Self Storage Rents Fall, Inventory Increases

New projects coming online have continued to put pressure on self storage rents, which have dropped by 4.9 percent nationally.

By Evelyn Jozsa

Self storage rents further declined in October as new supply continued to increase. Over the past 12 months, street-rate rents dropped by 4.9 percent for 10×10 non-climate-controlled and 2.9 percent for 10×10 climate-controlled units. Due to its large population and tight inventory, rents in New York rose 2.4 percent year-over-year for standard non-climate-controlled units. Western markets such as Las Vegas and the Inland Empire continued to rise 5.2 and 0.9 percent year-over-year. Other California markets remained flat or slightly negative, even as new supply remained limited.

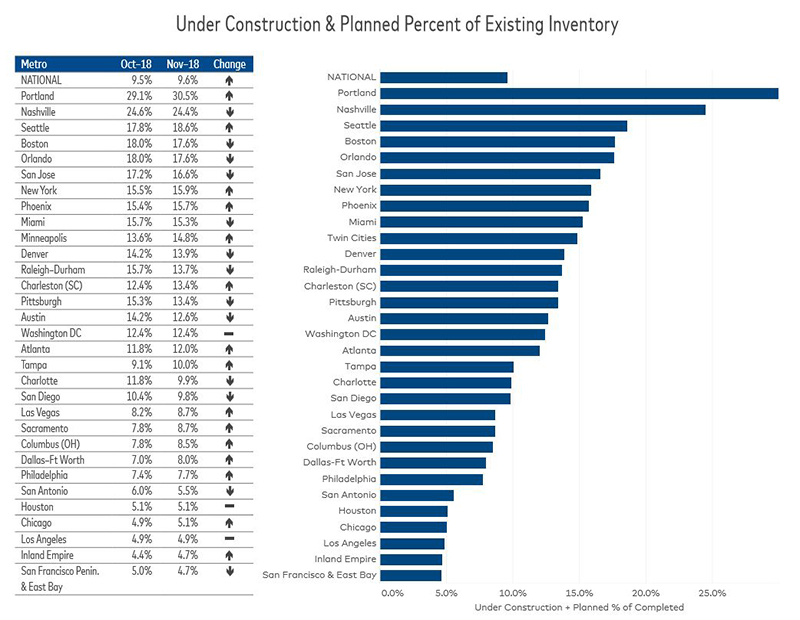

Despite the recently adopted zoning regulations, development activity has surged in New York City, where projects under construction and in the planning stages accounted for 15.9 percent of existing inventory, a 40-basis-point increase month-over-month. Robust development has done little to change the metro’s inventory per person, at approximately 3 net square feet. That’s only half the U.S. average. At the national level, development activity continued to increase. Units under construction and in the planning stages comprised 9.6 percent, which shows a 10-basis-point growth over September.

Millennial destinations were still leading development interest. Portland had the most projects planned and under construction with 30.5 percent of existing inventory. The metro was followed by Nashville (24.4 percent), Seattle (18.6 percent) and the historically underpenetrated Boston (17.6 percent). Looking at the other end of the list, new self storage projects accounted for less than 5 percent on California markets such as Los Angeles, the Inland Empire and San Francisco.

You must be logged in to post a comment.