Self Storage Rents Take a Dive

Nationally, rents fell 2.5 percent for standard non-climate-controlled units and 4.3 percent for climate-controlled units.

Continuous delivery of new self storage products substantially impacted rent growth in the month of July. Street-rate rents dropped 2.5 percent year-over-year for the average 10×10 non-climate-controlled and 4.3 percent for climate-controlled units of similar size. Street rate performance was negative in 89 percent of the top markets tracked by Yardi Matrix.

Street rates have dropped even in West Coast markets, where demand is still strong and supply is limited. For instance, San Jose experienced a 6.9-percent downturn, year-over-year. Nonetheless, asking rates remained the highest in California metros, such as San Francisco ($194) and Los Angeles ($184).

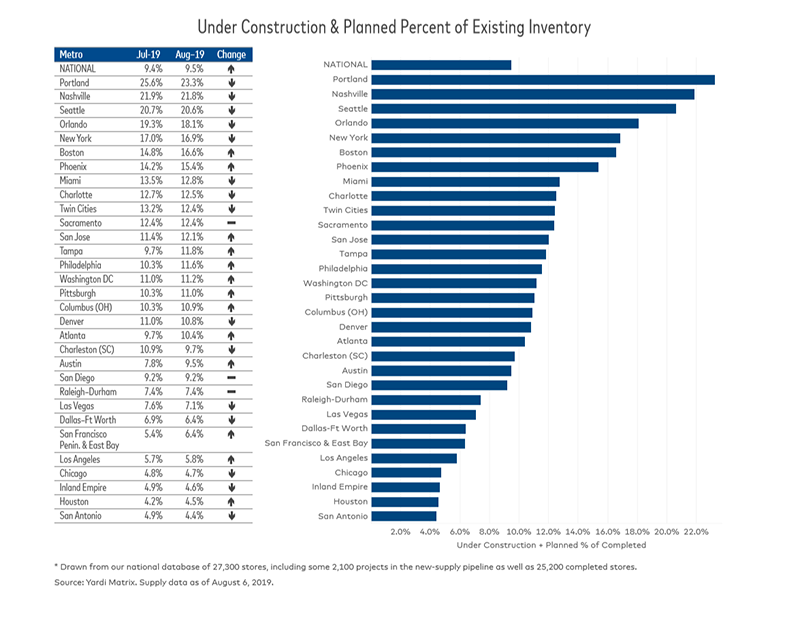

Nationwide, projects under construction or in the planning stages accounted for 9.5 percent of existing stock, representing a 10-basis-point growth over the previous month. Although steady economic growth and favorable demographic trends are driving demand in many markets, developers remain cautious to avoid overbuilding. Due to significant signs of oversupply, development activity started to slow in Portland, where the new supply pipeline dropped 230 basis points month-over-month. Facilities under construction or in the planning stages still account for nearly a quarter of existing inventory (23.3 percent).

Compared to July, however, development activity increased in about 40 percent of the top markets tracked by Yardi Matrix. Boston experienced the most notable growth—the new supply pipeline accounts for 16.6 percent of existing stock, which shows a 180-basis-point surge over the previous month. Demand is driven by the robust tech scene and a healthy business environment, while its large student population is also a major factor.

You must be logged in to post a comment.