Scouting Post-Pandemic Potential

Where opportunity awaits along the industry’s uncertain road to recovery.

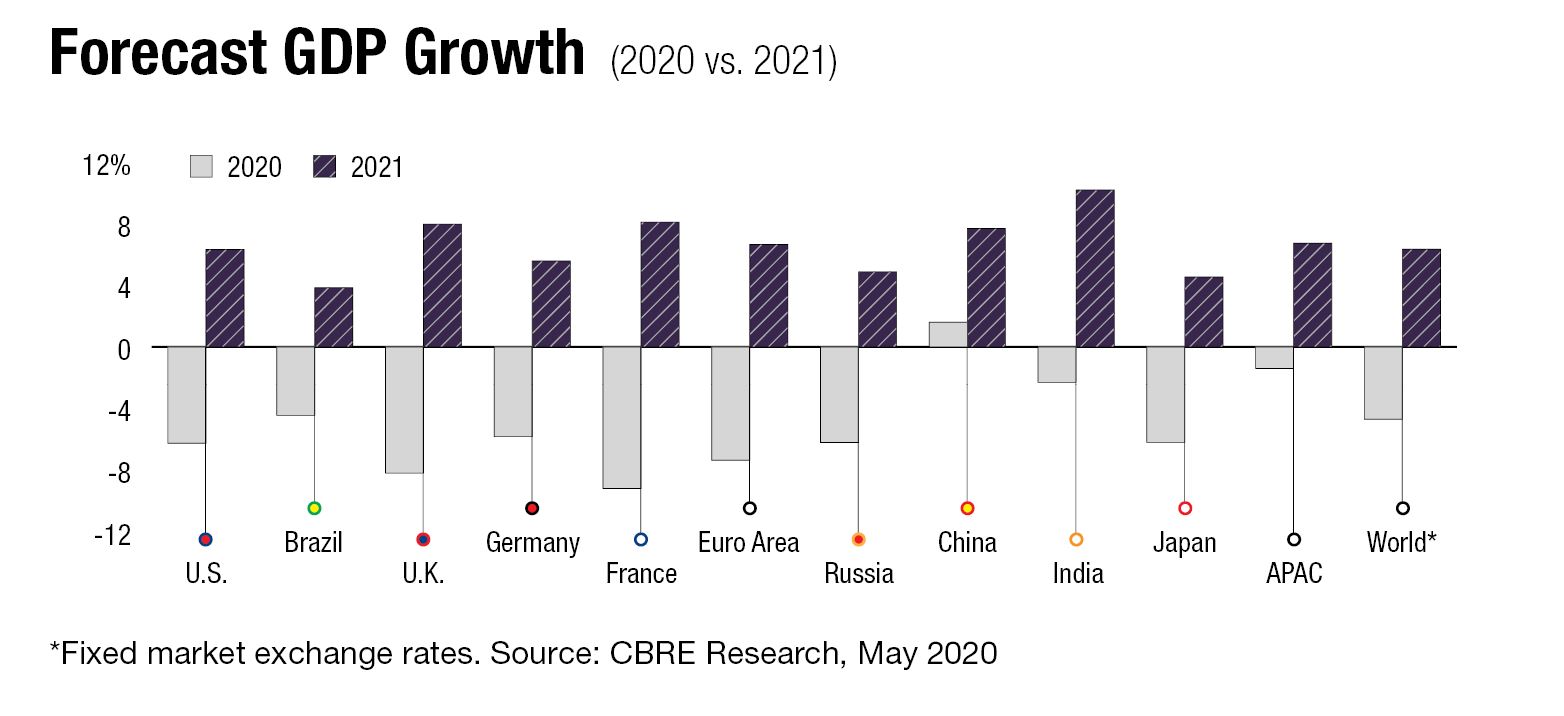

By any measure, the real estate industry has been severely impacted by the coronavirus pandemic. The outbreak has led to widespread job losses, delayed development and construction, and a shock to the world economy. Global gross domestic product could take a $9 trillion total hit in 2020 and 2021—a figure larger than the combined economies of Germany and Japan—the International Monetary Fund estimated.

READ ALSO: CRE Executives See Glimmers Emerging from Tough Times

Although the employment picture began to improve by early summer, nearly 41 million Americans filed for benefits in the first several months after the pandemic hit the economy with full force in March. Prospects for a quick recovery remained uncertain as new outbreaks forced state and local governments to reconsider the schedule for opening retail centers, offices, entertainment venues and other properties.

