Self Storage Development Weakens, Rents Still Down Year-Over-Year

Despite a slight 10 basis-point increase in the new-supply pipeline, development activity is starting to slow down in top markets tracked by Yardi Matrix.

The effects of heavy new supply continued to linger on self storage rents in December. Over the past 12 months, street-rate rents dropped 1.7 percent for the average 10×10 non-climate-controlled and 3 percent for climate-controlled units of similar size. Compared to December 2018, street rates declined in 24 of the top 31 markets tracked by Yardi Matrix.

On a year-over-year basis, street rate performance was positive in only five top markets tracked by Yardi Matrix. Heavy inventory put pressure on rent growth in Charleston (down 9 percent year-over-year), where the completed inventory per capita was 11.2 net rentable square feet, 72 percent higher than the national average. Las Vegas experienced the highest rent increase (up 2.9 percent year-over-year), however, compared to last year, growth has slowed by 5.4 percent. As of December, asking rates remained the highest in underpenetrated West Coast markets, such as San Francisco ($192) and Los Angeles ($184).

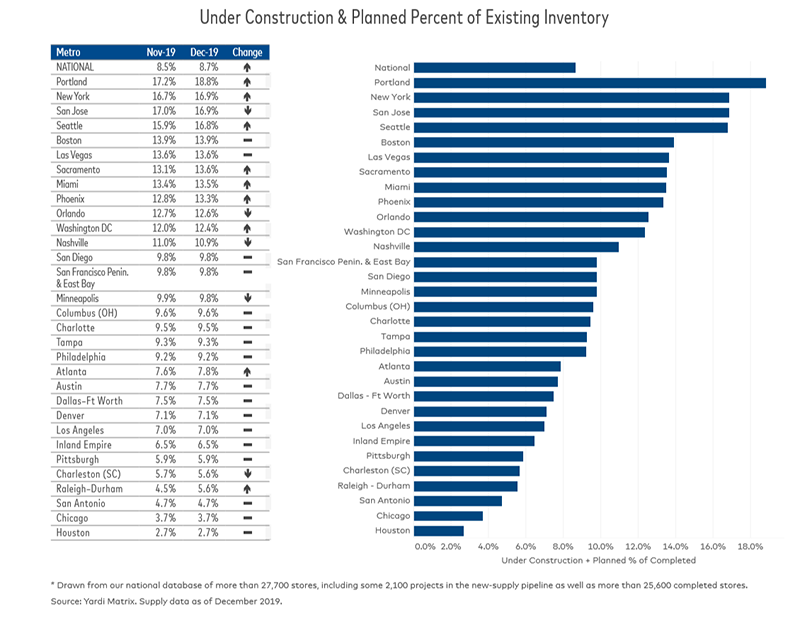

Nationally, projects under construction or in the planning stages accounted for 8.6 percent of existing stock, showing a 10-basis-point rise month-over-month. Despite the slight increase in the new-supply pipeline, development activity is beginning to weaken across the country. In 68 percent of the top markets tracked by Yardi Matrix, the development pipeline was flat or negative. This trend might be linked to developers shifting their focus from the top to secondary and tertiary markets, which provide more opportunities for new development. For example, in the Sarasota-Cape Coral market, new development has increased by nearly 250,000 net rentable square feet over the previous month.

Read the full Yardi Matrix report

You must be logged in to post a comment.