Self Storage Less Vulnerable to Economic Disruptions

After a long tenure of negative performance, street-rate rents for standard non-climate-controlled units remained unchanged year-over-year.

With continued demand and improving street rates, March proved to be a positive month for the storage industry. After several consecutive quarters of negative rent performance, national street rates for the 10×10 non-climate-controlled units remained unchanged year-over-year at $116. Street rates for 10×10 climate-controlled units, however, declined by 1.4 percent on an annual basis. Las Vegas was the best-performing metro in terms of rent growth—over the past 12 months, rates were up 2.9 percent for the standard climate-controlled units and 1.9 percent for non-climate-controlled units of similar size.

Although the coronavirus outbreak has burdened the economy and all the facets of the real estate business, self storage, compared to other asset types, appears to be less vulnerable to economic disruptions. RENTCafé data shows that the amount of weekly storage listing views, for the week of March 15, increased 81 percent compared to the first week of 2020, showing potential interest in self storage. According to Beyond Self Storage, demand for storage units was underscored by the abrupt closing of colleges and universities, urging students to move out. Nonetheless, the full impact of the outbreak on all the aspects of the storage industry, from the operations side to development to consumer demand, will be clearer in the coming months.

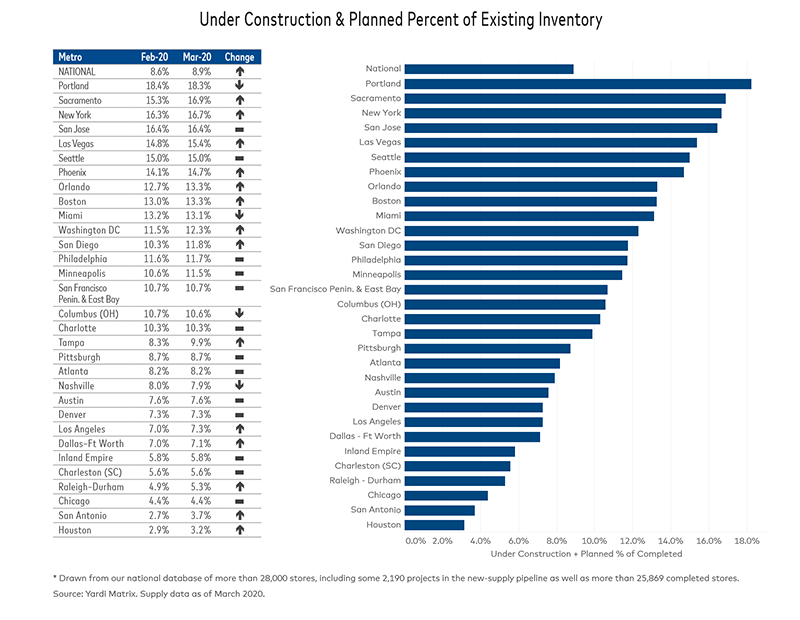

Nationally, units under construction and in the planning stages accounted for 8.9 percent of existing stock, representing a 30-basis-point growth month-over-month. However, the COVID-19 crisis is likely to cause a slowdown in development, as projects under construction and in the planning stages are expected to experience delays due to nationwide lockdowns. Yardi Matrix forecasts deliveries to drop by 40 percent over the next five years.

Read the full Yardi Matrix report

You must be logged in to post a comment.