The trajectory of the economy right now is unusually hard to track. Late spring data showed marked improvement in the job market, as the baseline unemployment rate dropped to 11.1 percent in June from April’s record 14.7 percent. That still reflected a 7.6 percent jump—12 million additional workers—in the unemployment rate since February, and a surge from the historically low 3.5 percent recorded in December 2019. The second half of the year will likely show strong job growth, but the economy has a long way to go to recoup the losses it has sustained this year.

Another concern is that 2020 is on track to record the weakest year for growth since World War II. One possibility is that the economy will rally in the third quarter, slip again during the fourth quarter and recover only in mid-2021, noted Daniel Bachman, an economist and senior manager at Deloitte Services LP.

In addition, the interest rate environment continues to change, since the Federal Reserve has not yet taken rate normalization off the table. That presents a challenge because of the weak outlook for growth, noted Indraneel Karlekar, the global head of research and strategy at Principal Real Estate Investors.

Karlekar’s additional concerns for real estate after COVID-19 included whether businesses operating at a reduced capacity will limit consumer spending and rehiring, and the issue of small to midsize businesses lacking a strong financial safety net. He also feared that even if the economy snaps back and grows in the short term, a single strong quarter may not be a sufficient indicator that a recovery is in progress.

Although the pandemic continues to bring warning signs, some observers see stakeholders acting on the assumption of a short downturn. “Landlords are trying to avoid kicking tenants out and borrowers, and lenders are trying to avoid defaults,” said Ryan Severino, the chief economist at JLL. “We see more instances of them trying to work with each other, since this is viewed as a rough patch that will be short in nature. Once we get past it, debts can be worked out on their own.”

Timing the recovery

Adding to the challenge of sorting out these issues, an unusually complex combination of variables is influencing the outlook for the industry: property type, timing, status of the pandemic and opportunity. “Commercial real estate is at the intersection of everything we do as humans,” Karlekar noted. “Working, shopping, dining—everything has been impacted.”

Given the uncertainty associated with the spread of the virus, one pattern that may emerge is cities and states reopening their economies, then closing them in response to new outbreaks, said Spencer Levy, the chairman & senior economic advisor of Americas research for CBRE. Levy summed up the industry outlook as a “one-two-three” scenario

