Sizing Up the Prime Office Building Landscape

The performance gap between these assets and the rest of the market is expected to widen, CBRE predicts.

Washington, D.C., is home to the most prime office buildings in the country, according to a new report from CBRE, with its 68 properties edging Dallas, which has 66.

The data is based on CBRE’s analysis of office markets in 57 U.S. cities, which found buildings that are bucking the negative trends in office, overcoming high interest rates, inflation and reduced demand due to hybrid work.

CBRE researchers and brokers identified 830 properties, which comprise just 8 percent of the U.S. office market by square footage and just 2 percent by building count.

It’s a more exclusive designation than the oft-used Class A, which spans 61 percent of the U.S. office market, according to CBRE.

San Jose, Calif., ranks third with 59 buildings, followed by Manhattan with 55, Los Angeles (53), Philadelphia (42), Atlanta (41) and Chicago (39).

READ ALSO: Office Sector Adapts Amid Market Shifts

These elite properties “underscore the ongoing ‘flight-to-quality,’ in which companies are favoring new, high-quality buildings to support and increase office attendance,” according to the CBRE report.

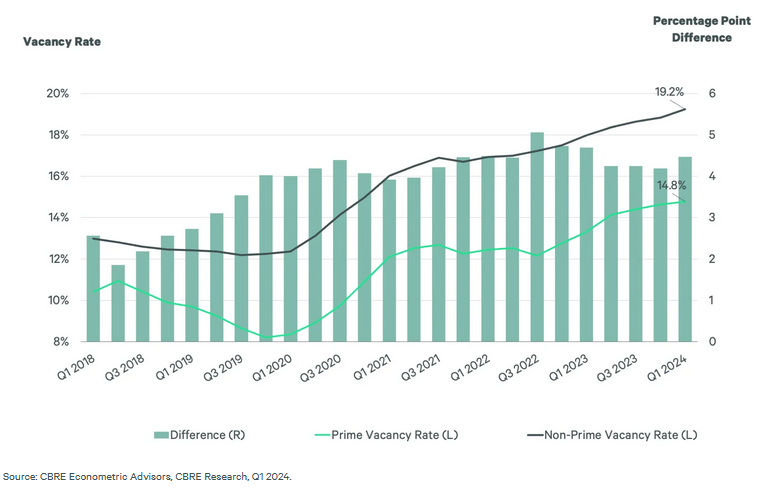

The average vacancy of 14.8 percent in prime buildings during this year’s first quarter was 4.5 percentage points lower than the rest of the market, a gap that has widened from 1.9 percentage points in the middle of 2018.

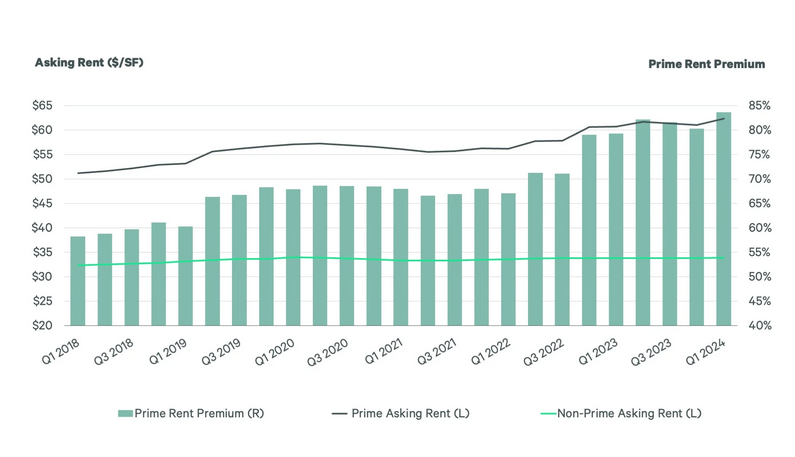

These properties are fetching an average rent premium of 84 percent more than the rest of the market as of the first quarter, up from 60 percent in mid-2018.

Factors studied by CBRE analysts included age, quality of design, location, views, green certifications, ceiling heights and differentiation from surrounding buildings.

Also receiving extensive consideration were amenities such as concierge service, on-site management, outdoor terraces, fitness centers, car parking, access to public transportation, daycare and electric vehicle charging stations, among others.

CBRE said the slowdown in the construction of prime office buildings will cause vacancies for that subsector to decline if demand remains relatively constant. And this may benefit the next tier of office properties, as some companies may choose to lease space in nearby Class A buildings.

You must be logged in to post a comment.