Self Storage Rents Show Significant Improvement

The year-over-year street rate performance was positive for the first time since 2017.

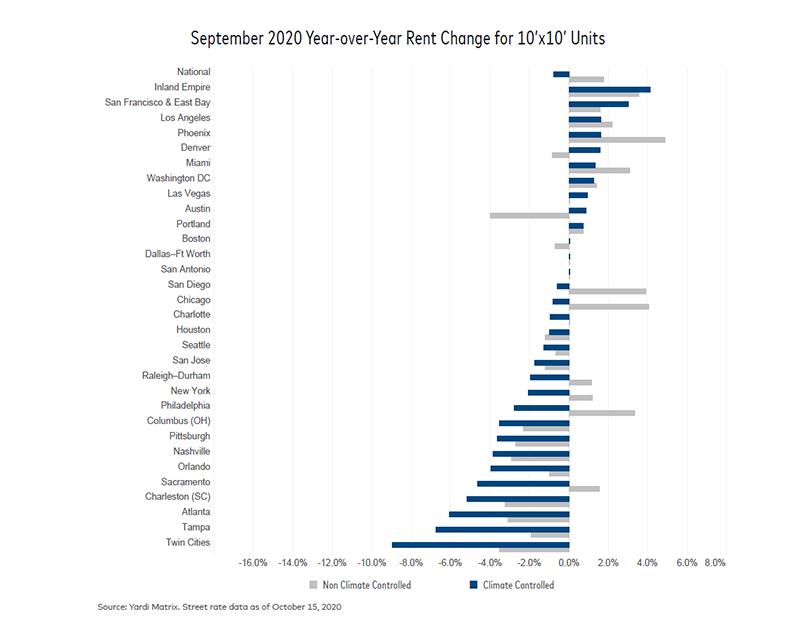

Although the U.S. economy is still facing significant headwinds, rents in the self storage sector have significantly improved in September. On a year-over-year basis, street-rate rents have increased 1.8 percent for 10×10 climate-controlled units, while rates for the climate-controlled units of similar size were down only 0.8 percent. The year-over-year street rate performance, for the average non-climate-controlled units, was positive for the first time since the end of 2017.

Overall, annual street rate performance was negative in 45 percent of the top markets tracked by Yardi Matrix. However, none of these markets saw a larger than a 4 percent drop in street rates for the 10×10 non-climate-controlled units. Even Charleston, a market struggling with oversupply, where rents took a significant dive in recent months, experienced merely a 3.2 percent decline for the standard 10×10 non-climate-controlled units, on a year-over-year basis.

The flight from the Bay Area, accelerated by remote work opportunities, seems to be positively impacting self storage rents in the region. While the multifamily segment experienced a drop in both rental and occupancy rates, the self storage sector, on a year-over-year basis, saw a 1.6 percent growth in street rates for the average 10×10 non-climate controlled and a 3 percent increase for climate-controlled units of similar size.

Although forecasts show an eventual slowdown in new supply compared to initial predictions, development activity remained steady in September. Nationally, self storage projects under construction or in the planning stages accounted for 8.6 percent of total stock, up 10 basis points over the previous month. Only five of the 31 top markets tracked by Yardi Matrix recorded a shrinking new-supply pipeline month-over-month.

Read the full Yardi Matrix report.

You must be logged in to post a comment.