Self Storage Enjoys Pricing Power As Americans Continue to Relocate

A slower development pipeline and touchless transactions are driving leasing success.

Americans are on the move and the self storage industry is there to help while they figure it all out. It’s no surprise this recession-resistant sector is doing well during the pandemic.

“Even since the COVID-19 outbreak, we have seen self storage operations hold steady,” said Brian Somoza, managing director at JLL Capital Markets. The challenges have been on-site staffing and pivoting to touchless interaction when customers walk in to utilize the storage facility.

SmartStop Self Storage has a portfolio of 14 branded operating properties, including this facility in Chula Vista, Calif. An additional 20 sites are in the pipeline in the Greater Toronto area. Image courtesy of SmartStop Self Storage

COVID-19 has accelerated the self storage industry’s use of technology, which was happening naturally but became a necessity during the pandemic, according to H. Michael Schwartz, founder & executive chairman of SmartStop Self Storage. “Web-led volume still appears strong, but we have seen a slight, subtle shift back to more traditional channels, including walk-ins,” added Schwartz.

Still, heading into 2021, the self storage industry will need to transact with storage customers on their own terms. Offering technologies that facilitate remote transactions is one way SmartStop, and some other operators, have set themselves apart from less tech-savvy competitors.

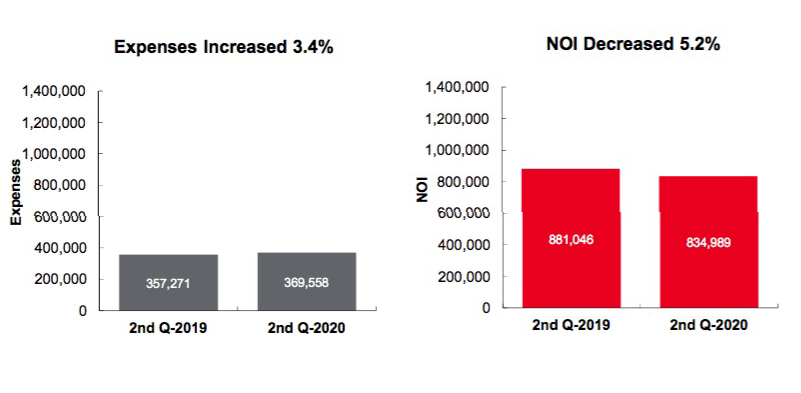

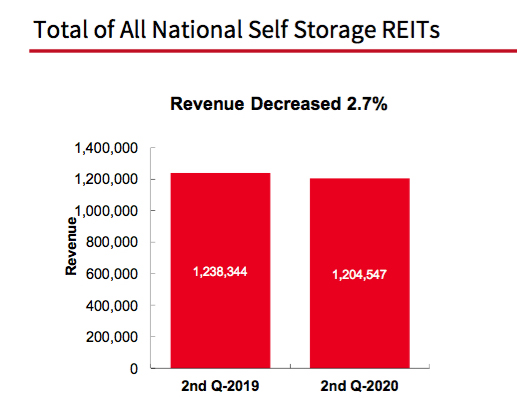

JLL’s Q2 2020 snapshot of all national self storage REITs shows that rates and collections were negatively impacted during Q2 due to COVID-19, but these metrics showed positive trends as of the end of July 2020. Chart courtesy of JLL

There hasn’t been much distress in the self-storage industry, but Somoza is seeing an increased desire by sellers to close before year-end.

“There is an oversupply of self storage development that will take some time to lease-up,” he said. “Even before the pandemic, that was an issue. The fact that COVID-19 is slowing down the development pipeline is giving the market a chance to catch up on the leasing.” More good news for investors in the sector.

“We still haven’t seen an offseason drop in occupancy like we normally would expect to see going into Q4,” said Schwartz.

In fact, occupancy in the SmartStop self storage portfolio grew from August to September, and remains in the low 90 percent range. Because of that, SmartStop still sees pricing power with new customers—at least for the time being.

JLL’s Q2 2020 snapshot of all national self storage REITs shows a 2.7 percent reduction in revenue from Q2 2019 to Q2 2020. Chart courtesy of JLL

In addition, given that this offseason is starting differently, there are still unknowns in terms of when occupancies come down and how much they come down. Operators that have the ability to analyze data quickly across several markets are going to be in a better position to respond when the market changes.

Currently, the trends in self storage development continue to be geared towards custom-built, multistory self storage properties, instead of redevelopment of big box retail.

“New supply is always in the back of our minds,” added Schwartz. “During this pandemic, SmartStop’s lease-up assets have continued to push occupancy at a better-than-expected rate. During the same period, we haven’t really seen incremental impact on our stabilized assets from new supply.”

Sector Insights rotates among office/medical office, industrial, retail, multifamily, self storage and hotel/hospitality.

You must be logged in to post a comment.