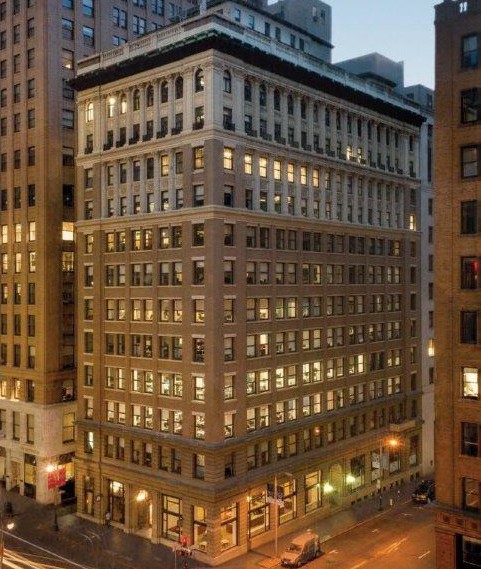

San Francisco’s 115 Sansome Office Tower Sells for $83M

TA Realty sold the 15-story asset to Vanbarton Group, marking the third trade of the property in five years.

By Barbra Murray, Contributing Editor

San Francisco—It’s the kind of game of hot potato most investors would want to play. TA Realty LLC has sold the office building at 115 Sansome St. in San Francisco to Vanbarton Group for $83 million. The transaction marks the third trade of the 128,000-square-foot property in five years, with each seller having pocketed substantially more money than the previous.

“The sale of 115 Sansome demonstrates the successful execution of TA Realty’s value-add strategy in a high barrier to entry market,” Jim Raisides, partner with TA Realty LLC, said in a prepared statement. TA Realty, which sold the property on behalf of The Realty Associates Fund X, relied on commercial real estate services firm JLL to broker the deal.

The short-term-hold trend at 115 Sansome began in 2011, when Harvest Properties picked up the asset, purchasing it from The Swig Co. for $27.5 million. In 2013, Harvest sold the building to TA Associates for $51.5 million, roughly $30 million less than the price the property just fetched.

Designed by Benjamin Greer McDougall in the French Beaux-Arts style in 1912, 115 Sansome opened as the headquarters of Standard Oil Co. in 1915. The 15-story tower has since undergone a bevy of capital improvements, the most recent of which involved TA Realty’s conversion of the traditional office square footage into creative office space, and the addition of ground-level retail space.

“The result (of TA Realty’s repositioning program) has provided a unique neighborhood gathering destination for building tenants, as well as other professionals throughout San Francisco’s Financial District,” Raisides added. “The building’s dynamic ground floor and coveted creative space has helped attract tenants from a diverse set of industries.” The proof is in the numbers: 115 Sansome is 100 percent leased.

The office transactions in San Francisco just keep on coming, and the Financial District is proving a big draw for investors these days. Among the properties that traded in the submarket during the third quarter are 123 Mission, which commanded $255 million from HNA Group North America; 760 Market St., picked up by Phelan Building LLC for $374 million; and 100 Montgomery, which Vanbarton, clearly in an acquisitive mood, purchased for $285 million. And the year isn’t over just yet. Per a third quarter report by commercial real estate services firm Colliers International, “Sales volumes for 2016 are poised to result in one of the strongest years for investment sales in San Francisco.”

You must be logged in to post a comment.