Semiconductor Boom Continues to Boost CRE

New legislation has eased investor concerns, and large-scale fabs and related plants are mushrooming.

Image by Dmitry Steshenko via Pixabay.com

Attracting ongoing widespread government and private sector investment, semiconductor fabrication plants and manufacturing facilities have become one of the largest contributors to industrial real estate development and related investment activity nationwide.

Critical technologies using semiconductor materials play a vital role in modern economies, from smartphones to vehicles or medical devices. Over the past three years, 40 new semiconductor development projects have been announced, along with $200 billion in private investments across 16 states to increase manufacturing capacity, according to a report from the Semiconductor Industry Association. The industry has already attracted investments and large-scale development projects from Samsung, Micron Technology Inc., Intel, Taiwan Semiconductor Manufacturing Co. and Tesla in some of the nation’s largest industrial markets.

Of late, the most notable developments have been the Biden Administration’s passage of the CHIPS and Science Act, which allocates $280 billion over the next decade to the domestic production of semiconductors, including $52 billion to research and development. To date, the legislation is the largest government effort as part of a re-shoring of the nation’s related industry amid ongoing geopolitical instability and latent supply chain hiccups.

In 2021, the U.S. accounted for 34 percent of semiconductor demand, while producing 14 percent of the world’s supply, data from a January 2023 report from McKinsey and Co. shows. At present, the nation manufactures 12 percent of the global total, down more than threefold from three decades ago, the same data shows. At the same time, the most advanced chips, those less than 10 nanometers in thickness, with specific applications to smartphones and cars, are produced entirely in East Asia, the same data shows.

Manufacturing motivation

Ermengarde Jabir, senior economist at Moody’s Analytics, sees the volume of domestic and foreign investment as partly preventative measures, citing the slowdown in global supply chains brought by pandemic-era ripple effects as causing the highest inflation in four decades.

“These conditions have only served to accelerate the push for near- (and long-term) reshoring, but the main concern definitely revolves around avoiding future supply chain pressures,” Jabir told Commercial Property Executive.

Jason Tolliver, executive managing director and co-lead of Americas Logistics & Industrial Services at Cushman & Wakefield, attributes this large scale demand for manufacturing capabilities to congressional concern over the historic “fabless” model, one where “semiconductor and related firms focus on R&D and design capabilities, while contracting with outside, mostly foreign, fabrication companies.” The fabrication plants have a host of vulnerabilities towards disruption, including trade disputes and potential military conflict, according to Tolliver.

Additionally, export controls, such as those recently announced by the U.S. Commerce Department that have targeted and restricted the semiconductor industries in China, have made a reliance on foreign manufacturing all the more difficult.

According to Seth Martindale, senior managing director of Americas consulting at CBRE, the restrictions “likely add to the list of potential issues to take into consideration when manufacturing abroad to serve a U.S. customer.” Consequently, the risks of continuing to rely on manufacturing abroad to save on costs will far outweigh the benefits. “Companies will find it harder to justify the savings associated with manufacturing abroad when the operational risks have substantially increased,” Martindale added.

In line with these trends, much recent investment has been directed toward manufacturing facilities where the myriad specialized equipment and tools for semiconductors are made. Such projects significantly reduce the industry’s reliance on an international web of equipment and materials, something fractured by both pandemic-era supply chain slowdowns and the ongoing conflict in Ukraine, which has created major price hikes of neon gas, a necessary component of the specialized lasers that are used to etch circuits into silicon wafers. Indeed, 22 of 40 ongoing developments are devoted to materials, SIA statistics show.

Rendering of a $100 billion semiconductor manufacturing plant being built in Syracuse, N.Y. The facility is part of a larger investment in semiconductor fabrication-related industrial real estate across upstate New York. Image courtesy of Micron Technology

A recent high-profile project that reflects this trend includes the $319 million project on the part of Edwards Vacuum, a British manufacturer of vacuum and abatement equipment that creates the sterile conditions necessary for semiconductor fabrication. The company is set to build a 240,000-square-foot facility in the Upstate New York Science & Technology Advanced Manufacturing Park, where it will produce its dry pumps that are used in many fabrication plants.

