Sizing Up CRE Investment’s Plunge: CBRE

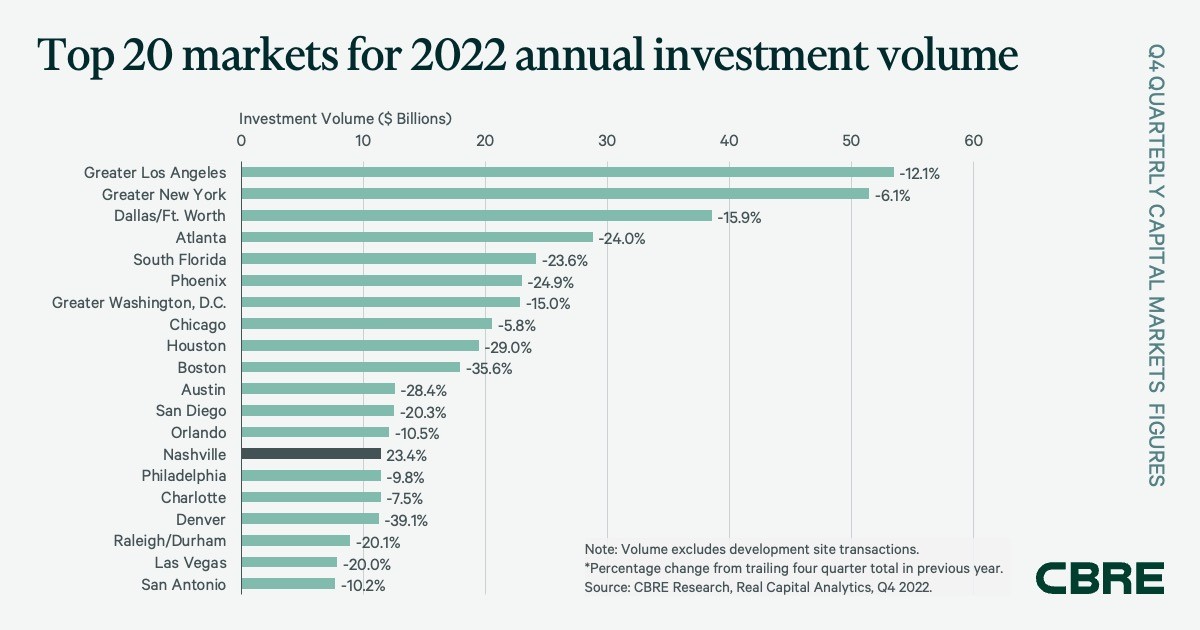

Among the top 20 U.S. markets, only Nashville saw year-over-year growth in 2022.

If it feels like investment in commercial real estate is down—a lot—it is, according to fourth-quarter numbers in a new report from CBRE. U.S. commercial real estate sales volume dropped by 63 percent year-over-year in the fourth quarter of 2022, to $128 billion.

To put that in perspective, however, the fourth quarter of 2021 was stunning, approaching $350 billion in investment volume. In 2022 overall, CBRE reports, although volume fell by 17 percent to $671 billion from the record year of 2021, the 2022 total was still the second-highest annual amount on record.

READ ALSO: The Fed’s Misguided Path on Interest Rates

More meaningfully, perhaps, the $128 billion in the fourth quarter just past was modestly below the average from 2015 through 2019, at $132.5 billion.

On the foreign investment side, incoming cross-border investment crashed by 81.3 percent year-over-year from $33.3 billion in Q4 2021 to just $6.2 billion in the fourth quarter of 2022. Foreign investors were net sellers by a ratio of $1.4 in dispositions for every $1 in acquisitions in 2022. CBRE cites a strong U.S. dollar and uncertainty about the overall economy as the main reasons.

REITs, too, were net sellers in the fourth quarter, while institutional and private investors were net buyers.

Products and places

Among asset classes, multifamily was the top sector in the fourth quarter, with $48 billion of investment volume, followed by industrial/logistics at $32 billion and office at $19 billion.

On a trailing-four-quarter basis, Los Angeles was the top metro with $53 billion in volume, followed by New York with $51 billion. Interestingly, among the top 20 markets for CRE investments, only Nashville had year-over-year growth (of 23.4 percent) from 2021 to 2022. Even New York and Los Angeles, with their big investment numbers and perennial appeal, saw sizable declines (on a trailing-four-quarter basis), of 6.1 percent and 12.1 percent, respectively.

The largest percentage declines (on the same basis) were seen in Denver (39.1 percent), Boston (35.6 percent), Houston (29.0 percent) and Austin (28.4 percent).

You must be logged in to post a comment.