Self Storage Rents Still Down Across the US

Despite significant rent growth in the West, street-rate rents declined 1.7 percent on a national level. Additionally, the new development pipeline continued to decrease.

Self storage rents stayed somewhat flat in January, as new projects coming online are still preventing growth on a national level. Over the past 12 months, street-rate rents fell by 1.7 percent for the average 10×10 non-climate-controlled and by 1.5 percent for climate-controlled units. Due to substantial population growth, in Las Vegas, street-rate rents rose 6.1 percent on a year-over-year basis. In contrast to this, significant deliveries in Nashville led to an 8.3-percent decrease.

Asking rents continued to drop by $1-$2 in most markets, except in San Jose, where rents dropped $3, from $179 to $176. Limited opportunity for new development is still fueling rent growth in major California metros such as San Francisco and Los Angeles, where asking rents were $189 and $180 as of February. Rents were flat or down in Florida markets, such as Orlando ($103), Tampa ($112) and Miami ($135)—down $1 from the previous month.

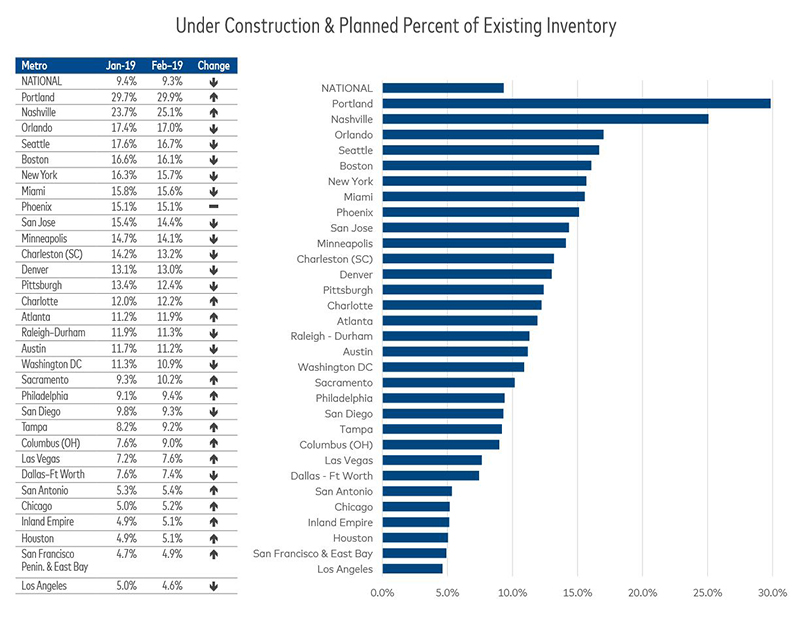

On a national level, units under construction and in the planning stages account for 9.3 percent, which shows a 10-basis-point decrease since January. Portland and Nashville are still leading the nation when it comes to new development—the new-supply pipelines account for 29.9 and 25.1 percent of existing inventory.

Diverse job relocations and a large number of colleges are the driving force of development in historically undersupplied markets in the Northeast, such as Boston and New York. Stable economy and continuous job growth also fuel demand for new storage in Atlanta, where units under construction and in the planning stages comprise 11.9 percent of the existing stock, which represents a 70-basis-point hike over the previous month.

You must be logged in to post a comment.