SIOR: CRE Market Confidence Slightly Higher

Respondents to the Society of Industrial and Office Realtors' Snapshot Sentiment Survey show growing optimism about the health of commercial real estate markets.

Commercial real estate professionals’ confidence in the market’s immediate future increased ever so slightly from April to May, according to the Society of Industrial and Office Realtors’ May 2020 Snapshot Sentiment Survey.

READ ALSO: Hotel, Retail Lead Late Loans—Will Other Assets Follow?

Additionally, survey participants recorded a notable month-over-month rise in transactions progressing on schedule.

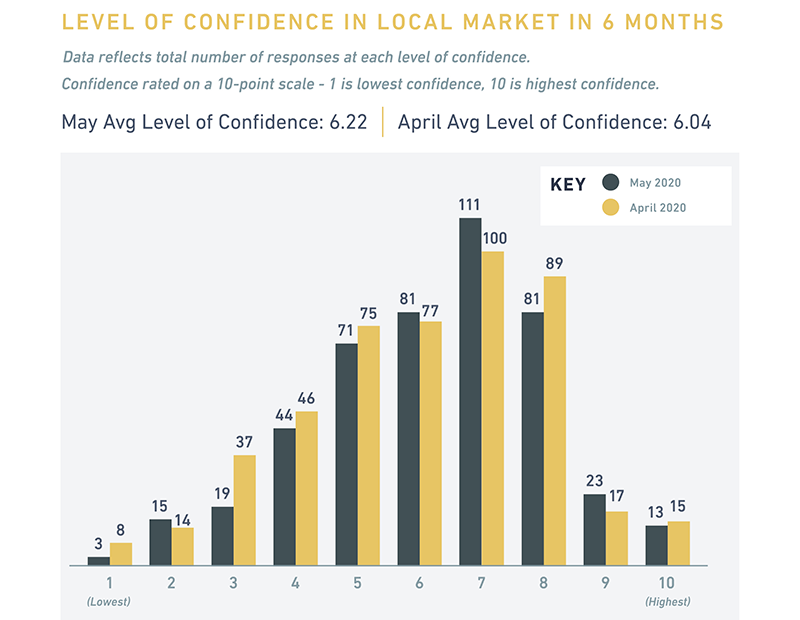

SIOR queried its designees and member associates from May 20 to May 22, securing a response rate of 14.9 percent from its approximately 3,400 SIOR members across the globe. Based on a 10-point scale, respondents’ overall level of confidence in the local market in the upcoming six months increased from 6.04 in April’s survey to 6.22 in May. At the microlevel, however, inconsistencies exist.

“The crisis has affected all regions, but not equally,” Mark Duclos, SIOR, president of the Society of Industrial and Office Realtors, told Commercial Property Executive. “Most regions with large, densely populated cities were disproportionately affected, as were regions whose main industries were most negatively affected by the crisis—automotive, gaming, hospitality, oil/gas and aerospace, to name a few. Couple this with the various state/region ‘re-openings’ and you have a varied, uneven view of your particular markets.”

In North America, Canada recorded the lowest confidence level in both sectors. Industrial specialists’ confidence dropped from 6.9 to 5.7 month-over-month, and office specialists reported a confidence level of 5.3. At the other end of the spectrum, confidence among industrial brokers in the Mid-Atlantic and Northwest was the highest at 7.2 and 7.0, respectively. The Southwest and Great Lakes areas had the highest level of confidence in the office sector at a respective 6.6 and 6.4. The Southwest and the Great Lakes were also the only two of the 10 North American regions to have more confidence in office than in industrial.

Closing the deal

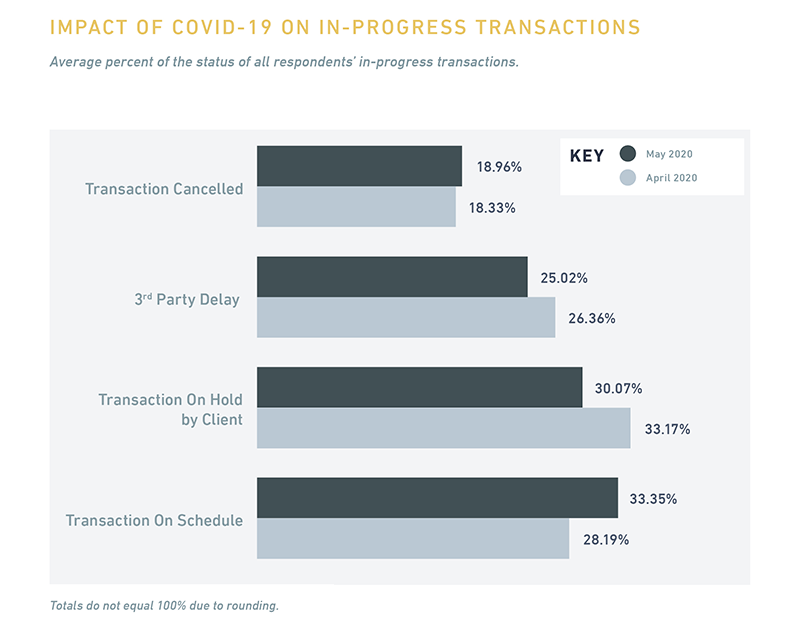

While North American confidence in the industrial sector trumped positive feelings for the office sector at respective levels of 6.4 and 6.1 in May, the status of in-progress transactions was fairly comparable for both sectors, which came as a surprise to SIOR leadership. “Popular theory is that existing office transactions, while still active, have been substantially renegotiated, including term and tenant improvements.”

In the overall status of in-progress transactions, the month of May brought marked change. On-schedule deals increased 5 percent from April to 33.4 percent, and the number of transactions put on hold by clients decreased 3 percent month-over-month to 30.1 percent. “While our markets continue to be very fluid, the news cycle, which used to change by the day, while still fluid, is significantly slower. Therefore, visibility into the status and future of our CRE markets, while still cloudy, is becoming clearer, for better or for worse,” Duclos concluded.

You must be logged in to post a comment.