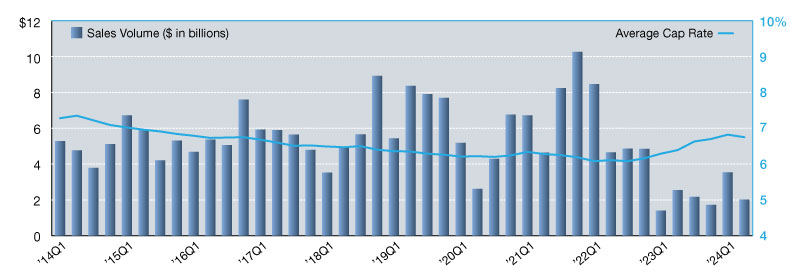

2024 Single-Tenant Office Quarterly Sales Volume & Cap Rates

Health-care properties are favored by investors, according to Northmarq.

The single-tenant office sector ended 2024 on a high note, with investment sales activity gaining momentum in the final months and fourth quarter volume nearing $2.6 billion. While quarterly performance was not quite as strong as at the start of the year, these results contributed to a full-year total of approximately $10.2 billion, outperforming 2023 by roughly 30 percent. Still, single-tenant office volume remains quite depressed compared to recent years.

Average cap rates in the office sector continued their upward climb, recording a modest 7-basis-point increase during fourth quarter. Now, at an average of 7.09 percent, cap rates have risen 44 basis points since year-end 2023. Cap rate growth has been more aggressive among older properties and those located in secondary or tertiary markets, whereas prime assets located in high-demand metro areas have held steadier valuations.

Private investors, with 30 percent market share, were the largest buyer group in the net lease office sector during 2024. However, this marks a notable decline from 2023 when half of all office buyers were private investors. REITs, on the other hand, have reported more than doubling their market share year-over-year, capturing 26 percent of market share in 2024—the highest activity rate reported for this buyer group since 2015.

Office space trends by category

The single-tenant office market’s performance in 2024 highlights the broader tensions facing the office sector. While stabilized assets with strong credit tenants continue to attract attention, we’ve seen a general reduction in demand for traditional office space, influenced strongly by ongoing changes in the workplace environment.

However, medical office and health-care assets have shown growing appeal due to an aging population and ongoing health-care reform that create long-term demand for medical facilities. Continued interest in these types of properties has helped mitigate some of the softness elsewhere in the sector.

Another trend to watch in 2025 is the performance of government-leased and owned assets. Return-to-office mandates may drive increased demand for office space, but this could be offset by a potential wave of GSA property sales or lease cancelations, adding further turbulence to the office sector in the months and years ahead.

—Posted on March 28, 2025

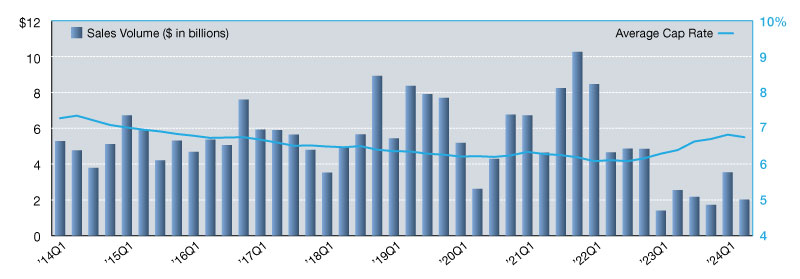

After a comparatively strong start to the year, investment sales activity in the single-tenant office sector has returned to below average levels. Just $1.6 billion in sales volume was recorded during third quarter 2024, making it the second slowest quarter on record in over a decade. However, due to first quarter’s strong performance, the sector has already nearly surpassed last year’s annual sales volume. While 2024 is still set to be a rather unimpressive year, the net lease office market should have no problem outperforming 2023, especially given the attractiveness of medical office and healthcare assets in today’s marketplace.

Average cap rates have been on a steep trajectory since bottoming out in mid-2022. After eight consecutive quarters of increases, the average office cap rate now sits 86 basis points higher at 6.94 percent. Regionally, however, there remains a nearly 125-basis point spread, with West region office transactions trading at an average cap rate of 6.26 percent and the Southwest region reporting an average of 7.50 percent.

International buyers remain largely absent from the single-tenant office sector for the third straight year, while private investors, at 28 percent, represent the most active buyer group. Their market share has decreased substantially from previous years though, as REITs have stepped up activity. With nearly a quarter of the market share, REITs have been pursuing net lease office and healthcare properties at the highest rate seen since 2015.

