Self Storage Rents Continue Recovery Despite COVID-19

While street-rate rents were down 0.9 percent over the past 12 months, all the top markets saw positive rent performance month-over-month.

Despite severe economic distress caused by the global health crisis, the self storage sector continued to hold steady in August. Over the past 12 months, street-rate rents declined 0.9 percent for the average 10×10 non-climate-controlled and 3 percent for climate-controlled units of similar size. On a month-over-month basis, national rates grew 0.9 percent for the standard 10×10 non-climate-controlled and 0.8 percent for climate-controlled units of the same size. All the top markets saw positive or flat rent performance month-over-month.

San Jose was one of the best-performing markets, as month-over-month rent growth reached 4.9 percent for the average 10×10 climate-controlled units. Asking rents in the metro rose $8 to $171 an amount last registered before the pandemic, in January. When it comes to the standard 10×10 non-climate-controlled units, Miami saw the largest rent increase, up 3.9 percent over the previous month.

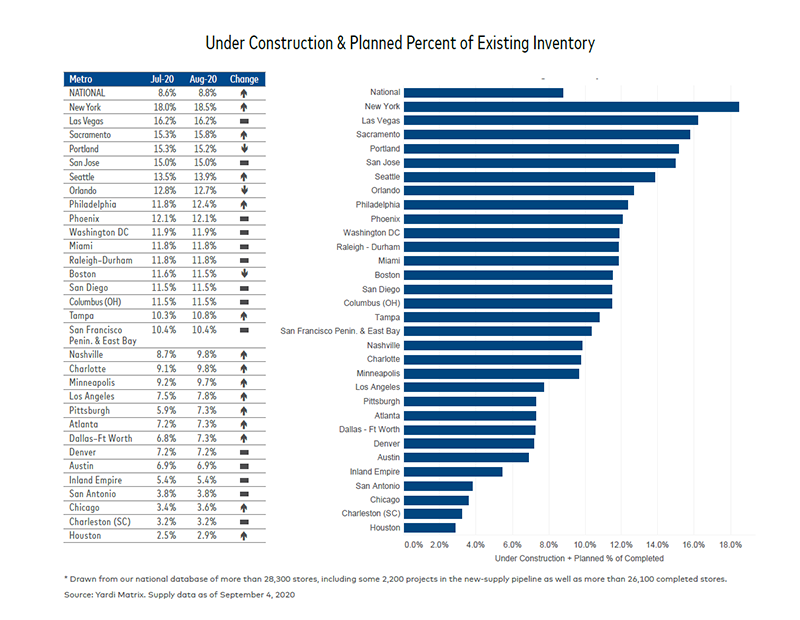

Nationwide, projects under construction or in the planning stages accounted for 8.8 percent of existing inventory, up 20 basis points over July. The coronavirus outbreak, however, seems to be putting pressure on development activity in the sector. Some 33 projects were abandoned in August, signaling that developers are facing uncertainty when it comes to investing in new facilities. Nonetheless, a slowdown in development activity could be a step towards restoring equilibrium in the storage sector.

New York City, Las Vegas and Sacramento led the nation in development, as projects under construction or in the planning stages accounted for 18.5, 16.2 and 15.8 percent of total inventory. Despite having an existing stock of 9.2 net square feet per person, Nashville’s new-supply pipeline accounted for 9.8 percent of total inventory, up 110 basis points since July. Heightened development activity in the metro has continually put downward pressure on street rates, therefore developers should remain cautious to avoid overbuilding.

Read the full Yardi Matrix report.

You must be logged in to post a comment.