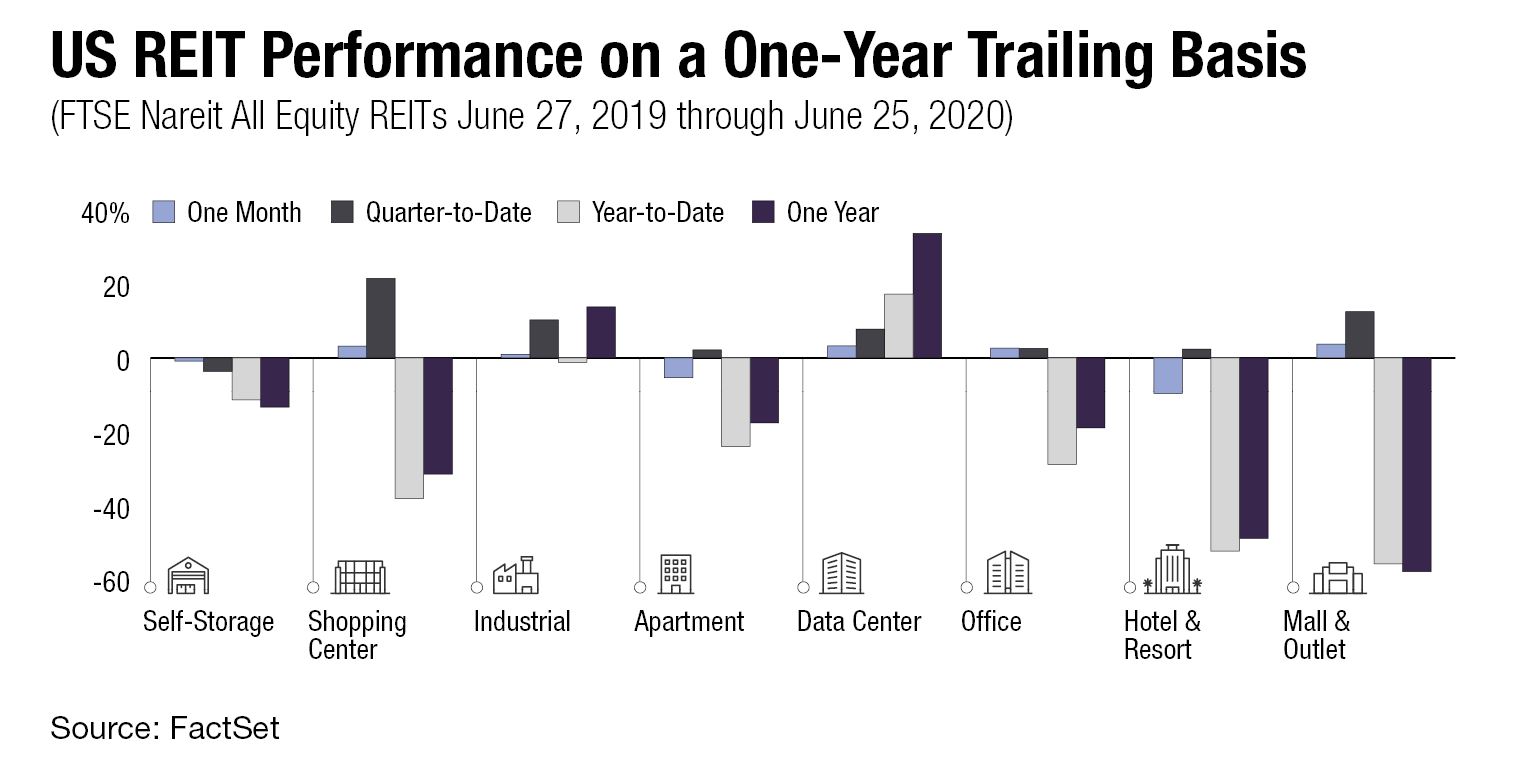

“We foresee that multifamily and industrial will only need about one year to recover from any loss, while the office sector will take around two years, followed by retail and hotel … with a three-year recovery,” he said. From a capital markets perspective, investors should protect themselves through the end of 2021, negotiating relief strategies with lenders, if necessary, to avoid distressed situations.

Multifamily rent collection has continued to perform well, due in large part to increased unemployment benefits and other government aid to residents. April, May and June rent payments held steady at upward of 90 percent—a pace comparable to the same months in 2019—according to the National Multifamily Housing Council. From a secular standpoint, the industrial sector is performing stronger now than it was pre-coronavirus, due to the influx of e-commerce generated by businesses and consumers.

On the other hand, hospitality has taken a much-discussed major hit. In a midyear assessment of the sector, STR and Tourism Economics project that room nights sold will not return to 2019 levels until 2023, despite a modest uptick in this year’s demand forecast. RevPAR is on track to decline 50.6 percent this year before a projected 40.6 percent uptick in 2021.

The challenging outlook for retail properties reflects the sector’s diversity. Several months of shutdowns have pushed a series of struggling retailers with large national footprints into bankruptcy protection or permanent closing. In recent months, J.C. Penney, Neiman Marcus, J. Crew and GNC have filed for Chapter 11 bankruptcy protection. The roster of brands that have announced shutdowns include Pier 1, Modell’s Sporting Goods and Garden Fresh Restaurants, which owns the Souplantation and Sweet Tomatoes brands.

Those trends raise questions about the prospects for re-tenanting retail space at a time when property operators were already grappling with the rapid evolution of consumer habits. At the same time, the nation’s largest retail owner, Simon Property Group, is giving brick-and-mortar space a resounding vote of confidence. By the end of June, the company had already reopened nearly all of its 204 properties in the U.S.

At least one principle applies across the board as all property sectors aim to get back on track: Operations must be updated in order to mitigate losses in future crises and help the company bounce back more quickly in the current situation.

“You’re going to see more owners and managers focusing on the idea of safety,” said JLL’s Severino. “This includes limiting capacity, social distancing measures, cleaning more frequently and especially thinking about how using technology can make things safer.” Examples include touchless check-ins and elevators, air filters that use ultraviolet light, and janitorial services elevated to the same level of importance as security and preparedness.

