Rising Construction Costs, Fewer Jobs Projected

A drop in nonresidential starts last year will equate to less construction activity in 2021, JLL predicts.

The construction industry, which had an “extremely volatile year” in 2020, is looking at another challenging year in 2021. JLL’s H1 2021 Construction Outlook foresees decreasing work volume, increasing costs, and a 5 to 8 percent drop in overall nonresidential construction.

READ ALSO: CBRE Reports Q4 CRE Lending Surge

JLL notes nonresidential construction starts decreased 24 percent in 2020, which means there will be less work overall in 2021, even if the volume begins to pick up later in the year as projected. The industry is expected to return to a period of growth in 2022.

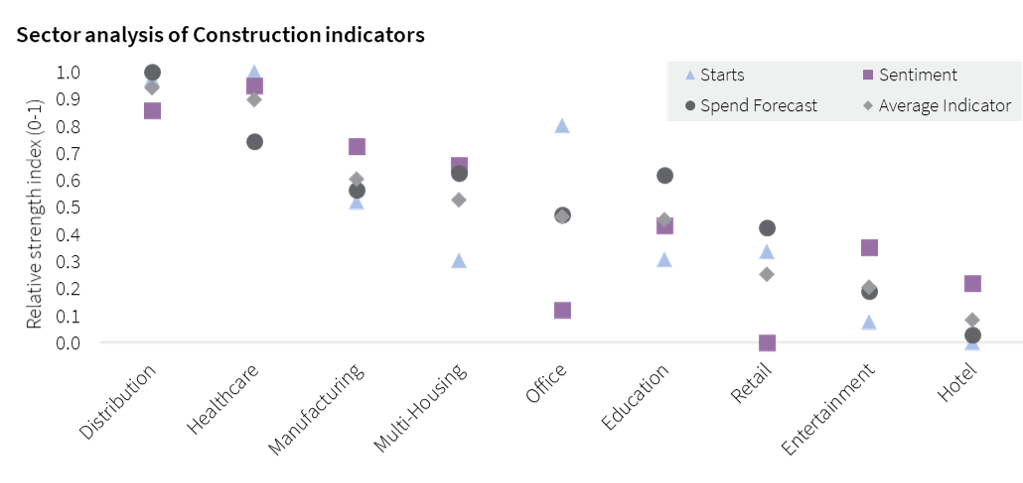

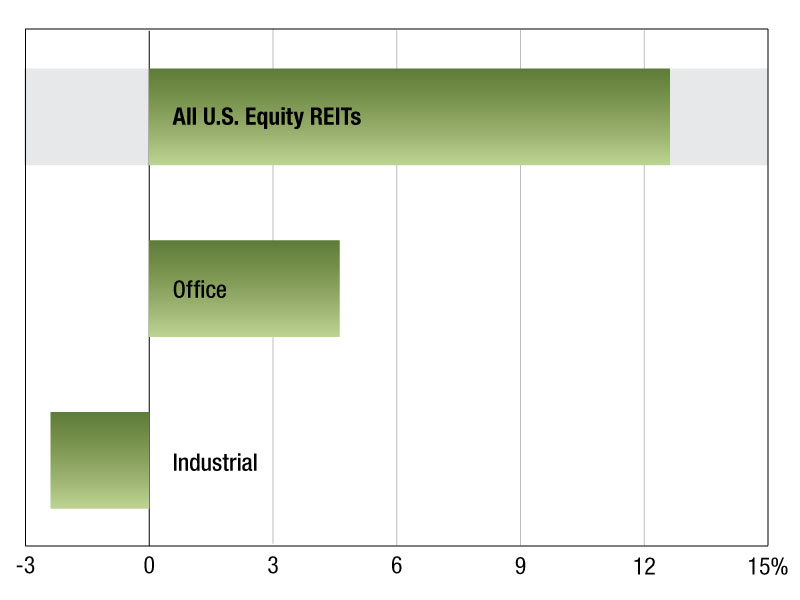

Unsurprisingly the pandemic impacted some segments of the construction industry more than others, with retail, entertainment and hotels sectors having the fewest starts last year and the distribution and health-care sectors having the most. Manufacturing, multifamily, office and education sectors placed in the middle, although the office sector performed the best among that group. The JLL report states that the average relative strength of three indicators—construction starts, construction-industry sentiment and forecast construction spending—“aligns with our forecasts for the relative performance of each sector in 2021.”

Chart courtesy of JLL Research, Dodge Analytics, American Institute of Architects, Associated General Contractors

JLL states that the pandemic was severe enough that construction in the worst-impacted sectors slowed down quickly early last year and the gap in the forecasts for the best- and worst-performing sectors is “now wider than anything seen in the last recession.”

