RICS Monitor: Is the Worst Behind Us?

Senior Economist Tarrant Parsons expects a September rate cut from the Federal Reserve. Listen now to an in-depth analysis of global trends!

Investor and occupier sentiment across the globe is still recovering, with no major changes from the first quarter of the year. This is the main trend stemming from the most recent Global Commercial Property Monitor survey released by the Royal Institution of Royal Surveyors in London. A growing number of CRE players sense that the market has reached the bottom of this cycle or is very close to reaching that level.

In this podcast episode of our RICS Monitor quarterly series, Senior Economist Tarrant Parsons told Commercial Property Executive Senior Editor Laura Calugar that the mood that stems from the organization’s latest survey is that the worst is now behind us.

In Europe, some financial institutions have already delivered at least one rate cut, and the most recent data on economic growth is favorable enough to allow for a September rate cut from the Federal Reserve, Parsons believes.

Here’s a dropdown of what else he talks about:

- Why no major changes in CRE sentiment should be expected (0:58)

- Why investors are a bit more optimistic (2:08)

- Credit conditions (3:07)

- CRE valuations (6:04)

- Development starts metrics (7:25)

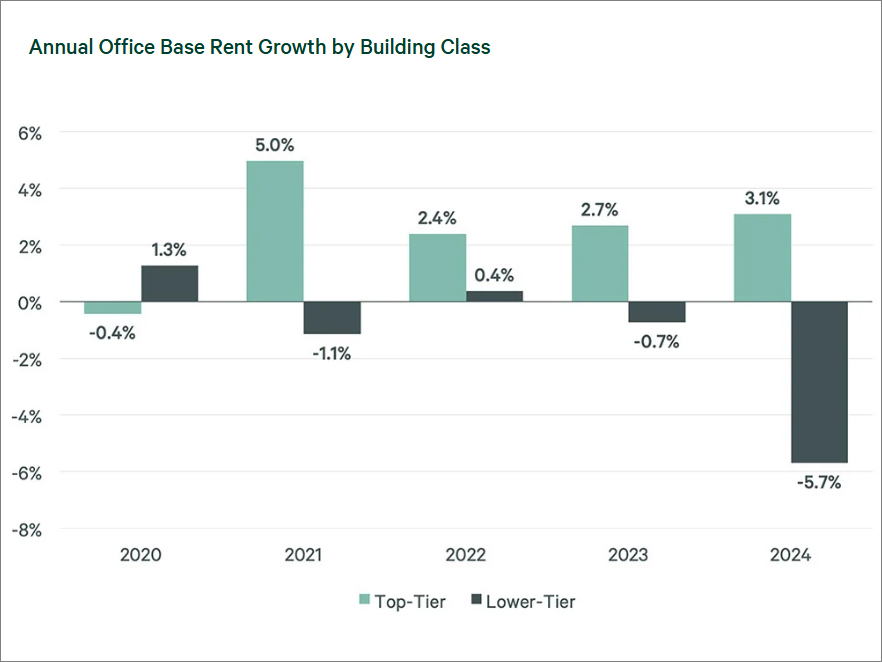

- Why alternative assets and prime space continue to outperform (8:56)

- The mixed picture in the APAC region (10:28)

- Investor and occupier sentiment in Europe (11:56)

- Upbeat results in the Middle East and Africa (13:50)

- The North American market (15:02)

- What should we expect for the second half of the year? (16:35)

Follow, rate and review CPE’s podcasts on Spotify and Apple Podcasts!

You must be logged in to post a comment.