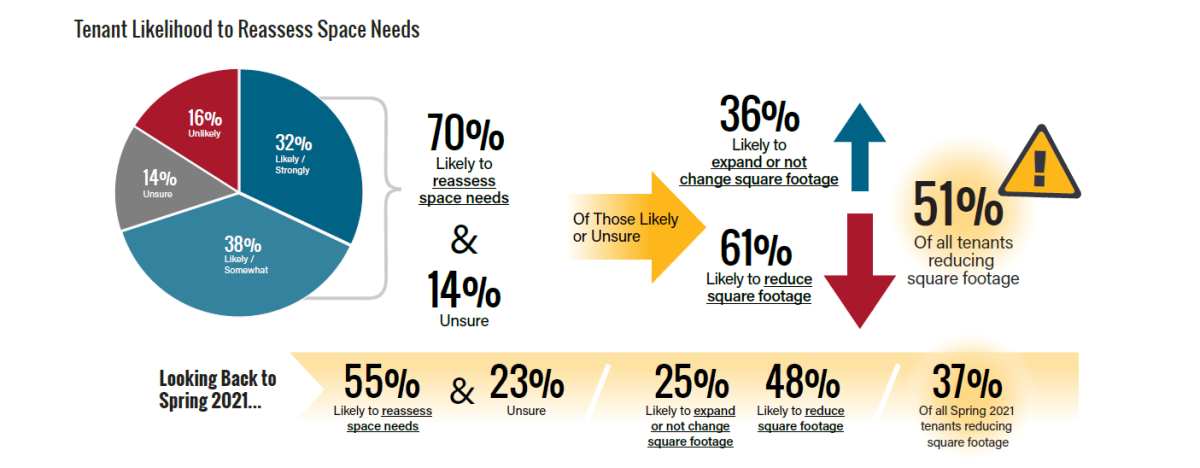

On the same front, despite a widely favorable view of physical office space, 70 percent of respondents stated that they were either somewhat or highly likely to re-evaluate their space needs, and 14 percent were unsure. Of those, 61 percent stated that they will probably reduce the square footage of space they occupy, a 13 percent increase. Overall, 51 percent of those with some likelihood of assessing their square footage will reduce it, a 14 positive change from the 2021 survey’s results.

Chart courtesy of BOMA International

The most dramatic increases in likelihood to reassess space needs came from respondents who see the value in their physical offices; those in Class A and Class B spaces, primarily in the Northeast, California and Texas, all leasing spaces more than 10,000 square feet. On the other hand, 36 percent of subjects stated that they would consider expanding or not changing their footprint.

Other highlights: 71 percent of property owners and managers say that they will make significant investments in safety-related physical features such as HVAC and sanitation, as well as an average of 67 percent expect to enhance amenities.

You must be logged in to post a comment.