Sealy & Co. Picks Up Memphis Industrial Duo

IDI Logistics sold the fully leased properties.

Sealy & Co. has acquired the Stateline and Crossroads Logistics Package, a 589,598-square-foot portfolio comprising two Class A distribution facilities in Southaven, Miss., and Olive Branch, Miss. Both buildings are in the DeSoto County submarket of Memphis, Tenn. JLL worked on behalf of the seller, IDI Logistics.

The properties that changed hands are Stateline Building K, totaling 347,604 square feet, and the 241,994-square-foot Crossroads Building L. They are both fully leased to Motivational Fulfillment & Logistics Services and American Musical Supply.

The facilities have 32-foot clear heights, flexible layouts for single or multi-tenant use, ESFR sprinkler systems, a total of 58 grade-level doors, 48 dock-high doors and ample parking spaces.

READ ALSO: Industrial Sector Settles After Supply Surge

Located at 1660 Stateline Road, the Southaven property is part of Stateline Business Park, a 230-acre master-planned campus totaling approximately 4 million square feet across 10 buildings. The Olive Branch facility at 12914 Stateline Road is one of the warehouses at Crossroads Distribution Centers, a 7 million-square-foot industrial campus with 12 buildings. Both industrial parks were developed by IDI Logistics.

Situated 13 miles apart, the industrial buildings are close to Interstate 55 and U.S. Highway 78. Memphis International Airport is 20 miles away, while the Port of Memphis is 27 miles away.

Senior Managing Directors Matt Wirth, Britton Burdette and Dennis Mitchell and Director Jim Freeman with JLL negotiated on behalf of the seller. The company’s Managing Director Jack Wohrman is the exclusive leasing agent for both properties.

Low investment activity in Memphis

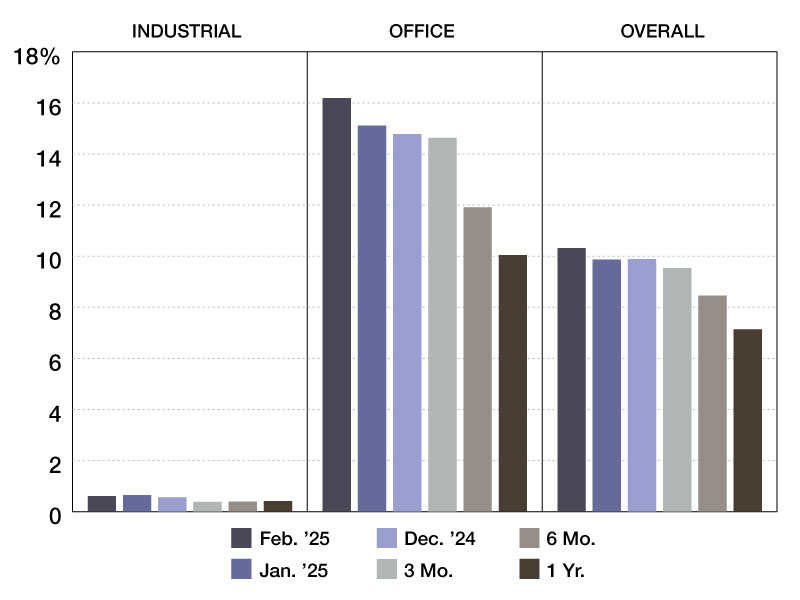

Despite having one of the most active industrial pipelines in the country, Memphis’ sales volume was one of the lowest in the South at the end of November, a recent CommercialEdge report shows. Investments totaled $362 million in 11 months—the lowest volume across Southern markets and the third-lowest in the U.S. Properties changed hands at $57 per square foot, way below the national average of $128 per square foot.

In one of the more recent deals, Phoenix Investors acquired a 411,500-square-foot industrial asset in Union City, Tenn. The company picked up the property from MVP Group International, with plans to substantially improving it.

You must be logged in to post a comment.