Self Storage Continues Positive Performance

The self storage industry continued to withstand the pressures of economic uncertainties, with street-rate rents increasing 1.7 percent over the past 12 months.

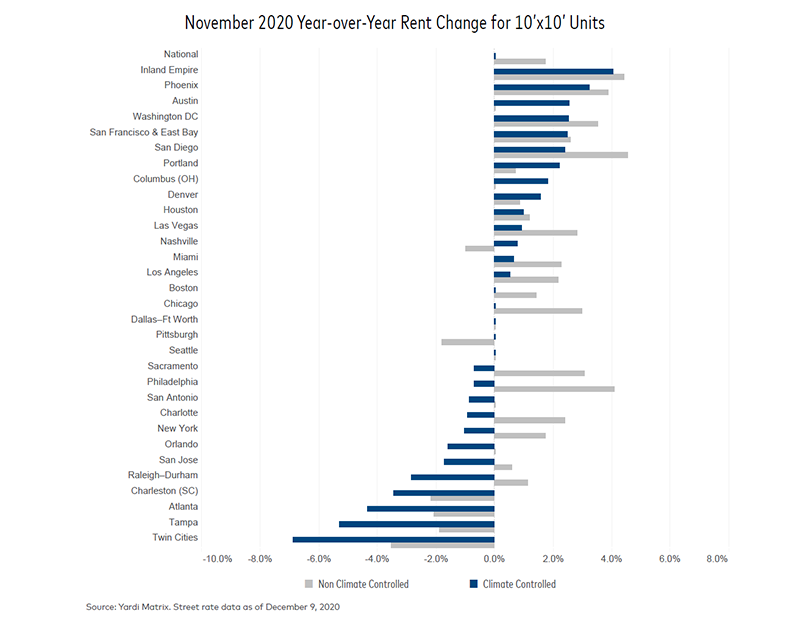

Despite the ongoing volatile market conditions brought about by the health crisis, the self storage industry continued to demonstrate its resilience in November. On a year-over-year basis, street-rate rents have increased 1.7 percent for 10×10 non-climate-controlled units, while rates for the climate-controlled units of the same size remained unchanged. Similarly, on a month-over-month basis, street-rate rents grew 0.9 percent for the 10×10 non-climate-controlled units, while rates for climate-controlled units were flat.

After several years of negative rent performance, all of the top four Texas markets—Austin, Dallas-Fort Worth, Houston and San Antonio—experienced positive rate performance in November. The extended period of negative rent performance was due to the substantial inventory expansion during the self storage development boom in 2018, which led to a significant imbalance in supply and demand across Texas.

Other markets with noteworthy rent growth include Columbus, Ohio, where year-over-year street rates for the average 10×10 climate-controlled units increased 1.8 percent, while month-over-month rates for the same unit type performed even better, increasing 3.7 percent. This growth might be credited to the metro’s optimistic economic outlook—the jobless rate dropped from 13.7 percent in April to 4.9 percent in October.

Nationwide, planned and under construction projects accounted for 8.3 percent of existing inventory, up 10 basis points over the previous month. Although a total of 53 self storage projects were abandoned over the past three months, overall development activity seems to be unaffected across the U.S. Nonetheless, developers should remain cautious as the economy is still not immune to the pandemic-driven uncertainties.

Read the full Yardi Matrix report.

You must be logged in to post a comment.