Rockpoint Group Raises $5.8B in Opportunistic Funds

Rockpoint Real Estate Fund VI and Rockpoint Growth and Income Real Estate Fund III completed their final closes, with contributions from investors of $3.8 billion and $2 billion, respectively.

Rockpoint Group has completed equity raises for two investment vehicles, securing an aggregate $5.8 billion. The global real estate investment and management firm has just announced the final close of Rockpoint Real Estate Fund VI, with $3.8 billion in commitments on the heels of the final close of Rockpoint Growth and Income Real Estate Fund III, which raised an aggregate $2 billion.

READ ALSO: CRE Advisory in the Time of COVID-19: Q&A

Introduced in 2018, Fund VI is an opportunistic vehicle focusing on the acquisition of high-quality, well-located office, multifamily and hospitality assets below replacement cost for the purpose of adding value through proactive asset management. Fund VI closed at roughly half a billion dollars above its $3.3 billion target, raking in capital pledges from public and corporate pension funds, sovereign wealth funds, endowments, foundations and other investors across the U.S., as well as in Asia, Canada, Europe, Latin America and the Middle East. The long list of Fund VI participants includes the State Board of Administration of Florida and The Merced County Employees’ Retirement Association Board, which contributed $25 million and $5 million, respectively. The Minnesota State Board of Investment committed $100 million to Fund VI three years after having contributed $100 million to Fund V.

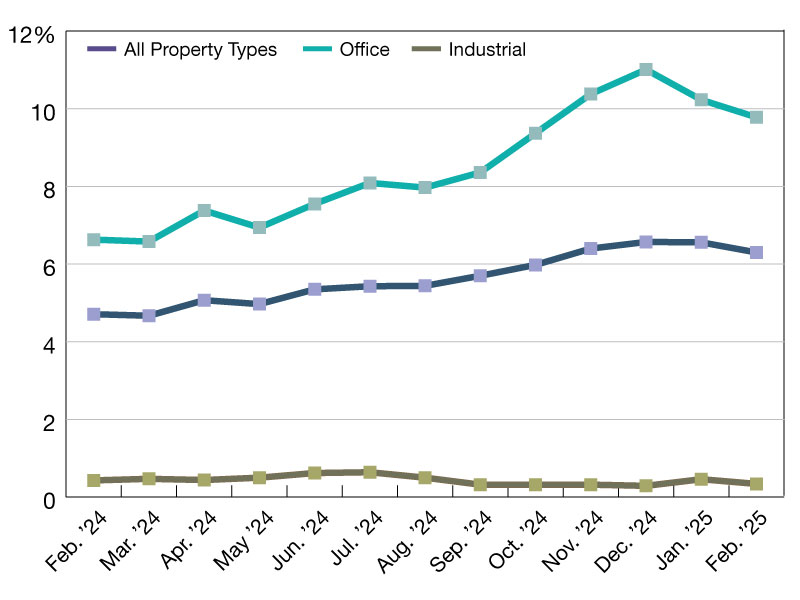

Fund VI’s close at a figure well above its goal contradicts the trend for opportunistic funds during the pandemic. “In terms of strategy, opportunistic real estate funds—which offer higher reward at higher risk—raised significantly less capital compared with the same period last year,” according to Preqin’s first quarter 2020 report on COVID-19’s impact on alternative assets. “Excluding [Brookfield Strategic Real Estate Partners III’s closing at $15 billion in January 2019] the drop in the total amount secured by opportunistic funds is 88 percent. That suggests investors may be taking a more cautious stance.”

Rockpoint’s fundamental value investment approach helped lure the investment community to RGI III as well, the company notes in a prepared statement. Like Fund VI, RGI III, which launched in 2018 with a target of $2 billion, attracted a diverse group of sophisticated investors from the U.S. and across the globe.

Deceleration: inevitable

Rockpoint was not the only fund manager to see a real estate investment vehicle close above its target amid pandemic-generated economic uncertainty. In June, Bell Partners, a leading apartment investment management company, completed the final close for Bell Apartment Fund VII above its $800 million goal, reaching its hard cap of $950 million. Realterm’s Realterm Logistics Fund III closed oversubscribed in May, with total equity commitments climbing to the fund’s hard cap of $370 million. Despite investors’ robust interest in real estate funds, activity will not hold steady in the coronavirus environment.

“Fund commitments will slow in 2020. The reasons for this include the difficulty of completing assessment and due diligence without face-to-face meetings, and the ‘Denominator Effect 2.0’ as the rest of the portfolio is revalued downwards,” according to the Preqin report.

You must be logged in to post a comment.