The Shifting Capital Stack

After a sluggish start to 2017, investment volume and lending activity began showing signs of rebounding in the spring.

By Samantha Goldberg

Lender Competition Heats Up Amid Fewer Deals

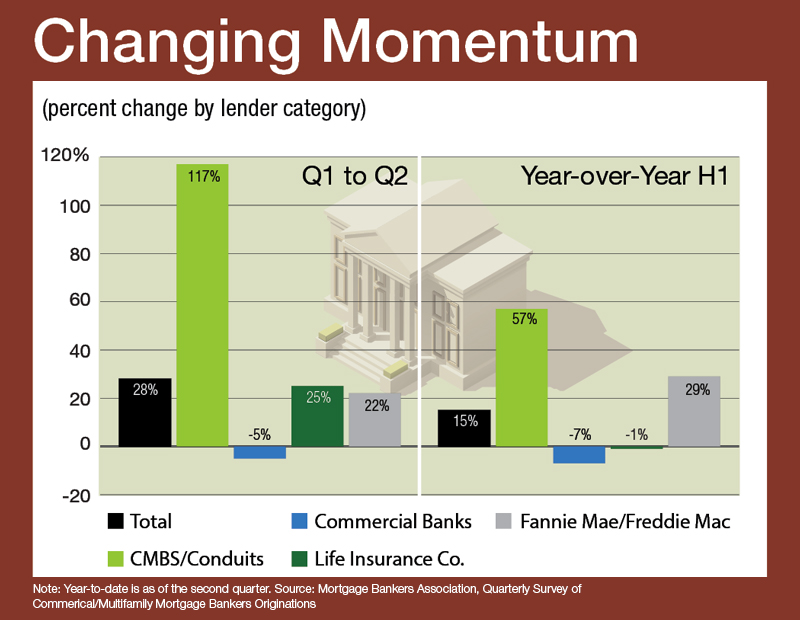

After a sluggish start to 2017, investment volume and lending activity began showing signs of rebounding in the spring. As Real Capital Analytics (RCA) reported, sales volume rallied in the second quarter, hitting $109.2 billion, up from $94.8 billion in the first quarter. That boost accompanied a 28 percent jump across the board for commercial and multifamily mortgage loan originations from the first to second quarters,

After a sluggish start to 2017, investment volume and lending activity began showing signs of rebounding in the spring. As Real Capital Analytics (RCA) reported, sales volume rallied in the second quarter, hitting $109.2 billion, up from $94.8 billion in the first quarter. That boost accompanied a 28 percent jump across the board for commercial and multifamily mortgage loan originations from the first to second quarters,

according to the Mortgage Bankers Association’s quarterly survey.

Despite those encouraging signs, however, the comeback is more complicated. All told, deal volume declined 8 percent year-over-year during the first half, according to RCA. Uncertainty about policy changes in Washington and potential market shifts set the stage for that slowdown, which was further complicated by early interest rate hikes that created buyer-seller dislocation. Meanwhile, reduced demand for acquisition financing makes it more challenging for lenders to deploy debt. These dynamics are compelling capital sources to shift their acquisition lending strategies as they jockey for position in the capital stack.

“A big-picture theme in the capital markets right now, whether it be debt or equity, is … a shortage of deals and an abundance of capital,” noted Brian Eisendrath, vice chairman at CBRE. “What we’ve seen in the second quarter, and we think will continue, is loan terms getting more aggressive. Capital providers will have to do different things to win deals, whether that be interest-only, higher leverage or something else.”

For investors, one encouraging trend is the emergence of more favorable lending terms, which contributed to stepped-up originations in the second quarter. Many observers expect the pattern to continue and stimulate increased investment activity. “I think the second half of the year … you will see investment sales volumes pick up substantially,” said Jeff Erxleben, executive vice president & regional managing director at Northmarq Capital. “Acquisition financing for the second half of the year should definitely outpace the first half of the year. It’s now starting to pick up and take off.”

Trading places

Origination volumes were up in the second quarter across lender types, but the lenders comprising the capital stack have shifted. CMBS led the way with issuances hitting $38.8 billion, a total that boosted the category’s share of volume from 16 percent during the first quarter to 36 percent in the following quarter, according to CBRE’s analysis of loans originated or arranged by CBRE Capital Markets. Meanwhile, others lenders’ shares of originations decreased, notably life companies’ (from 38 percent to 24 percent) and banks’ (from 26 percent to 18 percent).

Origination volumes were up in the second quarter across lender types, but the lenders comprising the capital stack have shifted. CMBS led the way with issuances hitting $38.8 billion, a total that boosted the category’s share of volume from 16 percent during the first quarter to 36 percent in the following quarter, according to CBRE’s analysis of loans originated or arranged by CBRE Capital Markets. Meanwhile, others lenders’ shares of originations decreased, notably life companies’ (from 38 percent to 24 percent) and banks’ (from 26 percent to 18 percent).

In the last year or so, low interest rates and cap rates have pushed many traditional lenders toward lower leverage and more secure positions. Terms on fixed-rate senior debt remain favorable to borrowers, as early 2017 interest rate hikes have largely been mitigated by spread compression for senior loans. That is keeping rates at “around 4 percent or sub-4 percent for long-term money and in the mid-3s for short-term money,” noted Erxleben. The percentage of loans carrying full or partial interest-only terms increased to 58.7 percent during the second quarter, a 3.1 percent uptick from the first quarter, according to CBRE.

