Self Storage Rents Still Down Year-Over-Year

Heightened construction activity continued to hinder rent growth in the storage sector across the U.S.

Self storage rents further decreased in October due to new projects coming online. On a year-over-year basis, street-rate rents have contracted by 3.4 percent for 10×10 non-climate-controlled and 3.7 percent for climate-controlled units of similar size. In Charleston, where the completed inventory per capita is 70 percent higher than the national figure, rents were down 10.7 percent year-over-year.

Over the past 12 months, street rate performance was positive in only two top markets tracked by Yardi Matrix. Steady population and job growth continued to fuel demand in Las Vegas, where rents rose 4.9 percent. Limited supply also pushed rents up in the Inland Empire by 1.8 percent for the standard non-climate-controlled units. On a month-over-month basis, the average asking rent dropped two dollars to $113 per unit. The highest rates were recorded in San Francisco ($189), Los Angeles ($181) and New York City ($171).

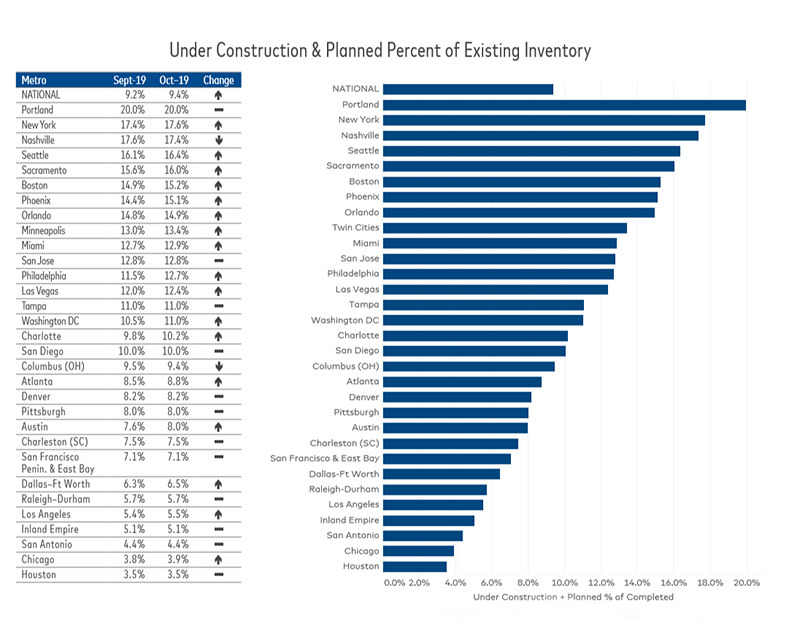

Nationwide, projects under construction or in the planning stages accounted for 9.4 percent of total inventory, representing a 20-basis-point increase over the previous month. Although metros such as Portland (20 percent), New York City (17.6) and Nashville (17.4) are leading the way, development activity has surged in Phoenix, where the new supply pipeline represents 15.1 percent of existing stock, a 70-basis-point increase month-over-month. Additionally, the Bay Area’s exodus is still positively impacting Sacramento’s self storage market—projects under construction account for 16 percent of all inventory, up 50 basis points over September.

Read the full Yardi Matrix report

You must be logged in to post a comment.