Deploying dry powder

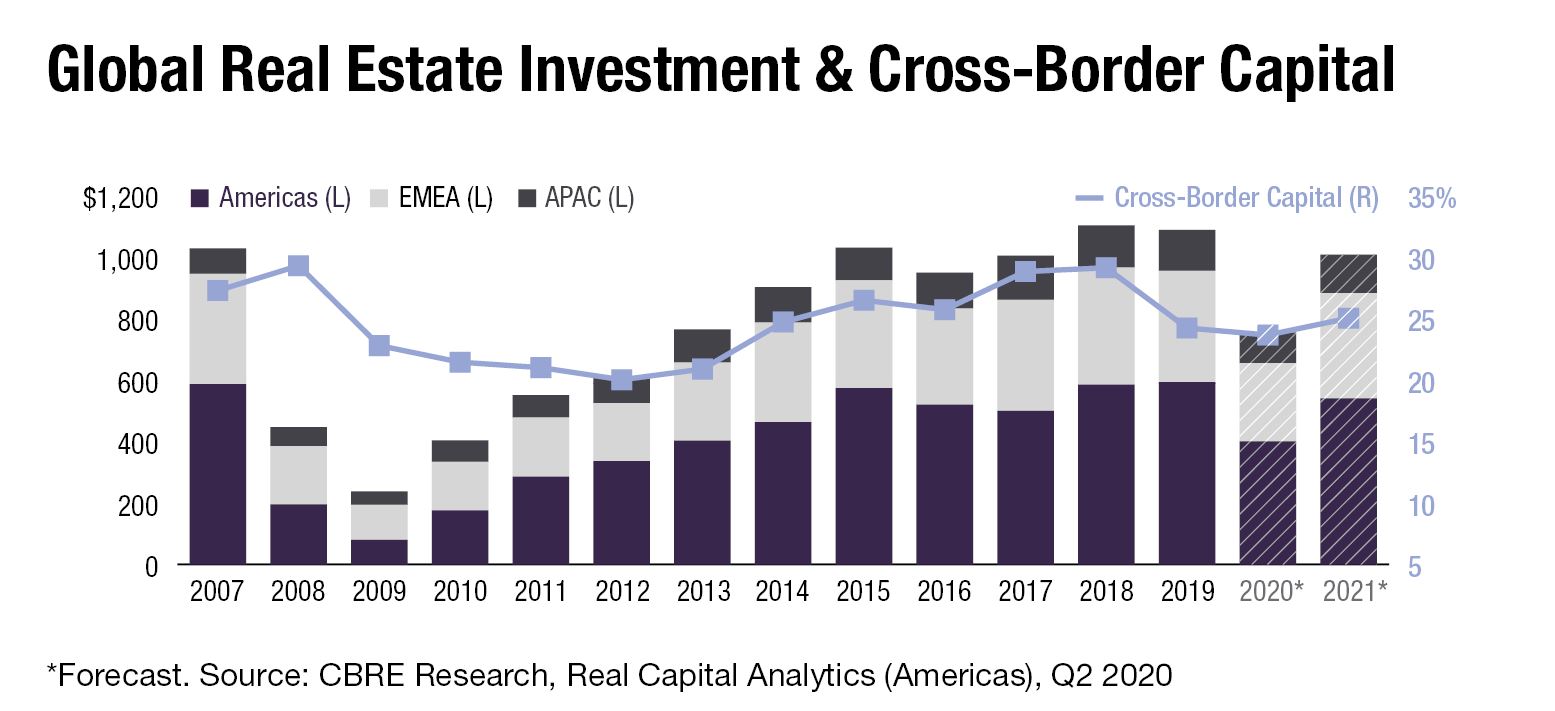

On the investment front, many principals and lenders are taking a wait-and-see approach. During April, May and June—the first full quarter to reflect the impact of the crisis on the investment market—transactions declined 68 percent year-over-year to $44.7 billion, according to Real Capital Analytics. That was the lowest volume since the Great Recession hit in 2007. Also striking was the 77 percent decline in portfolio transactions and the absence of any entity-level deals. Markets beyond major metropolitan areas recorded a larger-than-usual share of investment sales, RCA reported.

A trend to watch for the rest of 2020 will be distressed assets, which remained at low levels during the first half. Some $90 billion worth of properties were reported as potentially distressed during the first half of the year; hotel and retail properties accounted for 90 percent of the total. RCA expects that the degree to which those assets move from potential to actual distress will influence price discovery and, in turn, the pace at which capital returns to the investment market.

As is the case in every downturn, opportunity is present. Historically, durable demand drivers tend to be valuable guideposts. For example, grocery-anchored centers have a history of attracting investors in even challenging conditions because of the persistence of necessity retail.

Industry veterans recommend communicating with tenants about deals that could help them keep afloat during the near term. “Have an open-book policy with your current financial situation in order to protect yourself,” said Levy. “The industry will come back faster than we think because of the pent-up demand to want to get back to business.”

Perhaps the biggest takeaway is that strategies should be devised with the understanding that the current situation likely offers no linear path forward. Even when COVID-19 cases begin dropping, there will still be fluctuations in infection rates, given widely varying state and local approaches to reopening.

Recovery is coming, but when it will arrive and what form it will take is even more uncertain than in previous cycles. Taking advantage of this time to be strategic, and preparing for changed conditions, will yield better results once the recovery begins.

You’ll find more on this topic in the CPE-MHN 2020 Midyear Update.

You must be logged in to post a comment.