—Posted on November 29, 2024

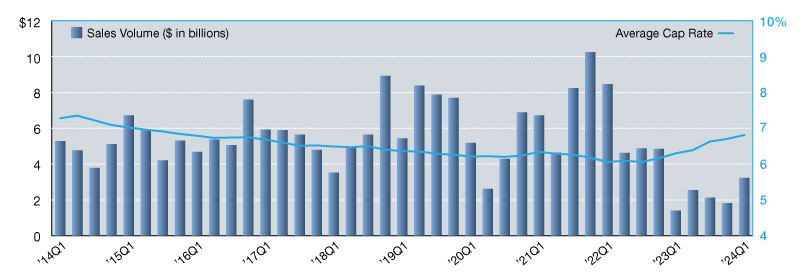

Following first quarter 2024’s impressive performance, the single-tenant office sector saw transaction volume return to levels more in line with recent quarters. With $2.02 billion logged during the second quarter, the market is set to outpace last year’s activity, even if second-half office volume remains muted, which is expected.

With very few high-priced trades, the majority of investment activity over the last three months occurred in sub-$10 million assets. Health-care properties, including dialysis facilities, imaging centers and physicians’ offices, were among the more frequently sold asset types. Several portfolios also traded. Among the higher profile transactions were Novant Health’s 16-property medical office sale-leaseback and the $60.7 million sale of the Class A headquarters campus of Blue Cross Blue Shield of Minnesota.

After a 12-basis point jump in first quarter, the average cap rate for single-tenant office receded slightly, ending mid-year at 6.75 percent. This is still elevated from the 2023 year-end average and further reductions are not anticipated. What’s more likely is that the market will see additional small upticks in the final months of 2024 to continue the general upward trend seen since mid-2022.

Buyer distribution

Buyer distribution for the first half of the year remains deviated from recent years. While institutional investors continue to represent roughly one quarter of the active buyers, REIT activity has become more prominent. With 27 percent market share, REITs were the most active buyer type for single-tenant office in the last six months.

Private buyers, which have captured up to half of the market in the last two years, now only represent 25 percent. In the second half of 2024, watch for net lease health-care transactions to continue buoying the market, which could result in a greater number of private investors becoming active in the sector.

—Posted October 30, 2024.

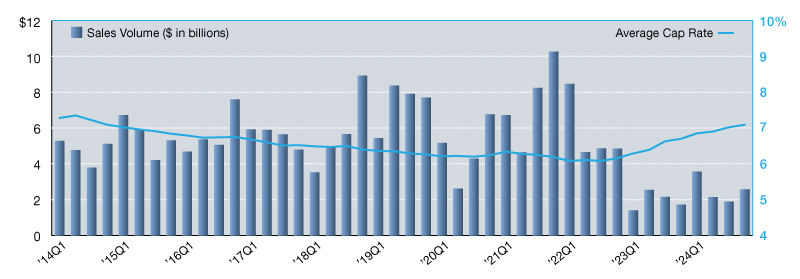

After a challenging 2023, where only $7.9 billion in sales were recorded for the entire year, the single-tenant office sector posted its strongest quarter since late 2022. Investment sales activity showed an incredible 77.5 percent increase quarter-to-quarter, logging more than $3.2 billion in transactions. We have yet to see larger portfolios or other signature assets that would drive totals even higher trade frequently, but robust activity for office and medical buildings at lower price points – sub-$25 million – allowed the quarter’s transaction count to increase 76 percent in the last three months. While it’s too early to say if the office market is moving towards recovery, investors should be encouraged to see this latest momentum.

The most prolific buyers this quarter were public REITs, contributing to nearly half the sector’s acquisition activity. This represents a significant deviation from previous years, when REITs were present but nowhere near the top ranking. With a pullback from both private and institutional investors, public REITs were able to secure dominant market share to begin the year.

After a decade of slow, declining trendlines for net lease office cap rates, the last few quarters have reported steeper increases. At the end of first quarter 2024, average rates sit at 6.81 percent – up 11 basis points from fourth quarter 2023 and up 51 basis points from this time last year. The office average is now the highest recorded since year-end 2015. Rates are expected to continue climbing, although the pace of escalation is likely to slow. It’s possible we could see average cap rates for the net lease office sector surpass the 7 percent mark this year, but with interest in healthcare assets leased by stronger credit tenants, cap rates could just as easily stabilize.

—Posted June 30, 2024.

You must be logged in to post a comment.