Self Storage Rents Not Immune to COVID-19

The self storage sector has started to feel the impact of the coronavirus outbreak, with street-rate performance declining in 97 percent of the top markets tracked by Yardi Matrix.

The global health crisis and deteriorating U.S. economy have taken a toll on self storage rents in April. Over the past 12 months, street-rate rents dropped 2.6 percent for the average 10×10 non-climate-controlled and 6 percent for climate-controlled units of similar size. On a year-over-year basis, street rate performance for standard non-climate-controlled units was negative in roughly 97 percent of the top markets tracked by Yardi Matrix. All top markets saw negative street rate performance for standard climate-controlled units.

Metros with the highest concentration of at-risk employment sectors had the greatest declines in rent rates. Due to Orlando’s tourism-dependent economy and high concentration of leisure and hospitality employment, street-rate rents fell 6.7 percent for 10×10 non-climate-controlled and 10.1 percent for climate-controlled units of similar size. Phoenix was the only top market without negative rent performance for the average 10×10 non-climate-controlled units—street rates there remained flat year-over-year.

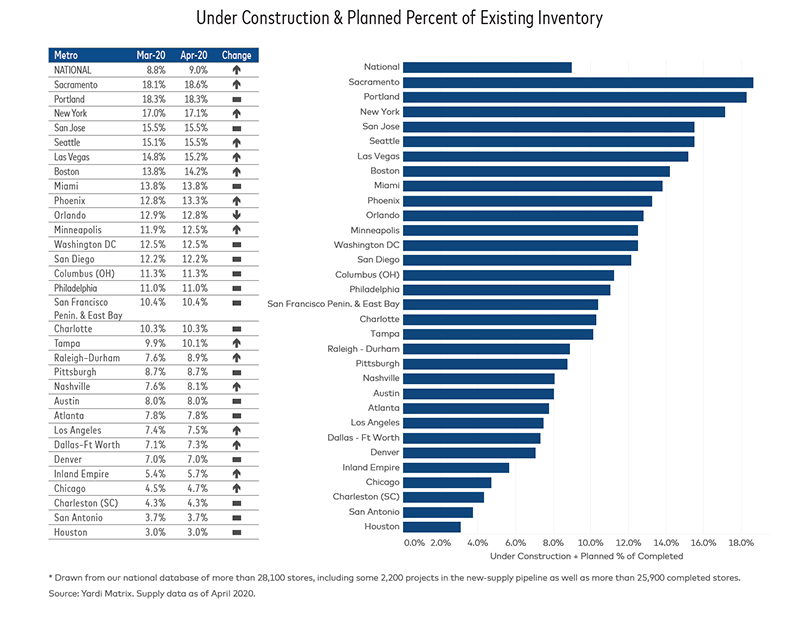

The pandemic has not yet visibly impacted self storage development activity across the country. Nationwide, projects under construction or in the planning stages accounted for 9 percent of total inventory, a 20-basis-point increase month-over-month. Raleigh-Durham saw the highest increase in development activity—the metro’s new-supply pipeline represented 8.9 percent of existing stock, up 130 basis points over the previous month.

However, the COVID-19 crisis is eventually expected to lead to a decline in construction activity. According to Yardi Matrix’s most recent new-supply forecasts, deliveries will drop by 10 percent in 2020, and by about 40 percent over the next five years. Oversupplied markets, however, could greatly benefit from a decline in self storage constructions.

Read the full Yardi Matrix report

You must be logged in to post a comment.