Secondary Markets Set to Dominate 2018 Industrial Landscape

The country’s industrial sector continues to improve and expand beyond the borders of traditional core markets, according to a new Colliers International report.

The rise of e-commerce and healthy fundamentals are fueling the U.S. industrial sector. With multiple markets reaching all-time low vacancies and skyrocketing rental rates, there’s no sign of slowdown in 2018. Expanding businesses need not only space, but also quality facilities and access to infrastructure and labor pools.

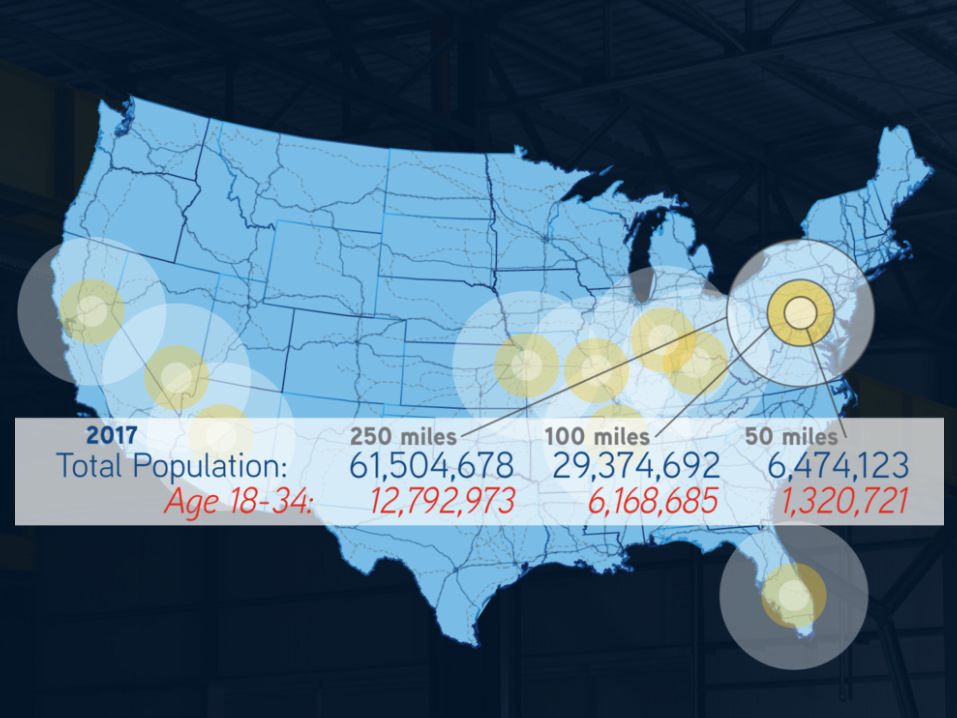

Based on the above factors, Colliers International published a report highlighting the top 10 markets bound to reshape the industry’s direction this year. As expected, activity is highest in core areas. However, secondary markets displaying demographic expansion, profitable lease rates and developable land recorded the greatest growth.

The Rust Belt legacy

Cincinnati, Indianapolis, St. Louis and Lehigh Valley are among the markets that successfully recovered from their corrosive economic decline. Cincinnati’s industrial evolution is driven by advanced manufacturing, the automotive industry and e-commerce, with Amazon’s presence providing an additional boost. The powerhouse is developing the $1.5 billion Amazon Air cargo hub, which is slated to spread across more than 900 acres near the Cincinnati/Northern Kentucky International Airport. On the larger map, the area also benefits from a central location.

Indianapolis, which sits at the intersection of eight interstate systems, offers similar qualities. Additionally, low tax rates and simple tax codes make Indiana one of the most business-friendly U.S. states. The metro also houses the second-largest FedEx hub in the world, where it employs more than 700 full-time and 3,000 part-time workers.

St. Louis’ strong freight rail network attracts investor interest, with the market recording ongoing positive absorption. The area’s strong industrial footprint is largely due to the presence of Port of Metropolitan St. Louis, which goes along 70 miles on both sides of the Mississippi River, as well as two international airports.

Further east, Lehigh Valley emerges as the second-best industrial market in the Northeast (topped by Northern New Jersey). Food distribution, retail supply chains and e-commerce stimulate economic growth, while large farmland parcels provide plenty of development opportunities. The area is also close to some of the country’s largest cities, major roads, multiple ports and one of the nation’s fastest-growing cargo airports, Lehigh Valley International Airport.