But low rates have also led traditional lenders to be more conservative. Eighteen months to two years ago, loan-to-value ratios for fixed-rate financing typically hovered around 75 to 80 percent; today, 65 to 70 percent leverage is more common. Banks are exercising heightened discipline in response to Dodd-Frank risk-retention rules, preferring to finance deals with established customers. “It’s more relationship-driven, as opposed to something more programmatic that you might find with other lenders,” Erxleben explained.

Alternative routes

As a result, sponsors are putting more equity into the capital stack. While this is less problematic for deep-pocketed institutional players, some borrowers who need higher leverage are finding alternatives. “We’ve been able to source mezzanine and B-note buyers both domestically and internationally to fill that gap at very attractive financing rates,” helping buyers reach 75 to 85 percent leverage, reported Natixis’ head of real estate finance for the Americas. By early August, the firm had funded or sold about $1 billion worth of subordinated debt this year, about 80 percent of it for acquisition financing.

As a result, sponsors are putting more equity into the capital stack. While this is less problematic for deep-pocketed institutional players, some borrowers who need higher leverage are finding alternatives. “We’ve been able to source mezzanine and B-note buyers both domestically and internationally to fill that gap at very attractive financing rates,” helping buyers reach 75 to 85 percent leverage, reported Natixis’ head of real estate finance for the Americas. By early August, the firm had funded or sold about $1 billion worth of subordinated debt this year, about 80 percent of it for acquisition financing.

“The mezzanine market is definitely a very viable, very liquid option in today’s market,” said Jimmy Board, managing director in JLL’s Real Estate Investment Banking group, leading the “mezzanine stack to become more and more competitive.”

Another factor shaping the capital stack continues to be competition among lenders and buyers for top-quality assets, which is helping buoy pricing and is pushing both sides to be more aggressive.

A growing number of alternative lenders are also entering the space and causing disruption. Debt funds are taking advantage of their unregulated status to lend at higher leverage than banks, therefore providing a one-stop-shop route to borrowers who would otherwise be required to secure financing from multiple sources, noted Gary Tenzer, principal of George Smith Partners.

“Everybody wants to put out more capital for 2017…combined with a shortage of deals, lenders are getting more aggressive, they’re tightening their spreads and the yields have become a little bit thinner for them,” Eisdendrath added.

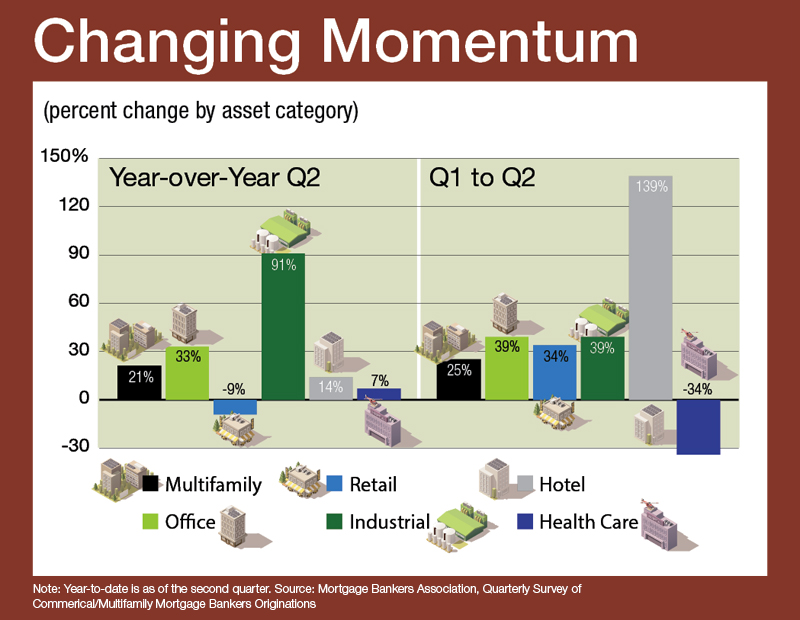

Wider Nets

As a result, many investors and lenders are broadening their acquisition strategies from trophy assets in gateway markets to solid secondary markets and property types they hadn’t considered before, such as Class B office or full-service hotels. Lenders are also becoming more comfortable financing value-add deals with floating-rate debt because “the higher yield is very attractive and real estate is fairly safe, even on the value-add side,” Murphy noted.

Traditional lenders like life companies are becoming more active in the floating-rate space as “the comparative yield differential between long- and short-term loans has compressed,” Erxlben added.

Especially for properties with strong cash flow potential, short-term bridge lenders may offer a lower debt service coverage ratio, he explained. While the minimum DSCR is typically 1.25, a bridge lender might approve a 1.1 or 1.0 ratio. Aside from cash flow, the sponsor’s quality and capital resources, as well as tenant and location quality, are the keys to good pricing for value-add deals.

Because value-add borrowers are typically using shorter-term financing and acquiring assets in less competitive markets, the properties generally trade at higher cap rates. That, in turn, “translates to sponsors being able to borrow at higher LTVs,” up to 70 or 80 percent, Eisendrath added.

Originally appearing in the September 2017 issue of CPE.

You must be logged in to post a comment.