San Francisco Office Report – Spring 2019

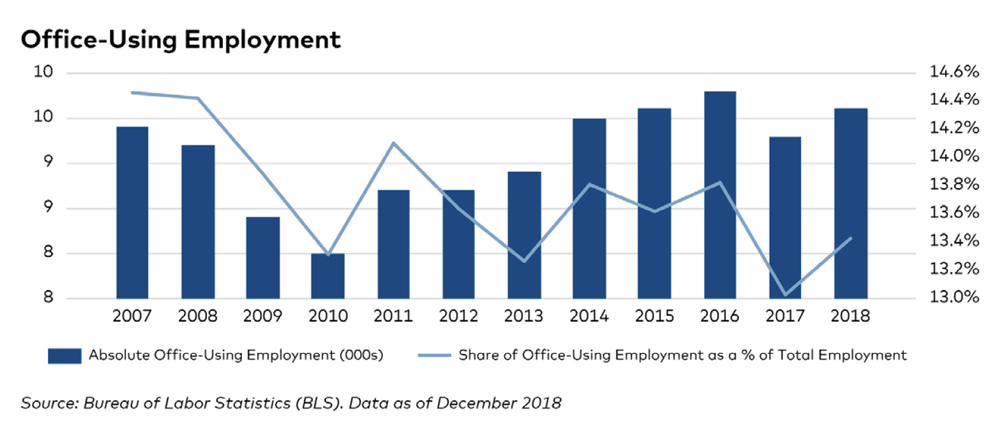

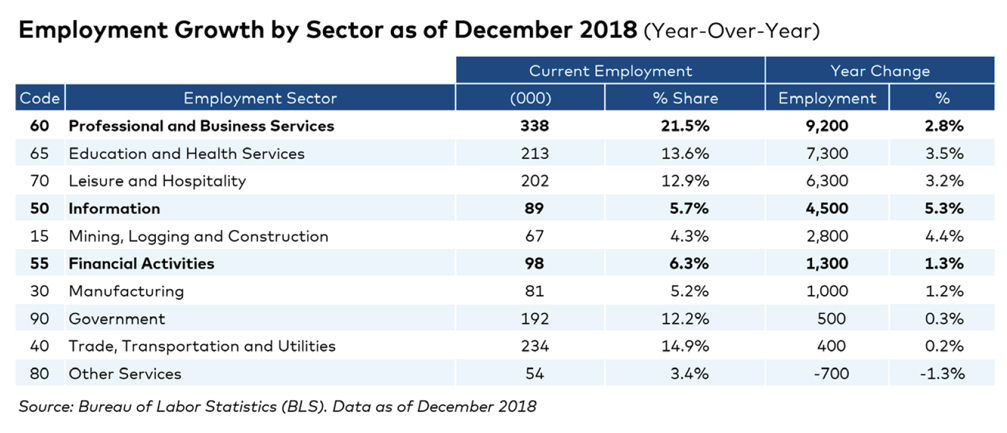

The metro’s economy continues to expand steadily as a center of the technology and financial industries, and it remains a destination for a young, educated workforce.

San Francisco’s market fundamentals remain strong. The metro’s economy continues to expand steadily as a center of the technology and financial industries, and it remains a destination for a young, educated workforce. That said, the metro also faces pressures as the high costs and difficulty of adding new space have led to the outmigration of companies and talent. While key employers such as Facebook and Salesforce are expanding workforces, other large companies have announced plans to shift operations to less expensive metros around the country.

READ THE FULL YARDI MATRIX REPORT

San Francisco continues to have a love-hate relationship with development. Despite low vacancy rates and high demand, the area’s regulatory environment places limits on new construction. New supply is on the upswing, as developers added a cycle-high 4.2 million square feet to the metro’s office inventory in 2018. Demand is such that nearly all of the new inventory was fully leased upon completion. Set to ease the pressure caused by low vacancies, nearly 6 million additional square feet is anticipated to deliver before the end of the year. Further, the San Francisco government approved the large-scale, mixed-use Central SoMa Plan, which will drive further development in the city.

The metro has among the highest rents in the country, as the average asking price for Class A space is near $70 per square foot, driven by a combination of low vacancy rates, government development constraints and a newly imposed office tax. The metro remains in high demand among domestic and foreign investors.

You must be logged in to post a comment.