Costs increasing

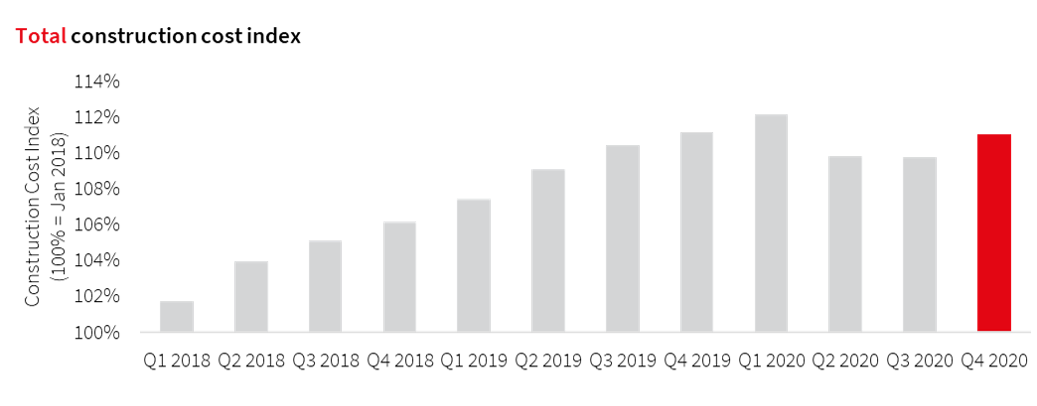

Total construction costs decreased immediately following the coronavirus outbreak in the U.S. and stayed down through the second and third quarters. During the fourth quarter, costs began to increase, and that trend is expected to continue. The JLL outlook notes material costs will have the highest growth, with labor costs also seeing steady increases.

While material and labor costs rose in 2020, total construction costs remained roughly flat. Weak demand led to more aggressive bidding from contractors seeking jobs, but JLL expects that contractors will not be able to sustain losses and will begin to increase margins once the market recovers.

The report states steady cost inflation, which had been occurring during the fourth quarter of 2020, has returned this year. Total construction costs rose between 3.5 percent and 5.5 percent every year from 2012 to 2019. JLL projects total construction costs for 2021 should be in that range, possibly the higher end of it. The report also expects the total cost and material cost inflation to be higher than 2019 levels.

The outlook notes political impacts from the Biden administration and Democratic-controlled Congress are expected to be wide ranging and likely add to increasing construction costs. But it is also likely to result in a large infrastructure bill that combined with another large-scale COVID-19 relief stimulus bill could boost the construction industry.

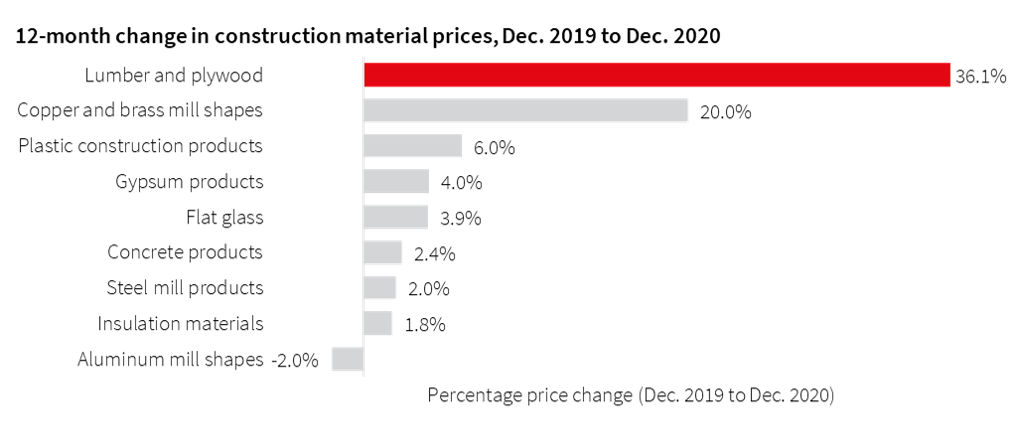

Average construction material costs are projected to rise between 4 percent and 6 percent during 2021. Last year, supply and demand issues caused by the pandemic led to shortages of some supplies and record cost growth for some materials.

Residential demand led to a 36.1 percent increase in lumber and plywood costs from December 2019 to December 2020. Copper and brass mill shapes also saw double-digit increases, up 20 percent during that time period. Some materials used predominantly by the nonresidential construction industry, like steel, were up 2 percent, which is lower than average. Lumber saw the most volatility last year because of production problems in mills, primarily in Canada, and retail locations that had to close temporarily because of COVID-19-related issues.

A shortage of construction labor, which was a problem before COVID-19, continued last year as contractors reported challenges finding enough workers to take on new projects. Contractors in boom markets like Reno, Nev., and Austin, Texas, had to bring in workers from outside the regions to meet demand. Construction wages rose 2.5 percent in 2020. JLL projects construction labor inflation in 2021 will be between 2 percent and 5 percent.

Read the full report by JLL.

You must be logged in to post a comment.