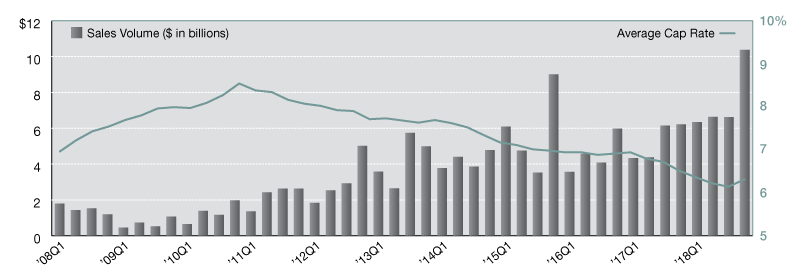

2018 Net Lease Industrial Sales Volume & Cap Rates

After bottoming out at 6.1 percent at mid-year, rates have seen noticeable increases during the last two quarters, ending the year at 6.32 percent.

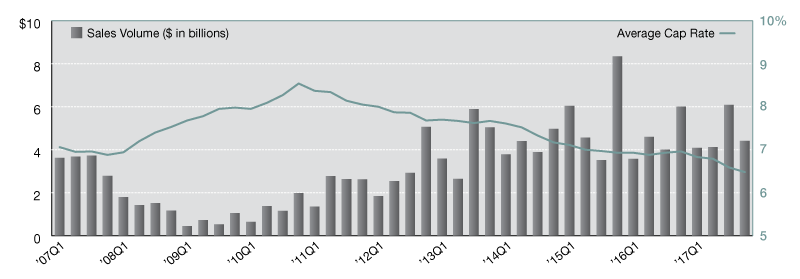

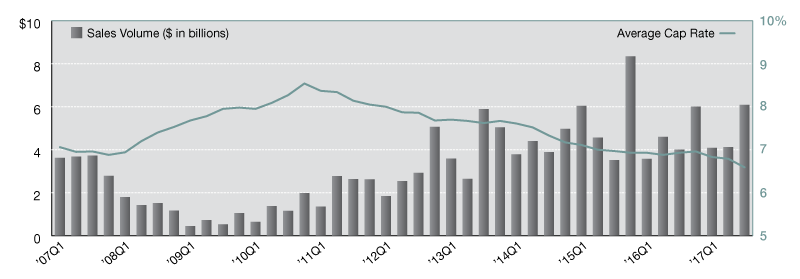

Unlike the retail sector, which has seen average cap rates bounce along the bottom for the last few years, single-tenant industrial cap rates have been following a more traditional “V”-shaped trendline. After bottoming out at 6.1 percent at mid-year, the last two quarters have seen noticeable increases, ending the year at 6.32 percent. But the real story in the industrial sector this year was sales volume. A record high fourth quarter lead to a record high year, as more than $10.3 billion in sales were recorded in the last three months. The nearly $30.0 billion in annual sales significantly outpaced the previous record set in 2015 by 28.1 percent. Another notable trend in 2018 was the return of the institutional investor. For the first time in recent years, domestic institutional buyers surpassed the 30-percent-mark, taking market share away from private buyers. But are they here to stay? It remains to be seen if recent activity is indicative of future trends, or if fourth quarter’s spike in sales was simply an anomaly.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Mar. 26, 2019

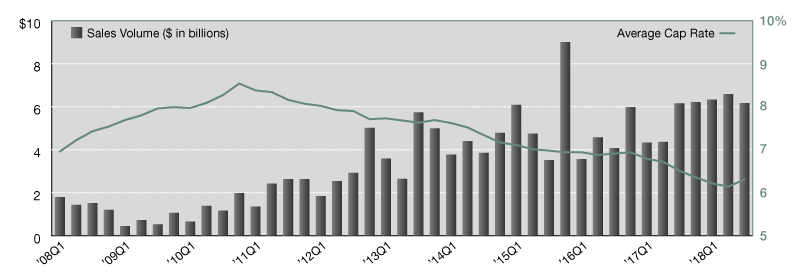

Sales volume totals in the single-tenant industrial sector have been remarkably consistent over the last several quarters, reporting between $6.1 and $6.6 billion each quarter. This reporting period was no different, although volumes were on the lower side of the range at less than $6.2 billion. However, recent momentum in the industrial sector has brought year-to-date totals to more than $19.0 billion, nearly matching last year’s $21.1 billion annual total and putting the market well on track to outpace the all-time high-water mark of $23.4 billion. The sector saw average cap rates increase quarter-to-quarter for the first time in two years, rising 17 basis points to 6.3 percent. While one quarter’s activity isn’t enough to be considered a trend, it is likely that industrial cap rates bottomed out at mid-year and we will continue to see sustained upward movement in future quarters, even in small increments.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Dec. 14, 2018

