Sacramento Sets the Pace

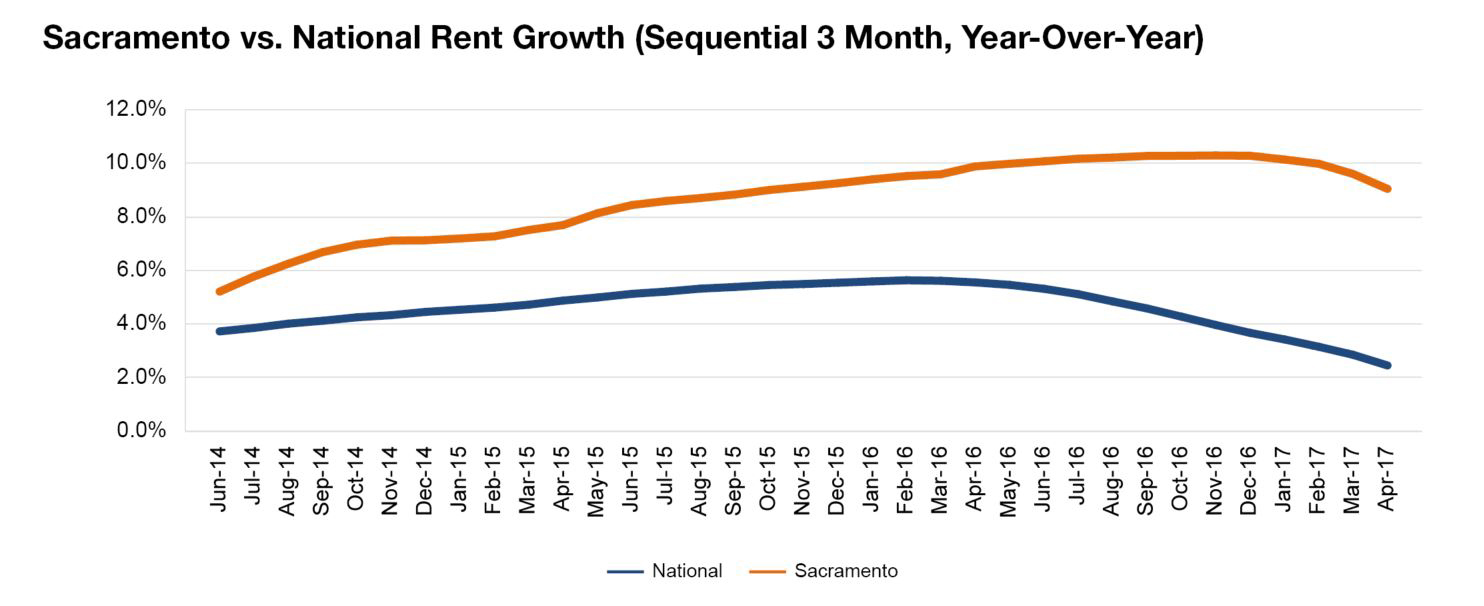

Although multifamily rent gains across the country have been decelerating in recent months, Sacramento continues to outperform. The average rent across the metro was up 9 percent year-over-year as of April.

By Alex Girda

Although multifamily rents across the country have been decelerating in recent months, Sacramento continues to outperform. While no longer in the double digits, its rent growth continues to lead major metros, and was up 9.0 percent year-over-year as of April. Investors have taken notice, with transactions ballooning during the second half of the cycle, leading to consecutive annual sales volumes topping the $1 billion mark.

While employment growth continued at above-trend levels, there is still concern that high-paying manufacturing and information jobs are lagging in Sacramento. Education and health services, and leisure and hospitality, drove gains in 2016, while a decline in construction jobs following the completion of Golden 1 Center hurt overall employment. However, after Kaiser Permanente acquired an 18-acre site in the city’s Railyards with the intent to build a new medical center, the conversation moved toward the potential for additional development in the area.

The impressive rent gains come from the combination of a strong demand and a dearth of deliveries, resulting in high occupancy rates. With 1,500 units underway, short-term supply growth is unlikely, but 10,000 units in the planning stages demonstrate a significant increase in developer interest. With affordability not yet a concern despite rapid growth, we expect rent hikes to continue at roughly 9.5 percent in 2017.

You must be logged in to post a comment.