Unexpected entries

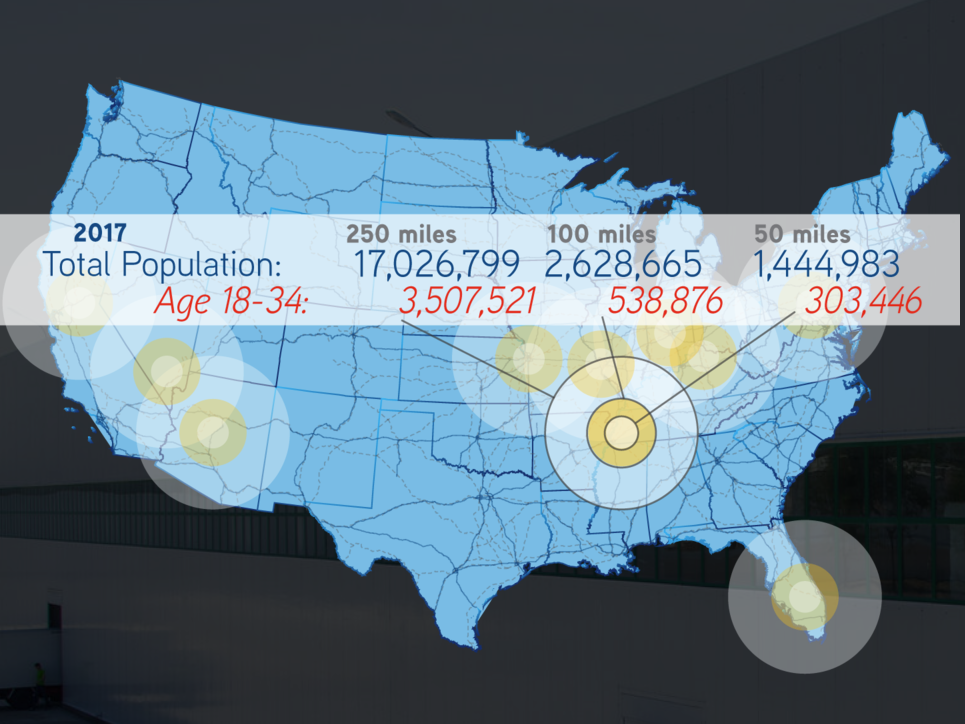

Kansas City, the lists most central market, stands out with 8.8 million square feet of new supply. The area benefits from excellent infrastructure and business-friendly foreign trade program, as well as a growing population of more than 14 million. The 1,700-acre master-planned Logistics Park Kansas City in Edgerton, Kan., provides 17 million square feet of industrial space and multiple development options.

High demand and low vacancy fuel the Memphis industrial market. The 5.5 million square feet of space expected to come online this year will not be enough for businesses coming to the area, due to low land prices and rents. The area’s largest developers are Johnson Development, Core5, Hillwood, IDI Gazeley and Panattoni. Additionally, Memphis International Airport, best air cargo freight in the country, provides a key access element.

Las Vegas is taking another kind of gamble, having absorbed a record-breaking 7.4 million square feet of space last year. Regional distributors turned away from Southern California markets due to Las Vegas’ strong fundamentals and growing economy and population. The region sits close to two of the largest ports in the country, as well as two major highways. In California, Stockton leads the way with a large number of Class A logistics and distribution facilities, as well as mammoth-sized chunks of developable land. Low vacancy levels and premier inventory have pushed up rental rates 13 percent.

Despite low residential vacancies and skyrocketing rents, South Florida’s population is expected to grow 9.8 percent over the next five years. The market is a key gateway to Latin America and the Caribbean—it includes Port Everglades, a main seaport for petroleum products, as well as Miami International Airport, which handles 83 percent of all air imports and 79 percent of Latin America air exports.

Last but not least, the Greater Phoenix area gained momentum after reaching 9.2 million square feet of positive industrial absorption and an all-time low vacancy rate. Growth is expected to continue this year due to expanding population, strong workforce, a modernized highway system and accessible rental rates.

Images courtesy of Colliers International

You must be logged in to post a comment.