Salesforce Subleases 286 KSF to Sephora

The deal marks San Francisco’s biggest office lease of the pandemic.

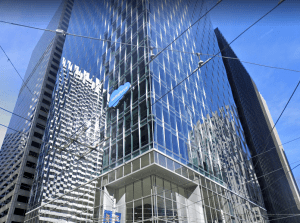

Salesforce has subleased 286,000 square feet at 350 Mission St., in San Francisco’s Transbay area, to Sephora, which will use the space as its new U.S. headquarters, the San Francisco Chronicle reported.

The deal qualifies as the city’s largest office lease since November 2019, or during the pandemic, according to the Chronicle. The Paris-based personal care and beauty products retailer will be occupying 16 floors in the 30-story building.

READ ALSO: Why REITs Outperformed in 2021: Nareit

In a prepared statement, Jeff Gaul, senior vice president of store development for Sephora, called 350 Mission “thoughtfully designed” and added, “this move consolidates the number of buildings our corporate employees work in and supports our hybrid in-person and remote work practices….”

Sephora reportedly will move into the space at 350 Mission in 2023, consolidating its current spaces at 425 Market St. and 525 Market St.

Also known as Salesforce East, 350 Mission is owned by Kilroy Realty Corp.

Salesforce had occupied all 30 floors in the building, till it put about half of its space up for sublease last year, citing a reduced need for space because of remote work—and despite the company thriving. It has about 10,000 employees in San Francisco.

The software company’s highest-profile home in San Francisco is the eponymous Salesforce Tower, a 1 million-square-foot structure (the city’s tallest) at 415 Mission St.

But Salesforce also owns space in San Francisco, and in May, it landed an advisory firm as a full-floor tenant at 50 Fremont St., which Salesforce bought from TIAA-CREF in 2015.

Active subleasing

Other Bay Area employers besides Salesforce are experimenting with various approaches mixing on-site, hybrid and remote work, according to a fourth-quarter report from Kidder Mathews.

Interestingly, subleasing comprised nearly 2 million square feet in 2021, or slightly more than one-third of all office leasing. The report notes: “The high demand for subleases is due to the uncertainty the new COVID-19 variants create for employers and the desire to keep terms short.”

Overall, the office market continues to recover, as leasing is on the rise, even as total vacancy is also increasing. As in other markets nationally, vacancy in Class B and C building is substantially higher than in Class A space, which is 17 percent, Kidder Mathews reported.

You must be logged in to post a comment.