Silicon Valley Office Portfolio Yields $200M in Financing for Carl Berg

NorthMarq arranged financing for an unencumbered, 711,000-square-foot office portfolio in California's Silicon Valley through Prudential Mortgage Capital Co.

By Barbra Murray, Contributing Editor

Billionaire real estate investor and venture capitalist Carl Berg has an extra $200 million in his hands, courtesy of a deal orchestrated by NorthMarq Capital. The real estate financial intermediary arranged financing for an unencumbered, 711,000-square-foot office portfolio in California’s Silicon Valley through Prudential Mortgage Capital Co.

“It was a great deal for Prudential and a great deal for Berg, too,” Dennis Sidbury, senior vice president with NorthMarq, told Commercial Property Executive.

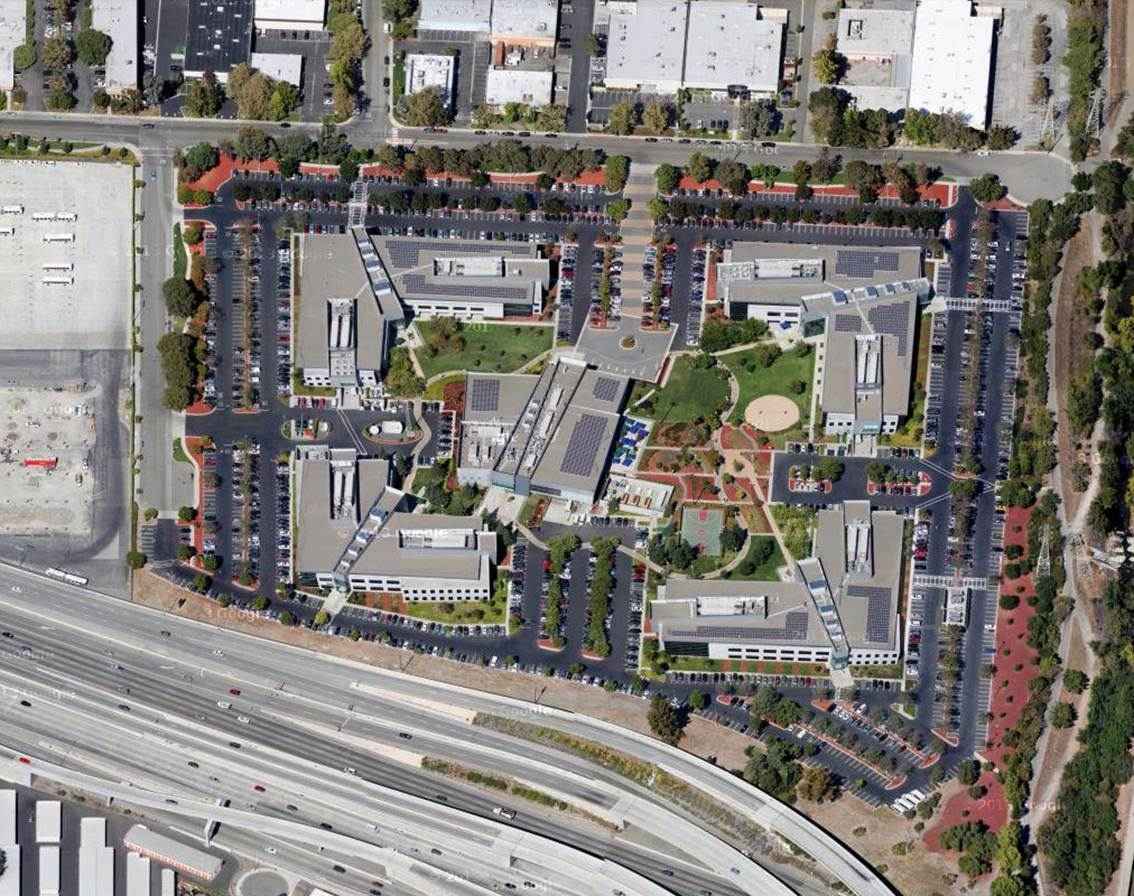

The properties encompasses Microsoft’s five-building, 500,000-square-foot campus at 1045-1085 La Avenida St. in Mountain View (pictured at right), and a 211,000-square-foot building occupied by Apple at 10500 N. De Anza Blvd. in Cupertino.

Lenders responded enthusiastically to the portfolio. While the size of the transaction ultimately precluded many from the race, NorthMarq was tasked with narrowing down eight or nine strong offers. “Of course, everybody liked it,” Sidbury added. “It’s incredible sponsorship, the properties themselves are high-quality and the tenancy–both of these tenants have more cash on their balance sheets than the federal government. So that’s pretty good.”

Berg developed the properties in 1999 and 1981, respectively, and held onto them after he disposed of the bulk of his real estate empire with the $1.3 billion sale of his Mission West Properties Inc. to Divco West and TPG Real Estate in late 2012. Berg is now focusing his efforts on venture capital endeavors.

Regarding the investor’s plans for the proceeds, Sidbury said, “He may not even redeploy it; he doesn’t even know . . . Even if he just puts the money in the bank now, at some point in time over the term of this loan, he’s going to find a way to deploy this cash into something that will generate higher yield.”

You must be logged in to post a comment.