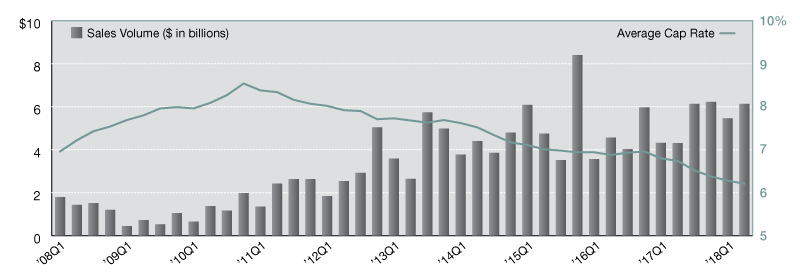

The single-tenant industrial sector was dominant again in second quarter 2018, reporting $6.1 billion in sales volume for the quarter. After a slower start to the year, the sector rebounded to report sales totals more on par with volumes reported in recent quarters. Coming off a year in which nearly $21.0 billion was reported, the industrial market is well positioned to exceed 2017 totals if activity levels are sustained during the second half of the year. Average cap rates for single-tenant industrial sales continued to trend downward. Cap rates have fallen 53 basis points in the last year, and they ticked down several more in just the last three months to end the reporting period at 6.2 percent. With retail rates leading the upward charge, the market will likely see cap rates start to trend upward for industrial and office product in the coming quarters. The last several years have seen buyer activity distributed relatively evenly across the different investor types. Private buyers continued to lead, with 38 percent of transactions involving a private buyer, but domestic institutional buyers are close behind, being involved in approximately a quarter of the industrial transactions year-to-date.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Sep. 13, 2018

The single-tenant industrial market has been quite robust in recent months. Nearly $5.3 billion in sales volume was reported during Q1 2018, representing a 24.3 percent uptick year-over-year. The Midwest and West regions drove volume this quarter, with $1.2 and $1.5 billion in sales respectively. Average cap rates for the industrial class declined for the fifth straight quarter, falling 10 basis points to 6.39 percent. In the coming quarters, we expect to see industrial cap rate compression halt, or at least slow dramatically, before likely reporting noticeable increases sometime next year. Buying activity, similar to trends seen across the office and retail sectors, was largely driven by private investors this quarter, with 47 percent of deals being purchased by a private buyer. The international investor community, on the other hand, did not appear to have industrial assets on their radar in the early months of 2018. Only one percent of transactions in first quarter involved an international buyer, although they will certainly gain market share as the year progresses.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on June 19, 2018

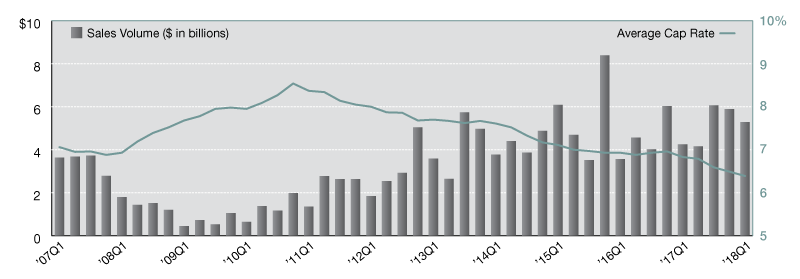

The single-tenant industrial sector posted the second strongest year of sales in history with more than $18.7 billion recorded. Coming off a particularly strong quarter in which more than $6 billion in sales were reported, Q4 2017 saw volumes fall more in line with recent averages as $4.4 billion in sales were logged. The industrial sector saw average cap rates compress for the fourth consecutive quarter, ending the year at 6.5 percent. In the last 12 months, cap rates have fallen almost 50 basis points–and while further compression is expected during 2018, we are likely to see only single-digit basis points declines each quarter rather than more significant drops. While average cap rates are not expected to dip as low as those reported in the retail sector, another 10 to 15 basis points lower than 2017’s year-end average is not inconceivable.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Mar. 20, 2018

For the first time in recent quarters, single-tenant industrial sales outpaced the other property types, reporting more than $5.2 billion during Q3 2017, compared to $5.1 billion in office and $3.7 billion in retail. This brings year-to-date sales volume for the industrial sector to nearly $13.5 billion, or $1.4 billion more than at this time last year. Industrial cap rates continue to be the highest across the three primary single-tenant property types. However, they saw the largest quarter-to-quarter compression, falling 15 basis points to end third quarter at 6.7 percent—office and retail cap rates fell less than five basis points each. This continued compression across the industry, albeit it fairly insignificant, continues to illustrate the “U-shaped” cap rate trendline that we’ve been experiencing for the last 18+ months. Looking forward, we expect cap rates to bounce along the bottom for another several quarters before beginning noticeable and sustained upward movement.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Dec. 30, 2017

You must be logged in to post a comment.