Investing in innovation

However, merely preventing shortages of the type seen during the pandemic is only part of the task at hand. The sector must remain competitive and innovative to be viable, according to Jabir. For this, Jabir has singled out “sustainability and automation” as the areas with the potential for most growth, those such as electric vehicles and artificial intelligence. Where sustainability is concerned, the CHIPS and Science Act, in particular, is likely to contribute further to these goals, with the provision of $67 billion toward zero-carbon technologies, and their associated research and development.

The push for innovation both benefits local economies and the capabilities of existing industrial real estate projects due to semiconductors requiring precisely engineered equipment and distinct building specifications. “(It) can become very useful in this aspect, as the industrial sector continues to thrive, and developers/landlords are willing to build out specialized infrastructure in warehouses to meet tenant manufacturing needs,” Jabir added.

Additionally, the legislation will have the effect of easing concerns on part of investors who may otherwise have been more reluctant to allocate capital to the developments, particularly in the current economic environment. “The additional Federal funds make it easier for companies that had been uncertain about investing to decide to actually move forward…,” Martindale said.

Beyond investment, both new facilities and their associated investments will also have more immediate, material benefits, through acts such as their construction and infrastructure improvements. Long-term, Meredith O’Connor, international director at JLL, anticipates the new public and private investment as incentives that “will secure domestic supply, create tens of thousands of good-paying construction jobs and thousands more high-skilled manufacturing jobs and catalyze hundreds of billions more in private investment.”

Semiconductor capitals?

Despite the broad number and scope of projects taking place across the nation, two cities in particular stand out as emerging hubs of the domestic semiconductor industry: Phoenix and Austin, Texas.

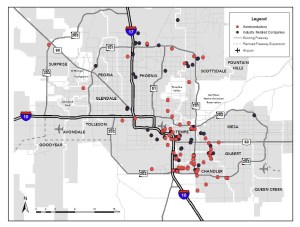

Map of all semiconductor-related industrial projects from around Phoenix. Image courtesy of the Greater Phoenix Economic Council

Metro Phoenix, whose semiconductor sector emerged in 1979 with the establishment of Intel in the city of Chandler, has seen large-scale investment from the company, as well as from TSMC, in a series of developments projected to cost $20 billion and $40 billion, respectively.

These developments are dedicated to the manufacturing of chips measuring four to five nanometers in thickness. At present, the metro is home to 14 ongoing developments, consisting of the above fabrication facilities, as well as 10 materials processing plants, and two equipment manufacturing centers, the SIA data shows.

Samsung Semiconductor Facility in Austin, Texas. Image courtesy of Samsung

Austin, with access to one of the nation’s largest university systems, has seen the development of a $17 billion fabrication plant from Samsung, alongside other fabrication plants from Texas Instruments and NXP, according to SIA information. O’Connor attributes these developments to “a highly trained workforce and partnerships between the region’s higher education institutions and the private sector.”

READ ALSO: Can Phoenix Become America’s Semiconductor Capital?

Rusty Kennedy, managing director and leader of Stream Realty Partners’ Phoenix office, oversees industrial services delivery in the region. He attests to the area’s strength as a hub of investment and development for the sector.

Kennedy cited the city’s population growth, educated workforce, access to cheap energy and isolation from natural disasters as making it a desirable option for chip plant construction. Equally important, however, is the city’s “business-friendly and business-focused” culture, one that Kennedy sees as being spurred by “tremendous interaction and collaboration between the business community and the government.”

In turn, the projects create centers of innovation through not only their associated labor and infrastructure requirements, but through their other contributions to the city’s commercial sector as a whole by way of the development of related material suppliers.

“What is great about the ability to attract semiconductor-focused companies and manufacturers, in general, is these companies not only bring large investments and great jobs to the Valley, but they all typically drive ancillary business as well,” he added. Kennedy also observes and anticipates more foreign investment, cementing the city as a “very powerful and stable ecosystem of innovation and employment.”

You must be logged in to post a comment.