RTO Policies Mostly Go Unenforced: CBRE

Research is shedding new light on what office workers want—including some surprises.

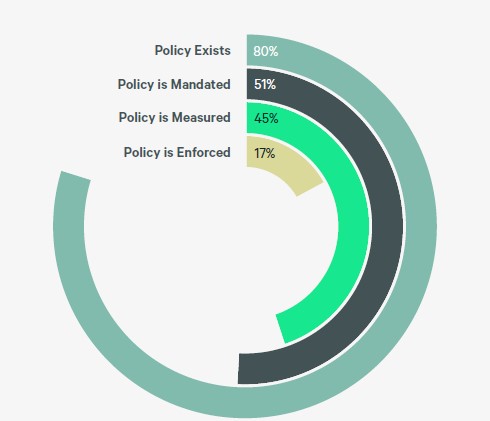

Some 80 percent of organizations have a return-to-office policy, but only 17 percent actively enforce it, according to a new survey from CBRE. And while adherence still lags, one-third of corporate real estate executives that responded want more in-office attendance.

However, the paper points out that holding employees accountable to mandates can create negative outcomes if employers don’t strive to understand and remedy the barriers blocking more frequent office utilization.

For its 2024 edition of the Americas Office Occupier Sentiment Survey, CBRE gathered insights from 225 corporate real estate executives overseeing office portfolios across the U.S., Canada and Latin America.

Remote vs. office reaches ‘stalemate’

Contrary to common assumptions, another recent survey showed that most U.S. workers prefer to be in the office. Less than 20 percent of workers prefer fully remote positions, the paper from Lincoln Property Co. revealed, with more than half of U.S. employees expressing interest in working in-office four to five days a week.

Sentiment suggests that the peak of contraction behavior in the office market is over as companies adjust to a more normalized state, putting this dynamic at a stalemate, Julie Whelan, CBRE global head of occupier research, told Commercial Property Executive

“These results and second-quarter positive net absorption numbers are an encouraging sign for the office market, with prime office buildings continuing to outperform,” Whelan said.

Office visits continued to creep back to prepandemic levels, according to Placer.ai. Nationally, visits in June were down only 29.4 percent compared to same month of 2019.

READ ALSO: Has the Return-to-Office Trend Peaked?

Looking at markets, Miami is closest to returning to 2019 figures, as its visits were down by just 9.8 percent for the month. In New York City, visits were down 14.2 percent, driven by strict return-to-office policies on Wall Street.

What’s more, a recent JLL report showed that tech companies are pivoting away from remote work and toward a return to the office, even as they often struggle to balance priorities regarding space utilization and reducing space costs.

Although tech companies rapidly adopted remote work during the pandemic, subsequent research suggested that “in-office work better supports onboarding, mentorship, inclusion and engagement, and, in some settings, productivity,” JLL reported.

Most people, companies want three days a week in the office

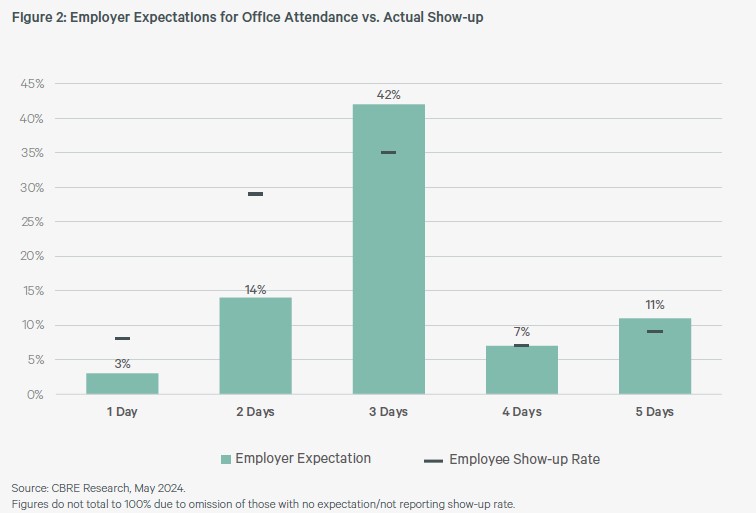

The disconnect between policy and enforcement contributes to the gap between employer expectations and employee behavior, according to CBRE. Sixty percent of firms want employees to work in the office three or more days per week, but only 51 percent of people are in the office that frequently.

Thirty-four percent of respondents to the CBRE survey anticipate closing this gap by increasing attendance. Space sharing remains top-of-mind to align with new utilization patterns and optimize portfolios.

Meanwhile, more than 70 percent report having an effective workplace but still struggle to measure performance objectively. Seventy-three percent of occupiers believe their workplace is effective, yet only 46 percent actively measure effectiveness.

Companies seek expansion, automation

As some things seem to stabilize, more companies are returning to expansion mode while renewals remain in favor. Thirty-eight percent of respondents expect to increase portfolio requirements, up from 20 percent last year. This reflects a waning of the post-pandemic focus on space reduction.

Eighty percent of respondents are considering renewals, motivated to stay in place and benefit from market adjustments while avoiding the high costs of moving and building new space. Still, 59 percent consider relocating to upgrade location, space or experience.

Forty percent of respondents report starting to deploy more advanced technologies and applications to automate workflows and operations, and 43 percent use AI primarily for lease administration. Most occupiers anticipate maintaining their real estate tech spending at last year’s level, likely due to economic pressures and cost containment strategies.

You must be logged in to post a comment.